Filling out the Kcb Registration form can seem straightforward, but many people make common mistakes that can delay the process. Here are ten key missteps to look out for when completing this important document.

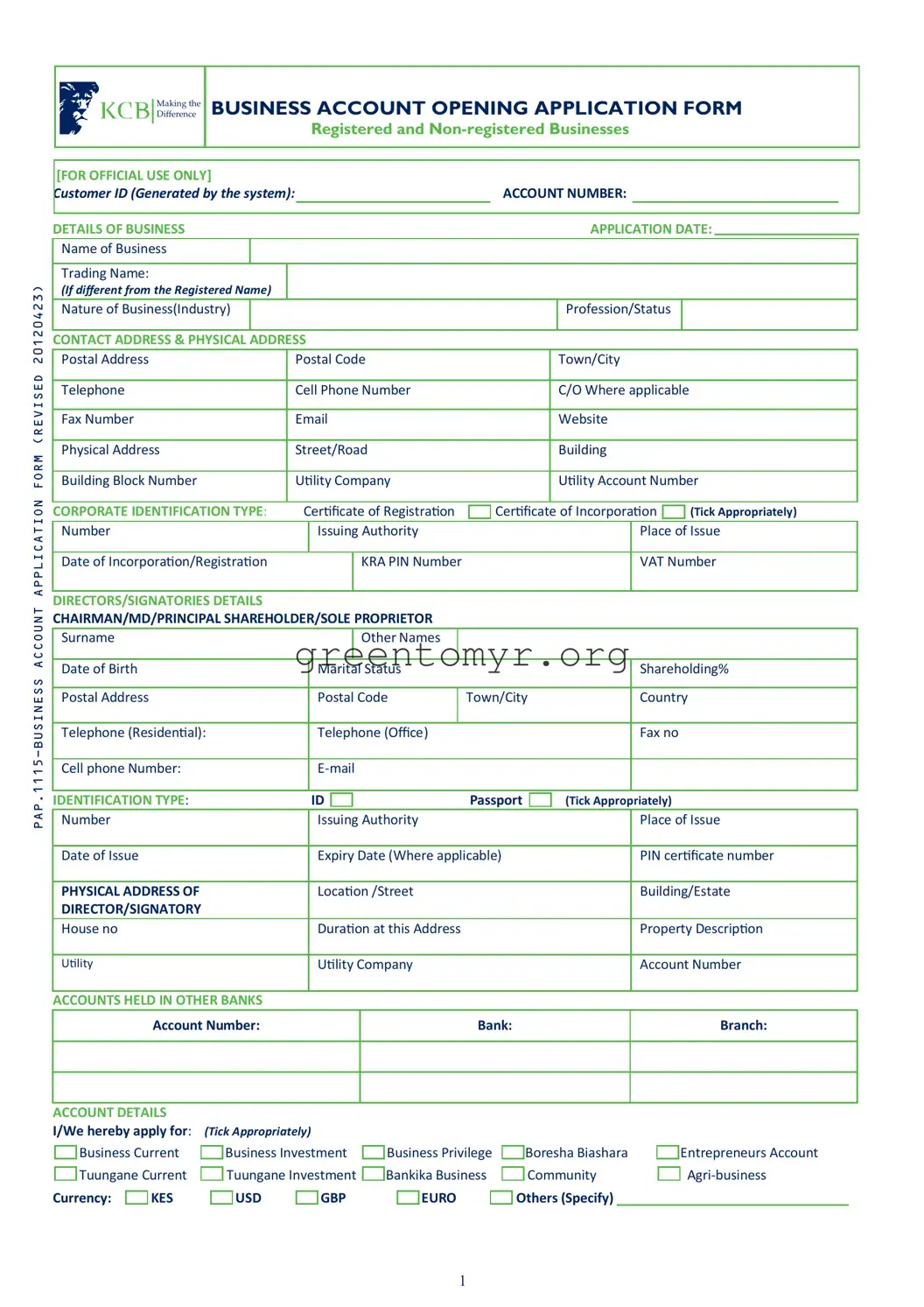

1. Missing or Inaccurate Business Information: One frequent error is not providing complete details about the business. Ensure the business name and trading name are accurate and that all required information, like the nature of the business, is filled out precisely. Omitting or misrepresenting these details can create confusion and lead to rejection.

2. Incorrect Contact Information: Providing incorrect or outdated phone numbers and email addresses can hinder communication with the bank. Always double-check for typos and ensure you list the best way to reach you.

3. Incomplete Corporate Identification: While filling out the section regarding corporate identification types, some applicants forget to tick the appropriate box. Remember to mark whether you have a Certificate of Registration or Incorporation, and include any relevant identification numbers accurately.

4. Missing KRA PIN Number: Many applicants mistakenly skip the KRA PIN number, which is crucial for tax identification. Ensure this number is filled in correctly to avoid tax-related complications later on.

5. Forgetting Utility Information: Failing to provide utility information, such as the utility company and account number, is a common misstep. This information is vital for verifying your physical address, so be thorough in this section.

6. Incomplete Directors/Signatories Details: Applicants often overlook filling out all the details for each director or signatory. Make sure to include the required identification type, valid contact information, and any other specified details for all individuals involved in the application.

7. Misunderstanding Account Types: Another mistake stems from ambiguity regarding the type of account being opened. Take a moment to consider the account types available and select the one that best meets your business's needs.

8. Neglecting the Financial Information Section: Applicants sometimes leave the financial information section blank or incomplete, omitting details about expected transaction ranges and incoming/outgoing payments. This information will help the bank understand your business better, so be comprehensive.

9. Not Signing the Form: A simple but critical mistake is forgetting to sign the application form. Be sure all required signatures are in place before submitting to avoid processing delays.

10. Ignoring the Customer Information Checklist: Failing to review the customer information checklist can lead to overlooking necessary documents. Always confirm that identification and supporting documents are clear, complete, and authenticated prior to submission.

By avoiding these common pitfalls, you can help ensure a smoother application process and facilitate the opening of your business account!