What is a Lady Bird Deed?

A Lady Bird Deed, also known as an Enhanced Life Estate Deed, is a legal document that allows you to transfer property to a beneficiary while retaining the right to live in and use the property during your lifetime. This deed can help avoid probate and may also offer certain tax advantages.

Who can use a Lady Bird Deed?

Any property owner who wishes to transfer real estate to a beneficiary can consider using a Lady Bird Deed. It is often used by individuals wanting to pass on their home to a child or loved one without the complications of probate.

What are the benefits of a Lady Bird Deed?

-

Avoids probate, making the transfer of property simpler and faster.

-

Retains control of the property during your lifetime.

-

May provide certain tax benefits, including protection from creditors.

-

Allows you to modify or revoke the deed at any time before your death.

Are there any disadvantages to a Lady Bird Deed?

While there are many benefits, it is important to consider potential drawbacks. For instance, if you need to sell the property, the deed may complicate the sale. Additionally, Medicaid eligibility could be affected if the property is viewed as an asset. Consulting with a legal professional is recommended.

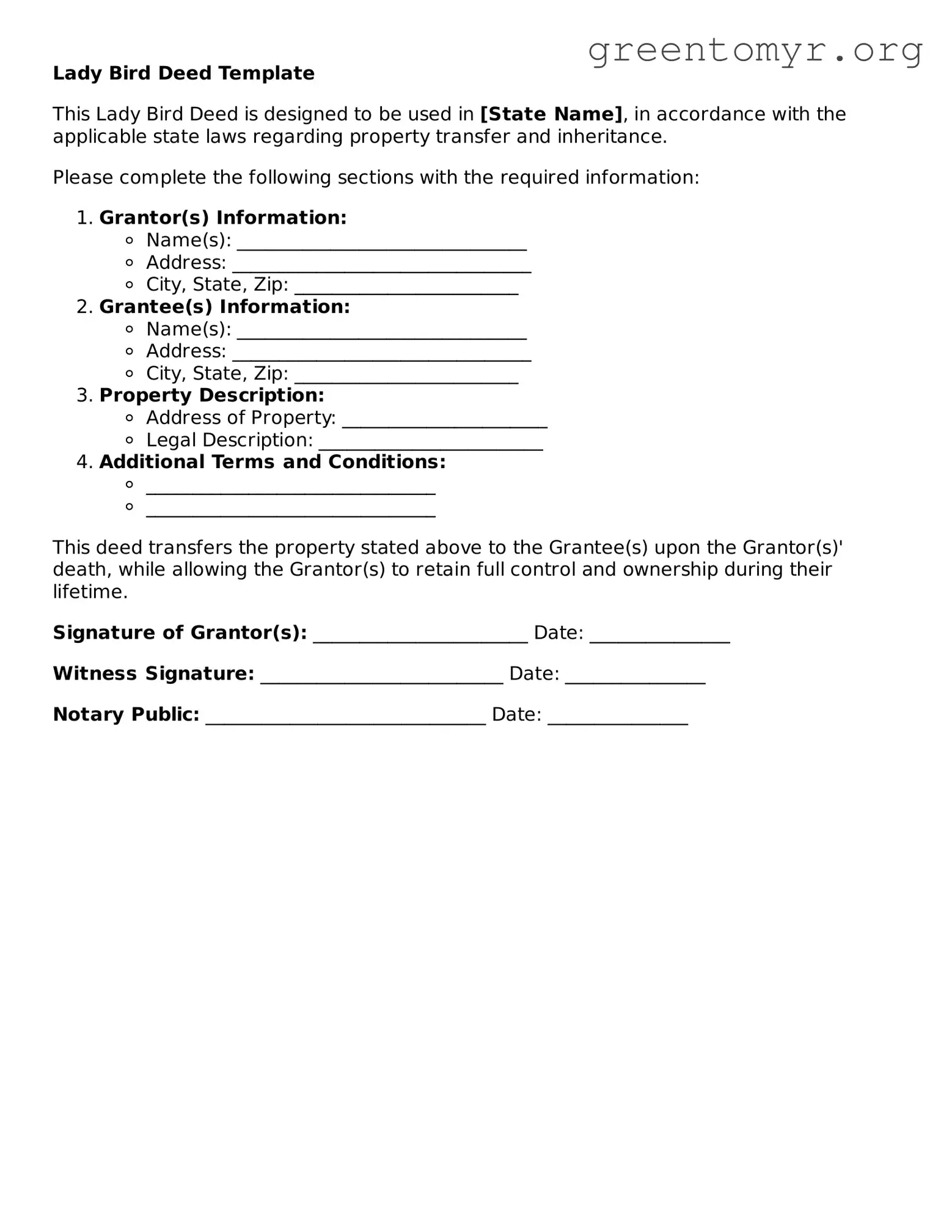

How is a Lady Bird Deed created?

A Lady Bird Deed must be drafted following state laws. It generally requires the property owner's information, the beneficiary's information, and explicit language indicating the type of deed. Once drafted, the deed must be signed and notarized, then recorded in the appropriate county office.

Can a Lady Bird Deed be changed or revoked?

Yes, a Lady Bird Deed can be changed or revoked. As the property owner, you maintain control over the property and can update the deed or revoke it as needed, as long as you are alive and mentally competent to do so.

What happens to the property if the beneficiary predeceases the owner?

If the beneficiary passes away before the property owner, the property will remain with the original owner. You can choose to add a new beneficiary or modify the deed to reflect this change.

Is a Lady Bird Deed recognized in every state?

No, not all states recognize Lady Bird Deeds. It is primarily used in certain states, such as Florida and Michigan. If you are considering this option, check your specific state laws to ensure it is a valid option.

How does a Lady Bird Deed impact taxes?

A Lady Bird Deed can potentially provide tax benefits, such as deferring capital gains taxes at the time of transfer. Upon the owner’s death, the property may receive a step-up in basis, which can reduce taxes for the beneficiary. Consult a tax professional to understand implications for your situation.

Do I need an attorney to create a Lady Bird Deed?

While it is not a legal requirement to have an attorney create a Lady Bird Deed, it is highly recommended. Legal assistance can ensure that the deed is properly drafted and complies with state laws, providing peace of mind for you and your beneficiaries.