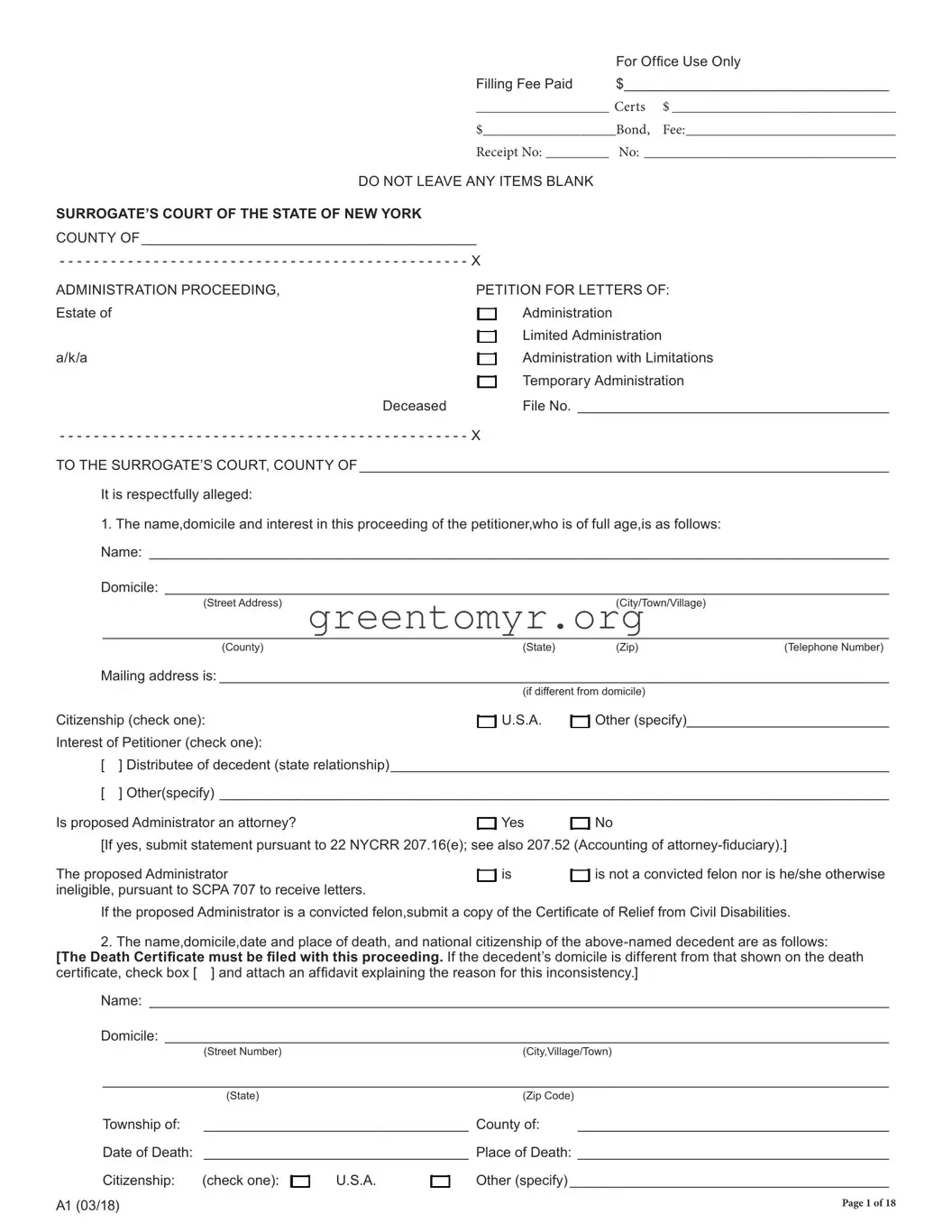

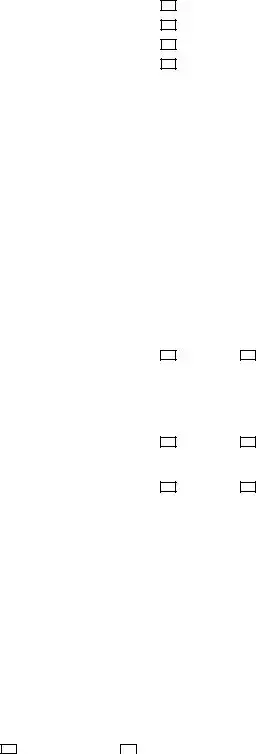

[Note: For Items 3a through c: Do not include any assets that are jointly held, held in trust for another, or have a named beneficiary.]

