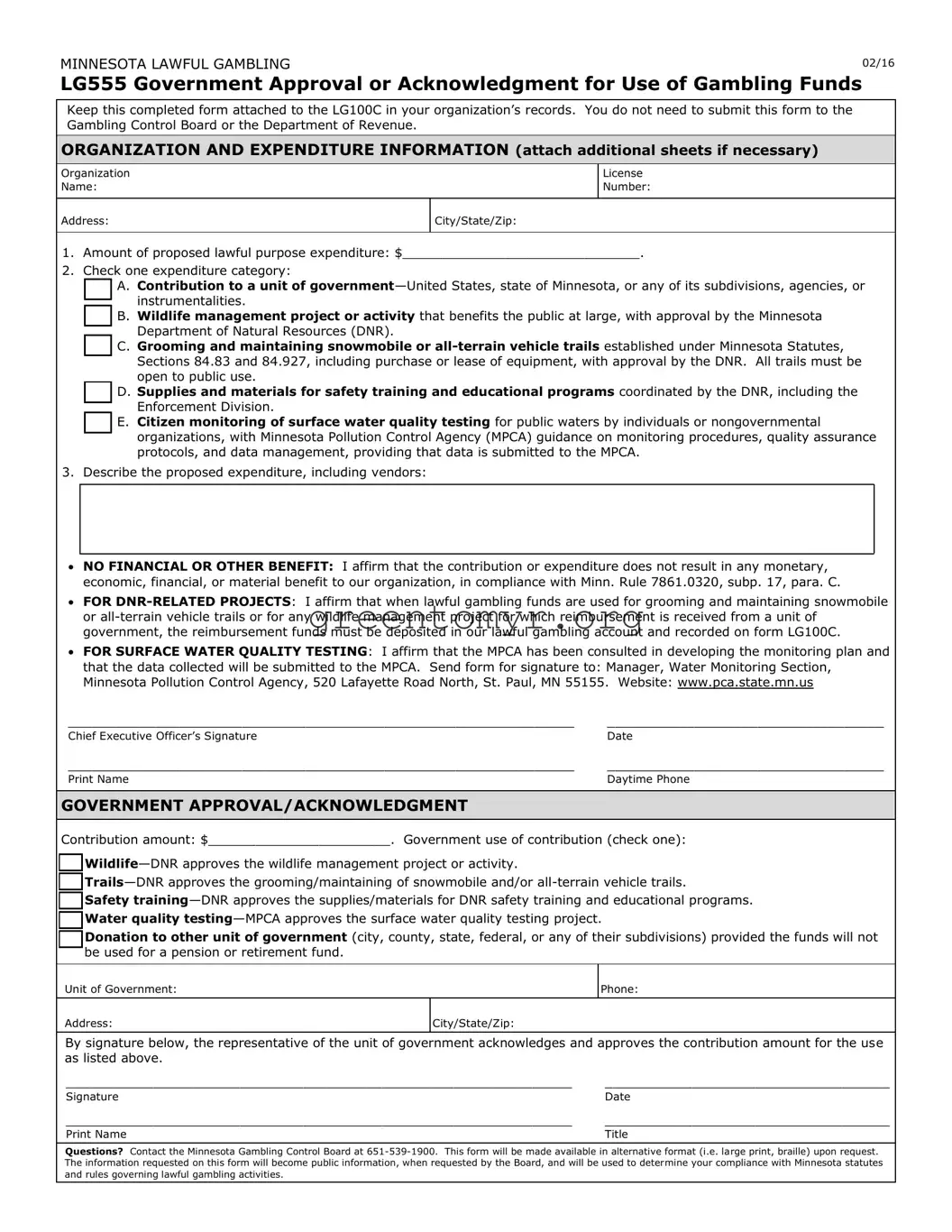

1.Amount of proposed lawful purpose expenditure: $______________________________.

2.Check one expenditure category:

A. Contribution to a unit of government—United States, state of Minnesota, or any of its subdivisions, agencies, or

instrumentalities.

B. Wildlife management project or activity that benefits the public at large, with approval by the Minnesota Department of Natural Resources (DNR).

C. Grooming and maintaining snowmobile or all-terrain vehicle trails established under Minnesota Statutes, Sections 84.83 and 84.927, including purchase or lease of equipment, with approval by the DNR. All trails must be open to public use.

D.Supplies and materials for safety training and educational programs coordinated by the DNR, including the Enforcement Division.

E.Citizen monitoring of surface water quality testing for public waters by individuals or nongovernmental organizations, with Minnesota Pollution Control Agency (MPCA) guidance on monitoring procedures, quality assurance protocols, and data management, providing that data is submitted to the MPCA.

3.Describe the proposed expenditure, including vendors:

NO FINANCIAL OR OTHER BENEFIT: I affirm that the contribution or expenditure does not result in any monetary, economic, financial, or material benefit to our organization, in compliance with Minn. Rule 7861.0320, subp. 17, para. C.

FOR DNR-RELATED PROJECTS: I affirm that when lawful gambling funds are used for grooming and maintaining snowmobile or all-terrain vehicle trails or for any wildlife management project for which reimbursement is received from a unit of government, the reimbursement funds must be deposited in our lawful gambling account and recorded on form LG100C.

FOR SURFACE WATER QUALITY TESTING: I affirm that the MPCA has been consulted in developing the monitoring plan and

that the data collected will be submitted to the MPCA. Send form for signature to: Manager, Water Monitoring Section,

Minnesota Pollution Control Agency, 520 Lafayette Road North, St. Paul, MN 55155. Website: www.pca.state.mn.us

________________________________________________________________ |

___________________________________ |

Chief Executive Officer’s Signature |

Date |

________________________________________________________________ |

___________________________________ |

Print Name |

Daytime Phone |

|

|

GOVERNMENT APPROVAL/ACKNOWLEDGMENT |

|

|

|

Contribution amount: $_______________________. Government use of contribution (check one):

Wildlife—DNR approves the wildlife management project or activity.

Trails—DNR approves the grooming/maintaining of snowmobile and/or all-terrain vehicle trails.

Safety training—DNR approves the supplies/materials for DNR safety training and educational programs.

Safety training—DNR approves the supplies/materials for DNR safety training and educational programs.

Water quality testing—MPCA approves the surface water quality testing project.

Water quality testing—MPCA approves the surface water quality testing project.

Donation to other unit of government (city, county, state, federal, or any of their subdivisions) provided the funds will not be used for a pension or retirement fund.