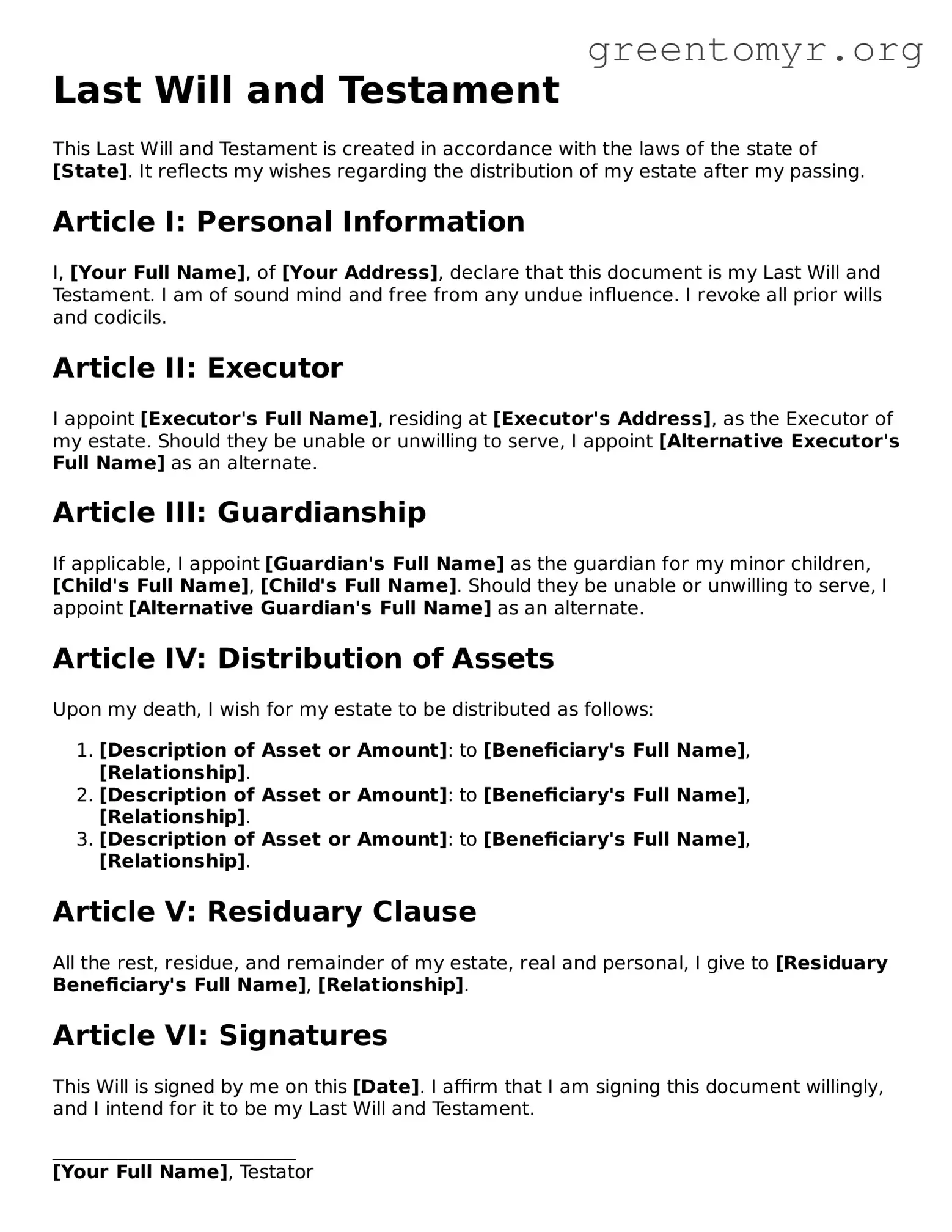

Last Will and Testament

This Last Will and Testament is created in accordance with the laws of the state of [State]. It reflects my wishes regarding the distribution of my estate after my passing.

Article I: Personal Information

I, [Your Full Name], of [Your Address], declare that this document is my Last Will and Testament. I am of sound mind and free from any undue influence. I revoke all prior wills and codicils.

Article II: Executor

I appoint [Executor's Full Name], residing at [Executor's Address], as the Executor of my estate. Should they be unable or unwilling to serve, I appoint [Alternative Executor's Full Name] as an alternate.

Article III: Guardianship

If applicable, I appoint [Guardian's Full Name] as the guardian for my minor children, [Child's Full Name], [Child's Full Name]. Should they be unable or unwilling to serve, I appoint [Alternative Guardian's Full Name] as an alternate.

Article IV: Distribution of Assets

Upon my death, I wish for my estate to be distributed as follows:

- [Description of Asset or Amount]: to [Beneficiary's Full Name], [Relationship].

- [Description of Asset or Amount]: to [Beneficiary's Full Name], [Relationship].

- [Description of Asset or Amount]: to [Beneficiary's Full Name], [Relationship].

Article V: Residuary Clause

All the rest, residue, and remainder of my estate, real and personal, I give to [Residuary Beneficiary's Full Name], [Relationship].

Article VI: Signatures

This Will is signed by me on this [Date]. I affirm that I am signing this document willingly, and I intend for it to be my Last Will and Testament.

__________________________

[Your Full Name], Testator

Witnesses

We, the undersigned witnesses, declare that the testator signed this Last Will and Testament in our presence and that we are not beneficiaries under this Will.

- __________________________

[Witness 1 Full Name], [Witness 1 Address]

- __________________________

[Witness 2 Full Name], [Witness 2 Address]

Witnessed at: [Location]