3.(a) The estimated gross value of the decedent’s personal property passing by intestacy is less than

$____________________________________________________

(b) The estimated gross value of the decedent’s real property, in this state, which is [ ] improved, [ ] unimproved, passing by intestacy is less than

$_____________________________________________________

A brief description of each parcel is as follows:

___________________________________________________________________________________________________________

(c) The estimated gross rent for a period of eighteen (18) months is the sum of $ ____________________________________

(d) In addition to the value of the personal property stated in paragraph (3) the following right of action existed on behalf of the decedent and survived his/her death, or is granted to the administrator of the decedent by special provision of law,and it is impractical to give a bond sufficient to cover the probable amount to be recovered the rein: [Write“NONE or state briefly the cause of action and the person against whom it exists, including names and carrier].

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

(e) If decedent is survived by a spouse and a parent, or parents but no issue,and there is a claim for wrongful death, check here [ ] and furnish names(s) and address(es) of parent(s) in Paragraph 7. See EPTL5-4.4.

4.A diligent search and inquiry, including a search of any safe deposit box,has been made for a will of the decedent and none has been found. Petitioner(s)(has)(have) been unable to obtain any information concerning any will of the decedent and therefore allege(s),upon information and belief,that the decedent died without leaving any last will.

5.A search of the records of this Court shows that no application has ever been made for letters of administration upon the estate of the decedent or for the probate of a will of the decedent, and your petitioner is informed and verily believes that no such application ever has been made to the Surrogate’s Court of any other county of this state.

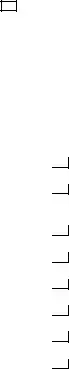

6.The decedent left surviving the following who would inherit his/her estate pursuant to EPTL4-1.1 and 4-1.2:

a.[ ] Spouse(husband/wife).

] Spouse(husband/wife).

b.[ ] Child or children or descendants of predeceased child or children. [Must include marital, nonmarital

] Child or children or descendants of predeceased child or children. [Must include marital, nonmarital

and adopted].

c.[ ] Any issue of the decedent adopted by persons related to the decedent (DRLSection117).

] Any issue of the decedent adopted by persons related to the decedent (DRLSection117).

d.[ ] Mother/Father.

] Mother/Father.

e.[ ] Sisters or brothers, either of whole or half blood, and issue of predeceased sisters or brothers.

] Sisters or brothers, either of whole or half blood, and issue of predeceased sisters or brothers.

f.[ ] Grandmother/Grandfather.

] Grandmother/Grandfather.

g.[ ] Aunts or uncles, and children of predeceased aunts and uncles (first cousins).

] Aunts or uncles, and children of predeceased aunts and uncles (first cousins).

h.[ ] First cousins once removed (children of first cousins).

] First cousins once removed (children of first cousins).

[Information is required only as to those classes of surviving relatives who would take the property of decedent pursuant to EPTL4-1.1.State “number” of survivors in each class. Insert “No” in all prior classes. Insert “X” in all subsequent classes].

] Spouse(husband/wife).

] Spouse(husband/wife). ] Child or children or descendants of predeceased child or children. [Must include marital, nonmarital

] Child or children or descendants of predeceased child or children. [Must include marital, nonmarital ] Any issue of the decedent adopted by persons related to the decedent (DRLSection117).

] Any issue of the decedent adopted by persons related to the decedent (DRLSection117). ] Mother/Father.

] Mother/Father. ] Sisters or brothers, either of whole or half blood, and issue of predeceased sisters or brothers.

] Sisters or brothers, either of whole or half blood, and issue of predeceased sisters or brothers. ] Grandmother/Grandfather.

] Grandmother/Grandfather. ] Aunts or uncles, and children of predeceased aunts and uncles (first cousins).

] Aunts or uncles, and children of predeceased aunts and uncles (first cousins). ] First cousins once removed (children of first cousins).

] First cousins once removed (children of first cousins).

]

]