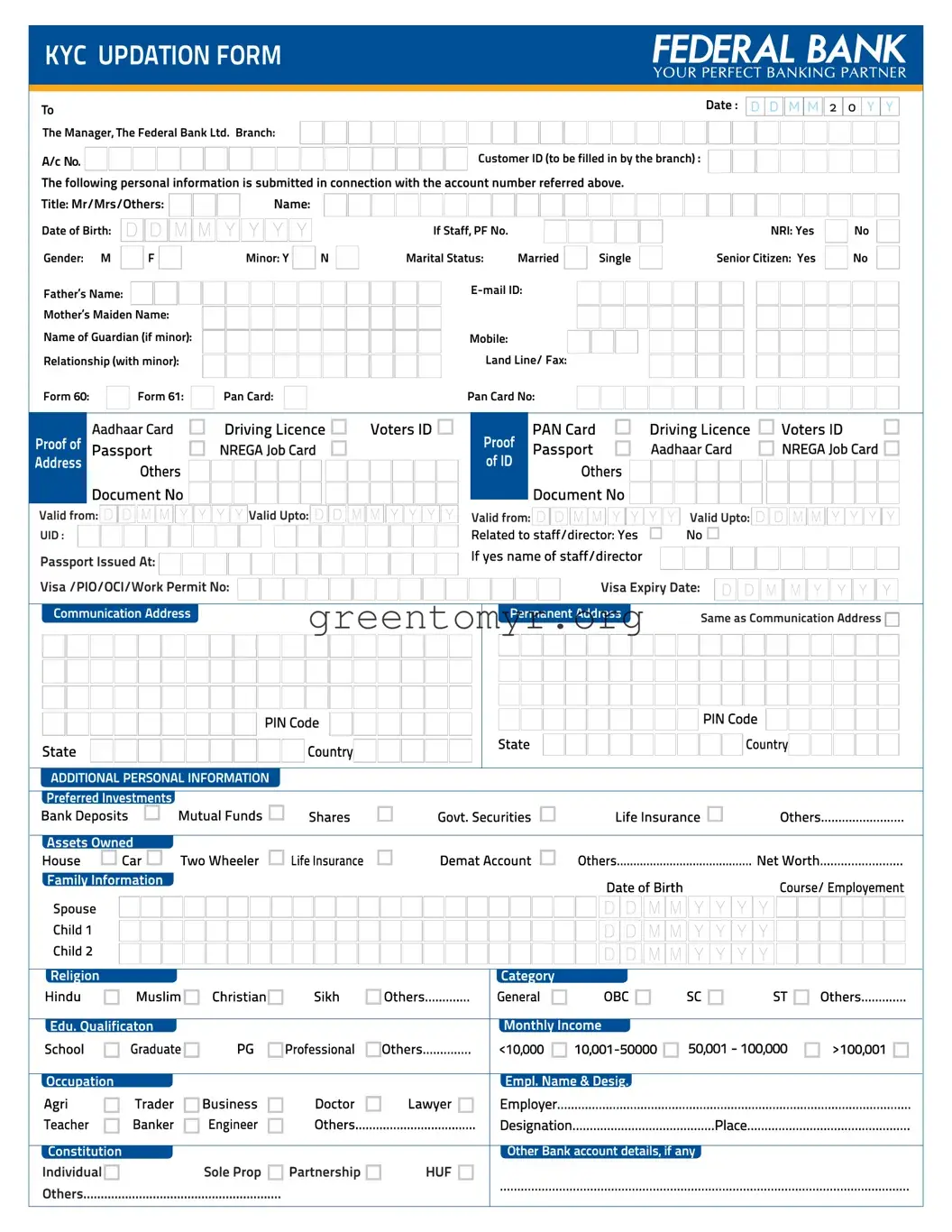

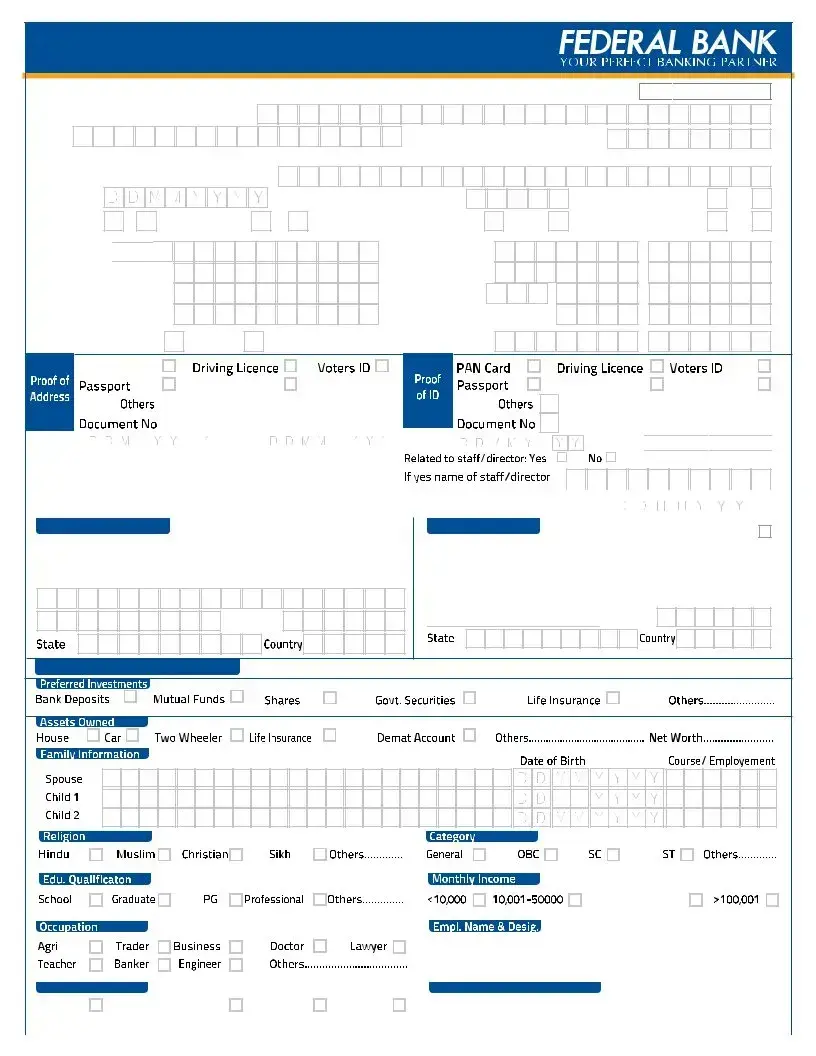

The KYC (Know Your Customer) Federal Bank form is essential for verifying the identity of bank customers. This helps in ensuring the safety and security of banking transactions. By collecting personal information and proof of identity, it keeps financial institutions compliant with regulations designed to prevent fraud and money laundering.

Any individual or entity wishing to open a bank account or update their existing account information must complete the KYC form. This includes personal accounts, joint accounts, partnerships, companies, trusts, and more. Regardless of your account type, updating your KYC is essential for maintaining a relationship with the bank.

What documents are required for submission?

To complete the KYC process, several documents are needed. This typically includes:

-

Identity proof (e.g., Aadhar card, passport, voter ID)

-

Address proof (e.g., utility bills, rental agreements)

-

Photographs of the account holder

-

PAN card or filled Form 60/61

Depending on the type of account, additional documents may be necessary, particularly for trusts, companies, or partnerships.

It is crucial to fill out the KYC form accurately and completely. All sections must be completed using black ink and BLOCK LETTERS. Any boxes that are applicable should be ticked. Missing or incorrect information could delay the processing of the form.

Even if you've submitted a KYC form before, it's necessary to update it when there are changes to your personal information, such as changes in your address, marital status, or identity documents. Keeping your KYC information current is vital for ensuring smooth banking operations.

While there may not be a specific nationwide deadline, banks typically encourage customers to keep their KYC information updated. If a customer's KYC is found to be incomplete or outdated, the bank may restrict certain account services. Therefore, it's important to address any KYC needs as soon as you receive a notice or whenever there are changes in your situation.

After submission, the bank will review the information and documents provided. If everything is in order, your KYC will be updated or established, allowing you to continue using your banking services without interruptions. In case of any discrepancies or missing information, the bank will contact you for clarification or additional details.

D

D

M

M  M

M

Y

Y  Y

Y

Mother’s Maiden Name: Name of Guardian (if minor): Relationship (with minor):

Mother’s Maiden Name: Name of Guardian (if minor): Relationship (with minor):

PIN Code

PIN Code