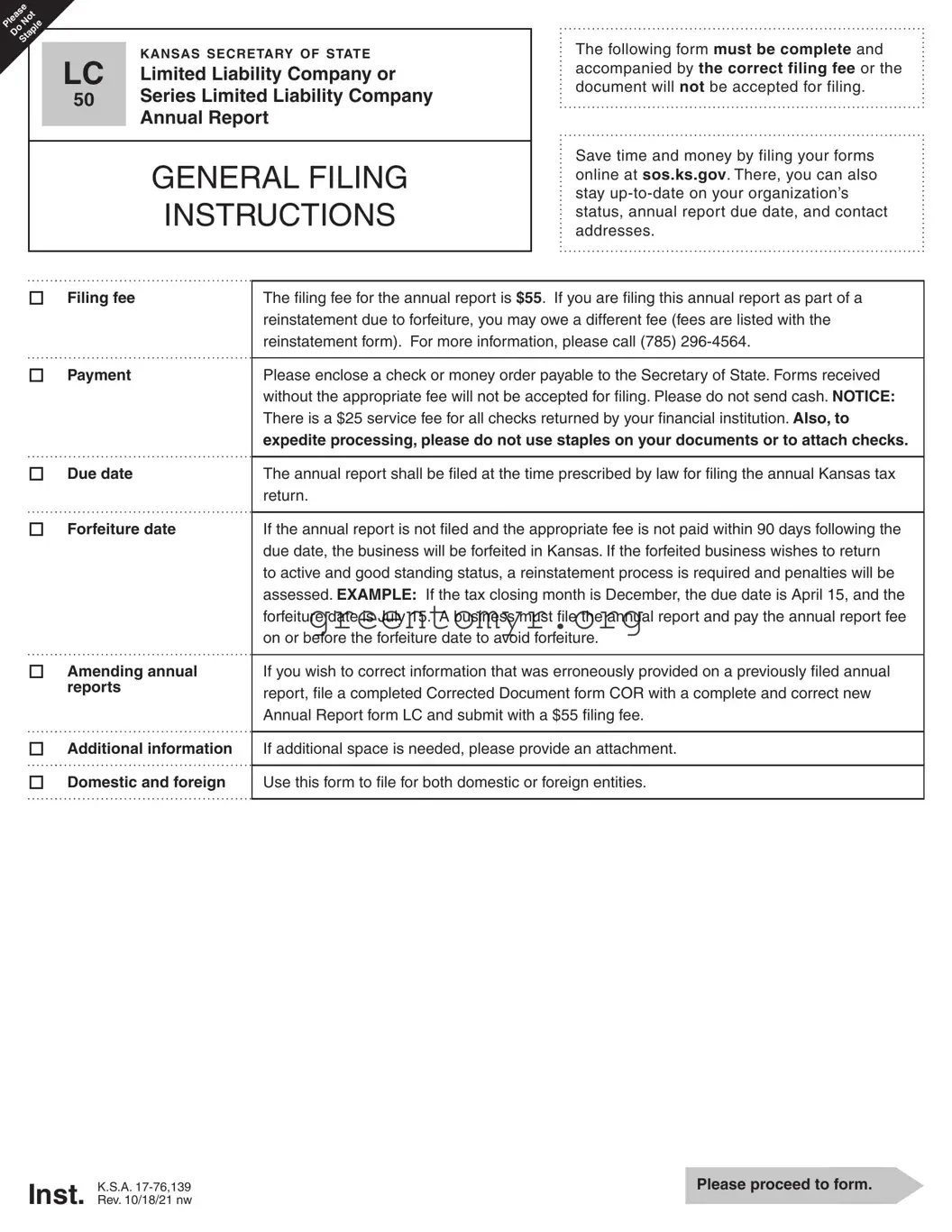

Filling out the Kansas LC 50 form is an essential task for maintaining compliance with state regulations. However, many people make common mistakes that can lead to delays or even rejection of their application. Being aware of these pitfalls can help you avoid unnecessary issues.

One frequent error occurs when individuals confuse their business entity ID/file number with their Federal Employer ID number (FEIN). These two identifiers serve different purposes. Ensure that you are entering the correct number to avoid processing delays.

Many people also overlook the requirement for the company name. The name of the LLC must match precisely with what is on record with the Kansas Secretary of State. If there are any discrepancies, your form may be returned for correction, wasting valuable time and resources.

Another mistake is related to the due dates for filing. It’s critical to file your annual report before the designated forfeiture date. Missing this deadline can lead to significant penalties. Make sure you are aware of the specific due dates based on your business’s tax closing month.

Using staples is another common misunderstanding. The instructions are clear: do not staple any documents or checks. Stapling can hinder the processing of your form, and may even result in rejection. Instead, use paper clips or rubber bands to keep your documents organized.

Providing incomplete information is yet another issue that can cause headaches. For instance, when listing members who own 5% or more of the capital, ensure that all relevant names and addresses are included. If you need more space, attaching additional sheets is a straightforward solution.

Lastly, failing to enclose the correct filing fee can lead to rejection. The annual report requires a fee of $55, and if you are reinstating a forfeited status, different fees may apply. Sending cash is also discouraged; checks or money orders are the preferred methods of payment.

By being mindful of these common mistakes when filling out the Kansas LC 50 form, you can streamline the process and ensure your filing goes smoothly. Double-check your information, follow all instructions, and always confirm that you have met all requirements before submission.