What is a Lease-to-Own Agreement?

A Lease-to-Own Agreement is a contract that allows a person to rent a property with the option to purchase it later. This type of agreement typically involves the tenant making monthly rental payments, a portion of which may be credited towards the down payment for the property should they decide to buy it at a later date.

Who benefits from a Lease-to-Own Agreement?

Both tenants and property owners can benefit from a Lease-to-Own Agreement. Tenants have the opportunity to test the property and neighborhood while working towards ownership. Property owners can attract tenants who are serious about purchasing, providing a potential future sale along with immediate rental income.

How long does a Lease-to-Own Agreement typically last?

The duration of a Lease-to-Own Agreement can vary, but it often ranges from one to three years. The length of the agreement is usually negotiated between the tenant and the property owner, allowing flexibility based on needs and circumstances.

What happens if the tenant decides not to purchase the property?

If the tenant chooses not to proceed with the purchase after the lease term ends, they typically forfeit any money credited toward the purchase price. The property owner is then free to lease or sell the property to someone else. Always review the specific terms of the agreement to understand any penalties or conditions related to this option.

Are there any upfront costs associated with a Lease-to-Own Agreement?

Yes, upfront costs can include an option fee, which secures the right to purchase the property later. This fee may be non-refundable and is often credited towards the purchase price. Tenants may also be responsible for standard costs, such as first month’s rent, security deposits, and in some cases, closing costs.

Can a Lease-to-Own Agreement be negotiated?

Absolutely. Lease-to-Own agreements are highly negotiable. Terms such as the purchase price, length of the lease, option fee, and how much of the rent goes toward the purchase can all be tailored to fit the needs of both parties involved. It's essential for both the tenant and homeowner to clearly communicate their expectations.

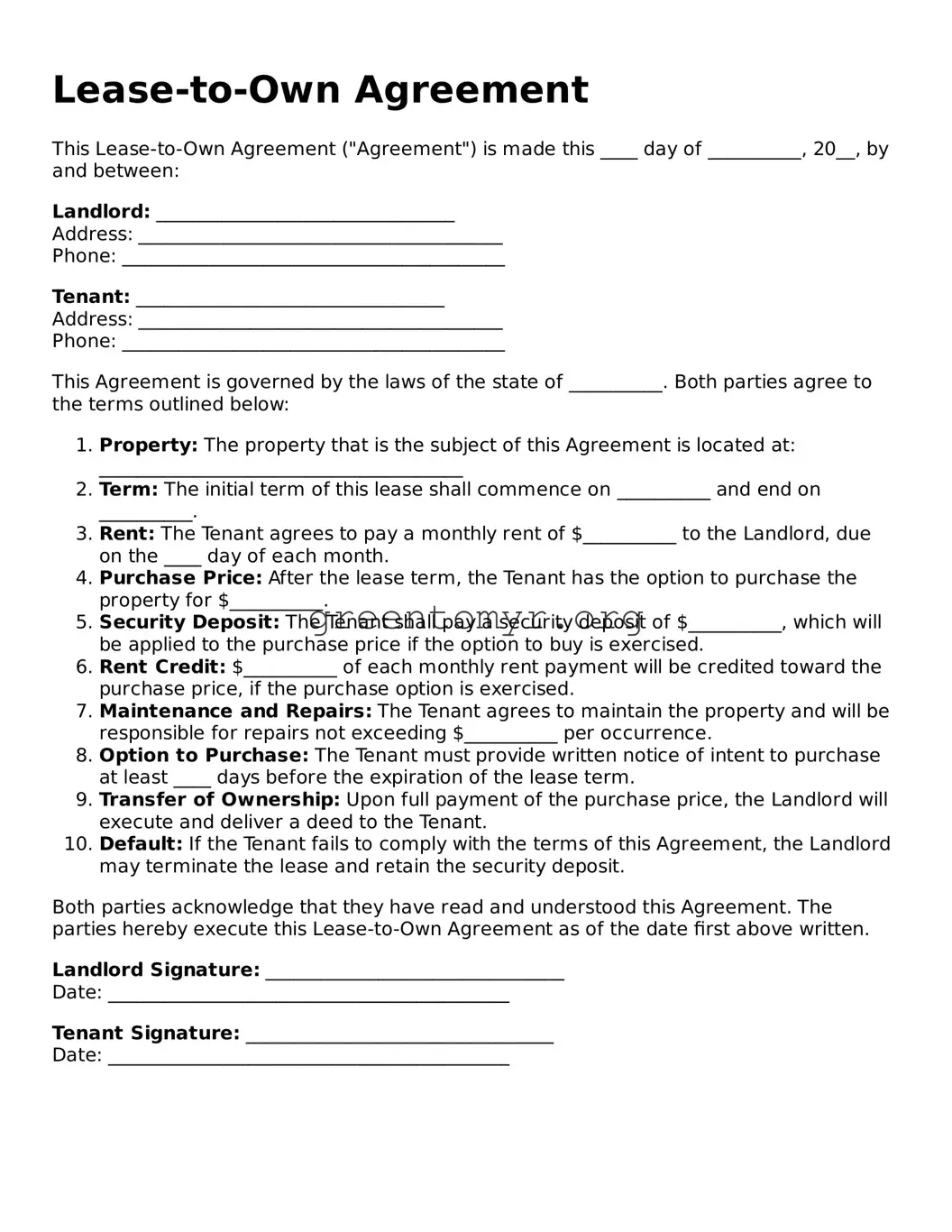

What should be included in a Lease-to-Own Agreement?

An effective Lease-to-Own Agreement should include several key components:

-

The purchase price of the property, or how it will be determined.

-

The length of the lease term.

-

The amount of the option fee and how it will be applied.

-

A clear statement regarding maintenance responsibilities.

-

Terms regarding the return of security deposits.

Can I repair the property during the lease period?

Generally, tenants are encouraged to maintain the property during the lease period. However, any major repairs or modifications should be discussed with the property owner. Some agreements may allow tenants to make improvements, while others may restrict such actions. Always review the agreement for specific guidelines related to repairs and maintenance.

Is it advisable to have a lawyer review the Lease-to-Own Agreement?

Having a lawyer review the Lease-to-Own Agreement is always a wise choice. Legal professionals can identify potential pitfalls and ensure that both parties' rights and responsibilities are clearly defined in the contract. This helps to prevent misunderstandings and disputes in the future.

What are the risks associated with a Lease-to-Own Agreement?

Some potential risks include the possibility that the property's market value may decline, causing the tenant to pay more than market value if they choose to buy. Additionally, if the tenant fails to make timely rental payments, they might risk losing their lease-to-own agreement and any contributions made toward the purchase. It's crucial to weigh these risks carefully before entering into such an agreement.