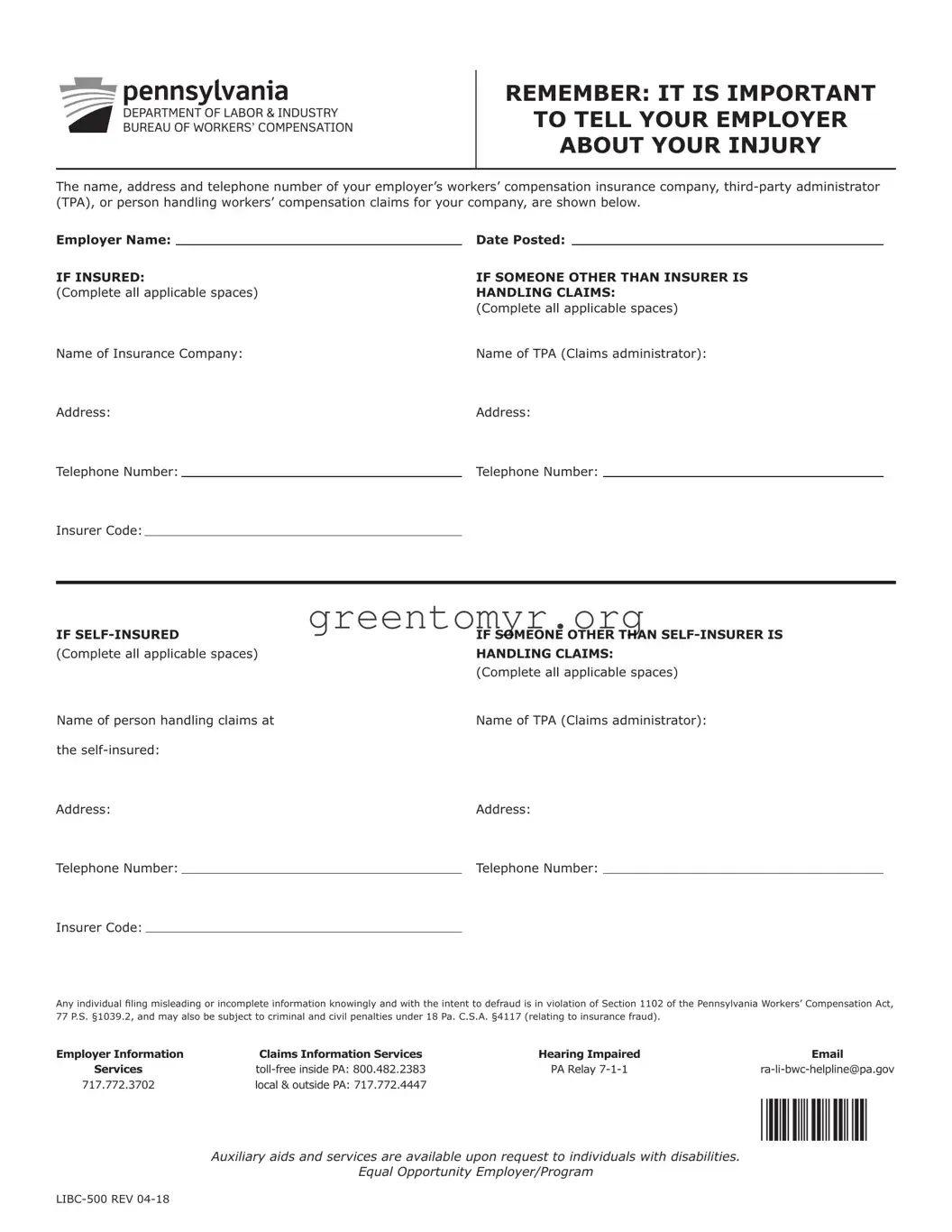

The LIBC 500 form is a crucial document in Pennsylvania's workers' compensation process, designed to facilitate communication between employees, employers, and insurance providers following a workplace injury. At the outset, the form emphasizes the importance of promptly notifying the employer about any injuries sustained on the job. It incorporates essential information, such as the name, address, and contact details of the employer’s workers' compensation insurance company or the third-party administrator (TPA) responsible for handling claims. This section ensures that all parties involved have access to accurate claims-related information, promoting a fluid handling of claims. Additionally, the form addresses situations where the employer may be self-insured, requiring completion details regarding the individual responsible for managing claims within that framework. The emphasis on accurate and honest reporting is paramount, as any intent to provide misleading information can lead to serious legal consequences under Pennsylvania law, reinforcing the importance of integrity in the claims process. Accessible support options are also noted, ensuring that individuals with disabilities can seek assistance as needed, reflecting an inclusive approach to workers' compensation.