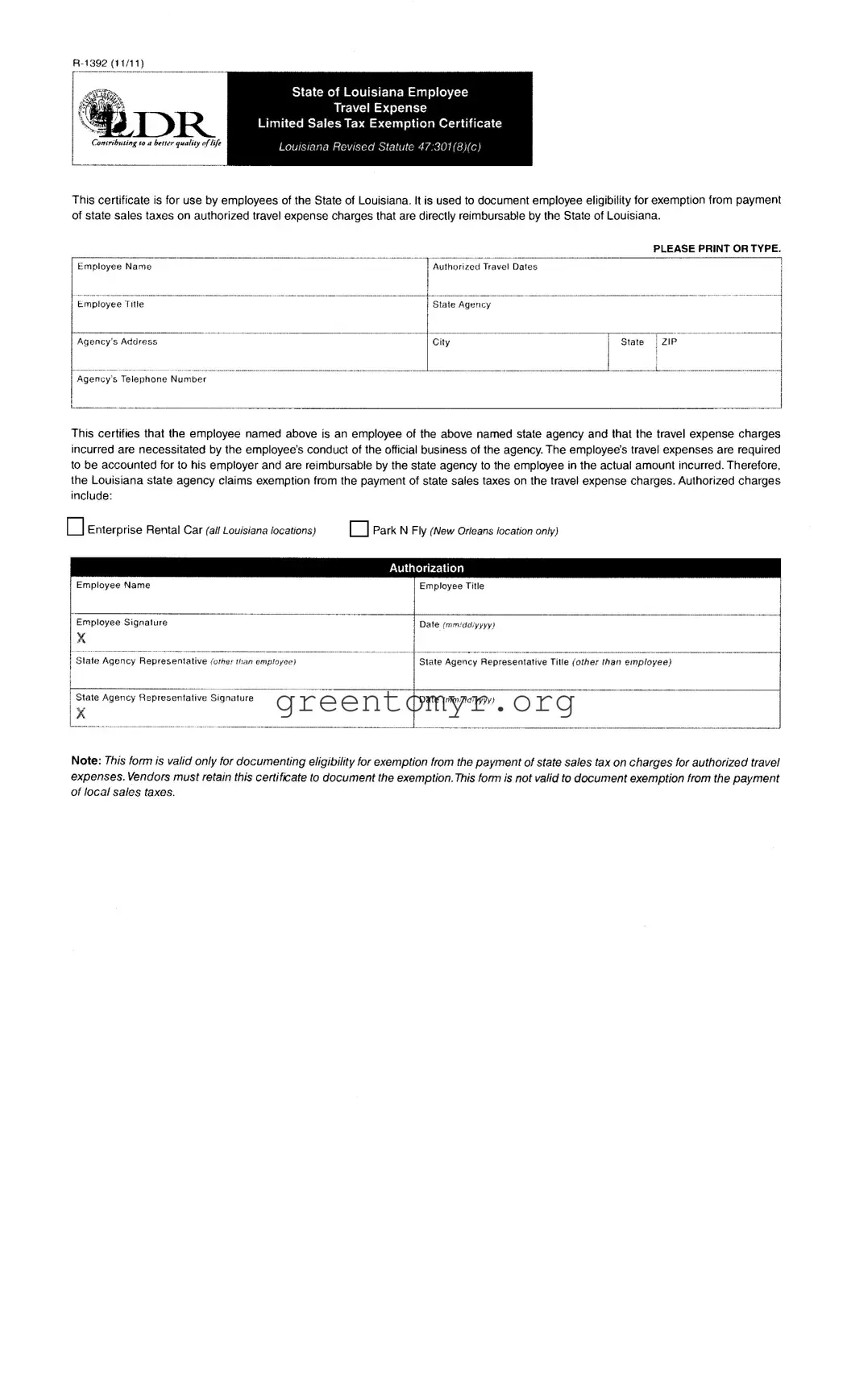

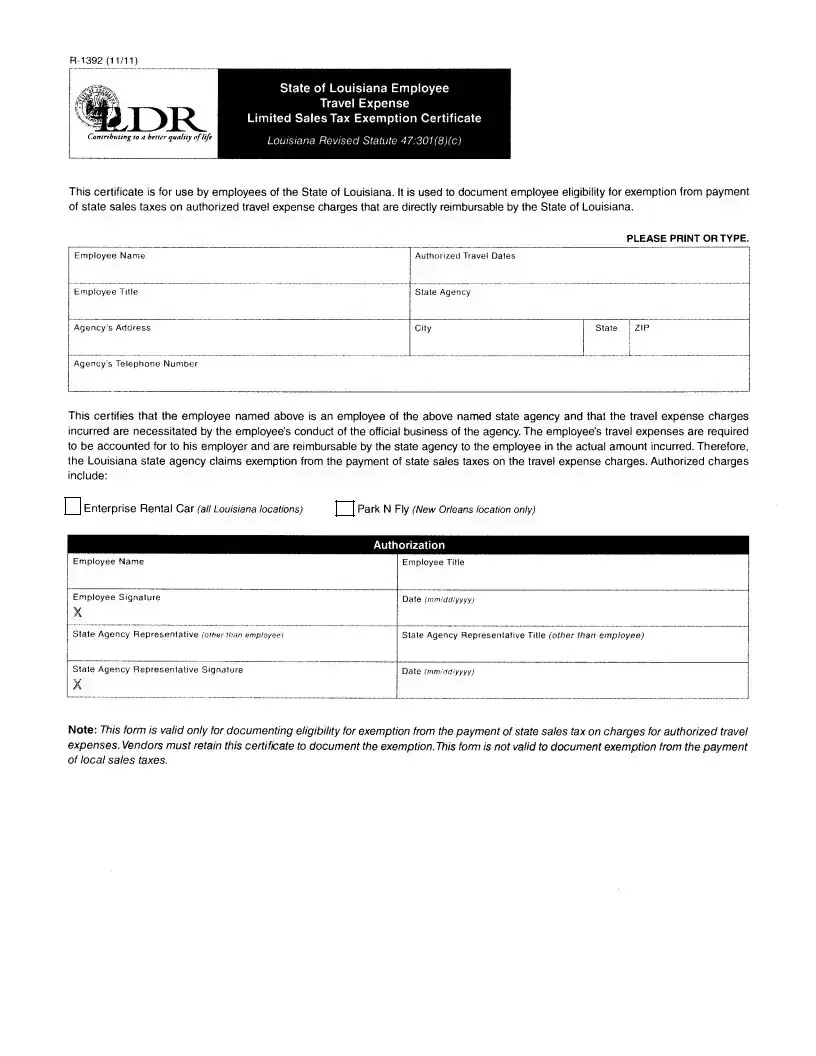

Filling out the Ldr R 1392 form can seem straightforward, but many people make common mistakes that can lead to delays or issues with reimbursement. Understanding these pitfalls can save time and ensure proper processing of claims.

One frequent error is the failure to print or type the information clearly. When the information is difficult to read, it can hinder processing. Handwriting that is illegible or using an incorrect font could lead to misunderstandings regarding critical details.

Another common mistake occurs when individuals do not complete all required fields. Omitting essential information, such as the authorized travel dates or agency’s address, may result in automatic rejection of the form. Always double-check that every section is filled out appropriately before submission.

Signing the form can also be an issue. Some forget to include both the employee’s signature and the state agency representative's signature. If either signature is missing, the form lacks validation, which can delay the exemption process.

Many individuals do not take care to ensure that the information matches their official employment records. Inaccurate names, titles, or agency details create confusion when verifying eligibility. Consistency with official documents is essential.

Another point of confusion arises with the understanding of authorized charges. Users sometimes check items that are not covered by the exemption. Familiarity with what qualifies as an authorized travel expense is crucial to avoid unnecessary complications.

It’s not uncommon for people to misinterpret the expiration of the form. Some believe that once completed, the form remains valid indefinitely. In reality, it should be used for a specific travel event and submitted in a timely manner to ensure reimbursement processes aren't affected.

Finally, a lack of attention to detail regarding the contact information can lead to setbacks. Providing incorrect or outdated phone numbers may prevent vendors from reaching the correct agency representative for validation. Ensure that all contact details are current and accessible.

By being mindful of these mistakes, employees can streamline their travel reimbursement process, facilitate better communication with the agency, and ultimately enjoy a smoother experience with the Ldr R 1392 form.