Please print

estate

Everything that you own at your passing after payment of debts and taxes. You will make decisions regarding the percentage share of your estate that you wish to give to your beneficiaries. And if you wish, you may leave specific items of property (car, investments, heirlooms, etc.) or sums of money to your beneficiaries.

will

A document which provides who is to receive your property, who will administer your estate, who will serve as guardian of your children, if applicable, and other provisions.

peace of mind

The wonderful feeling you get as a LegalShield member after having your Will prepared by a qualified law firm at a reasonable price.

For Your

Information

MEMBER AND SPOUSE FILLING OUT A SEPARATE FORM

In order to meet each person’s unique needs, you must each fill out a Will Questionnaire.

Get Started!

What You’ll Need to Complete This Questionnaire:

•Copy of your Prenuptial Agreement (if applicable).

•Names and birth dates of your children and grandchildren (if applicable).

•The name and contact information of the person you’ve chosen to be guardian of your child(ren), the trustee(s) of their estate, and your personal representative/executor.

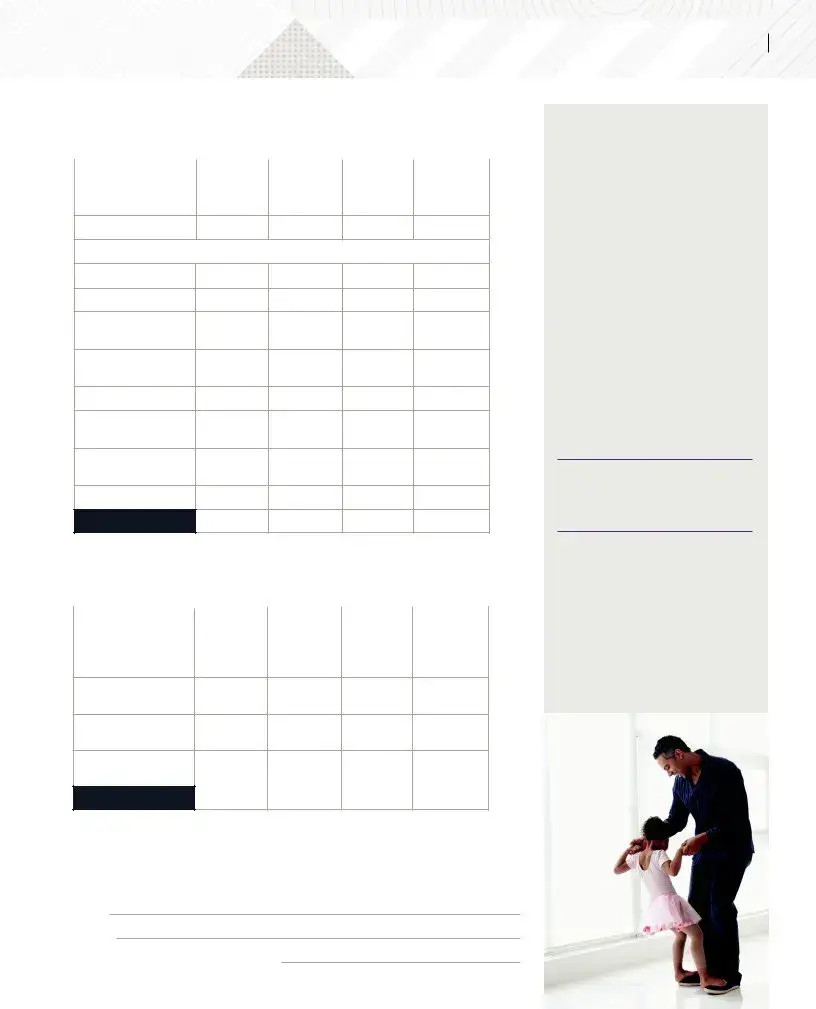

•To best serve you in completing your Will for estate tax purposes, you’ll be asked to provide the approximate dollar amount of such items as: your home, other real estate, bank accounts, vehicles, retirement plans, life insurance policies, and debts such as mortgages, loans, medical or others over $5,000.

Helpful Information before You Get Started!

•This Will Questionnaire is NOT your Will. It will help your Provider Law Firm prepare your Will. All questions applicable to you MUST be completed in their entirety in order to have your Will prepared.

•If you need more space to answer a question, attach a separate sheet and indicate the question number to which it pertains.

•If you have questions while filling out this form, don’t hesitate to call your Provider Law Firm at the number on your membership card.

•If you need the number to your firm, call Member Services at 1-800-654-7757 (7 a.m. - 7 p.m., Monday-Friday, Central Time).

1)Full name (first, middle, last):

All other names by which you have been known:

Membership Number:

Age: |

|

|

|

|

Date of Birth (DOB): |

|

|

|

|

|

|

Sex: |

Male Female |

Are you a US citizen?* |

Y |

N If no, country of citizenship: |

|

|

|

|

2) Current residence |

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address: |

|

|

|

|

|

City: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

County or Parish: |

|

|

|

|

|

|

ST: |

|

|

ZIP: |

|

Home Phone: |

|

|

|

|

_Work Phone: |

|

|

|

3) If you are married, your spouse’s full name (first, middle, last, maiden):

DOB: |

|

|

Date of marriage: |

|

|

Place of marriage: |

|

|

|

|

|

|

|

|

Are you currently living with your present spouse? |

Y |

N |

4)Do you and your spouse have a Prenuptial Agreement which identifies and disposes

of separate spousal property? |

Y |

N |

N/A |

If yes, attach copy with any filing data.

Y

Y  N

N  N/A If yes, state the following for each:

N/A If yes, state the following for each:

6

6