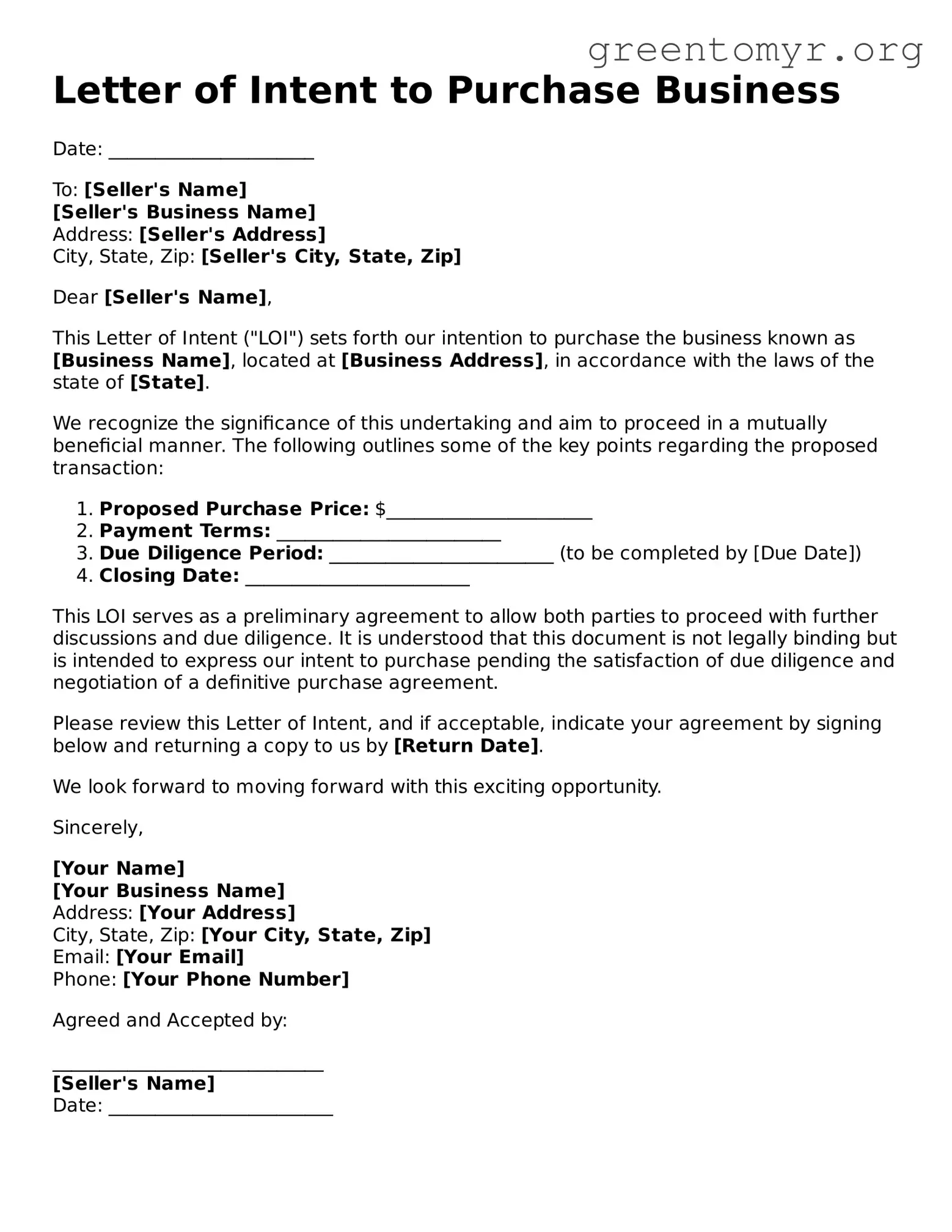

Letter of Intent to Purchase Business

Date: ______________________

To: [Seller's Name]

[Seller's Business Name]

Address: [Seller's Address]

City, State, Zip: [Seller's City, State, Zip]

Dear [Seller's Name],

This Letter of Intent ("LOI") sets forth our intention to purchase the business known as [Business Name], located at [Business Address], in accordance with the laws of the state of [State].

We recognize the significance of this undertaking and aim to proceed in a mutually beneficial manner. The following outlines some of the key points regarding the proposed transaction:

- Proposed Purchase Price: $______________________

- Payment Terms: ________________________

- Due Diligence Period: ________________________ (to be completed by [Due Date])

- Closing Date: ________________________

This LOI serves as a preliminary agreement to allow both parties to proceed with further discussions and due diligence. It is understood that this document is not legally binding but is intended to express our intent to purchase pending the satisfaction of due diligence and negotiation of a definitive purchase agreement.

Please review this Letter of Intent, and if acceptable, indicate your agreement by signing below and returning a copy to us by [Return Date].

We look forward to moving forward with this exciting opportunity.

Sincerely,

[Your Name]

[Your Business Name]

Address: [Your Address]

City, State, Zip: [Your City, State, Zip]

Email: [Your Email]

Phone: [Your Phone Number]

Agreed and Accepted by:

_____________________________

[Seller's Name]

Date: ________________________