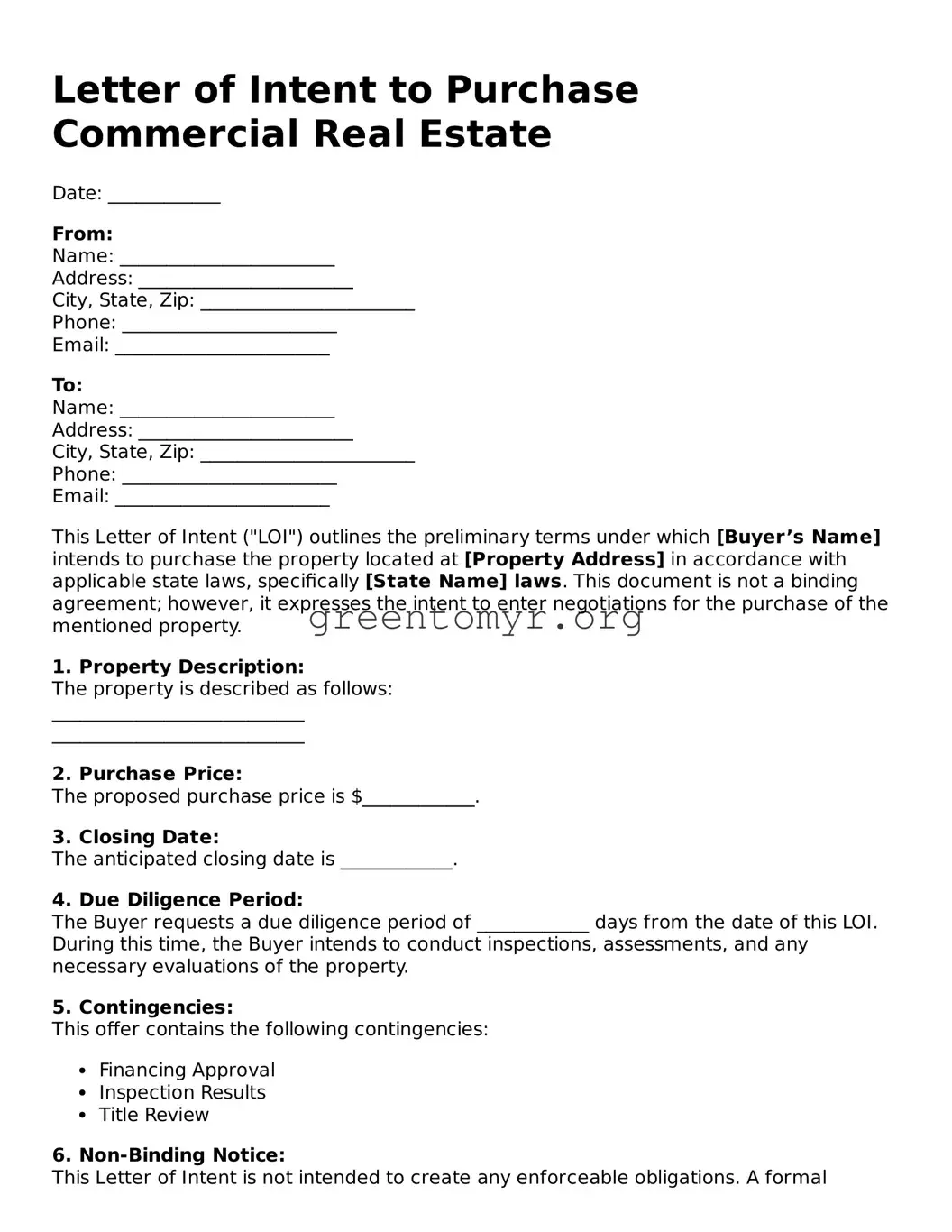

Letter of Intent to Purchase Commercial Real Estate

Date: ____________

From:

Name: _______________________

Address: _______________________

City, State, Zip: _______________________

Phone: _______________________

Email: _______________________

To:

Name: _______________________

Address: _______________________

City, State, Zip: _______________________

Phone: _______________________

Email: _______________________

This Letter of Intent ("LOI") outlines the preliminary terms under which [Buyer’s Name] intends to purchase the property located at [Property Address] in accordance with applicable state laws, specifically [State Name] laws. This document is not a binding agreement; however, it expresses the intent to enter negotiations for the purchase of the mentioned property.

1. Property Description:

The property is described as follows:

___________________________

___________________________

2. Purchase Price:

The proposed purchase price is $____________.

3. Closing Date:

The anticipated closing date is ____________.

4. Due Diligence Period:

The Buyer requests a due diligence period of ____________ days from the date of this LOI. During this time, the Buyer intends to conduct inspections, assessments, and any necessary evaluations of the property.

5. Contingencies:

This offer contains the following contingencies:

- Financing Approval

- Inspection Results

- Title Review

6. Non-Binding Notice:

This Letter of Intent is not intended to create any enforceable obligations. A formal purchase agreement shall be negotiated and executed to reflect the final terms of the transaction.

7. Confidentiality:

Both parties agree to keep the details contained herein confidential and not to disclose them to any third parties without prior consent.

If these terms are acceptable, please sign below. Upon acceptance, the Buyer will begin preparing a formal Purchase and Sale Agreement to be presented for review.

Sincerely,

___________________________

(buyer’s signature)

___________________________

(title)

___________________________

(date)

Accepted by:

___________________________

(seller’s signature)

___________________________

(title)

___________________________

(date)