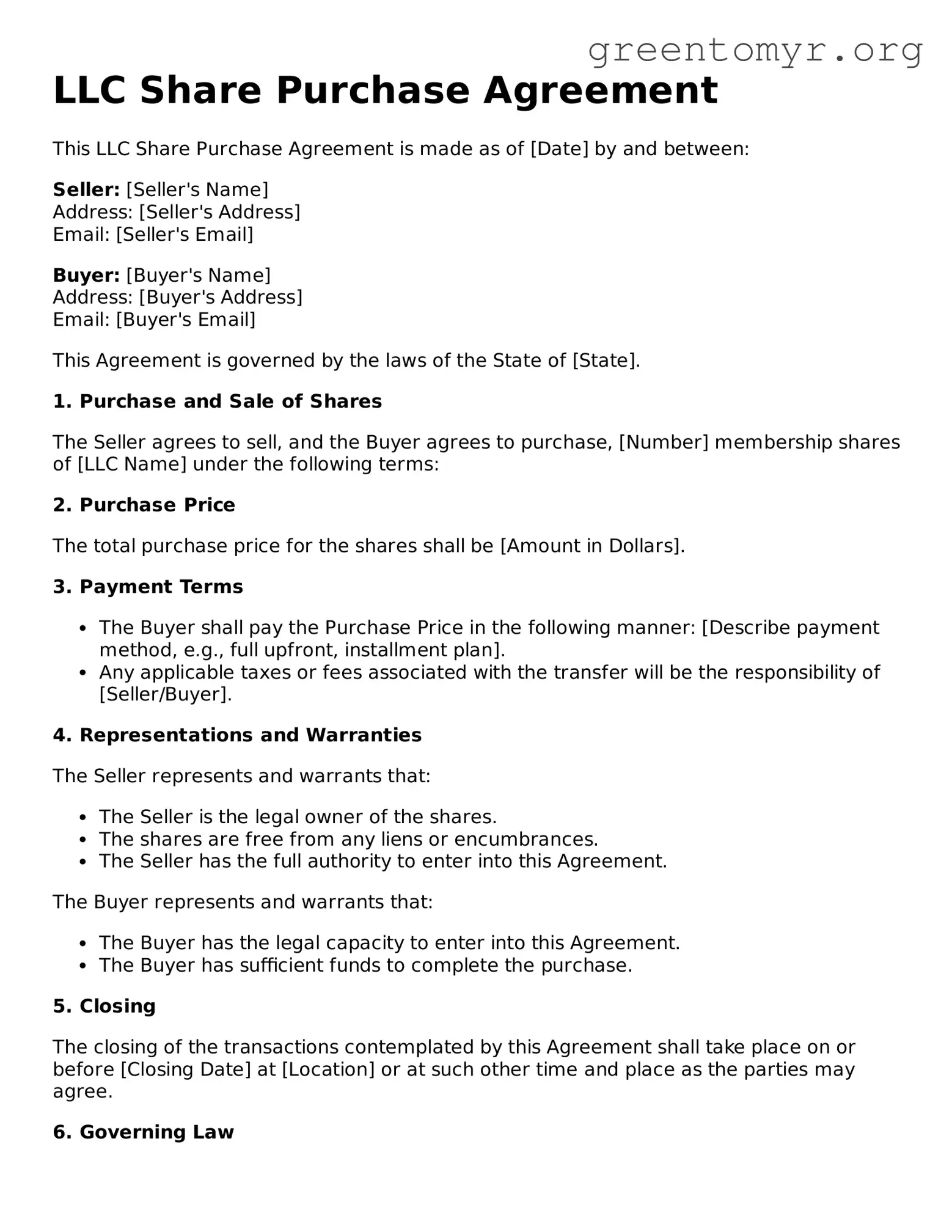

LLC Share Purchase Agreement

This LLC Share Purchase Agreement is made as of [Date] by and between:

Seller: [Seller's Name]

Address: [Seller's Address]

Email: [Seller's Email]

Buyer: [Buyer's Name]

Address: [Buyer's Address]

Email: [Buyer's Email]

This Agreement is governed by the laws of the State of [State].

1. Purchase and Sale of Shares

The Seller agrees to sell, and the Buyer agrees to purchase, [Number] membership shares of [LLC Name] under the following terms:

2. Purchase Price

The total purchase price for the shares shall be [Amount in Dollars].

3. Payment Terms

- The Buyer shall pay the Purchase Price in the following manner: [Describe payment method, e.g., full upfront, installment plan].

- Any applicable taxes or fees associated with the transfer will be the responsibility of [Seller/Buyer].

4. Representations and Warranties

The Seller represents and warrants that:

- The Seller is the legal owner of the shares.

- The shares are free from any liens or encumbrances.

- The Seller has the full authority to enter into this Agreement.

The Buyer represents and warrants that:

- The Buyer has the legal capacity to enter into this Agreement.

- The Buyer has sufficient funds to complete the purchase.

5. Closing

The closing of the transactions contemplated by this Agreement shall take place on or before [Closing Date] at [Location] or at such other time and place as the parties may agree.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of [State].

7. Miscellaneous

- This Agreement may be amended only in writing signed by both parties.

- If any provision is held to be invalid, the remaining provisions will remain in effect.

- This Agreement constitutes the entire agreement between the parties.

IN WITNESS WHEREOF, the parties have executed this LLC Share Purchase Agreement as of the date first above written.

Seller Signature: ________________________

Date: ________________

Buyer Signature: ________________________

Date: ________________