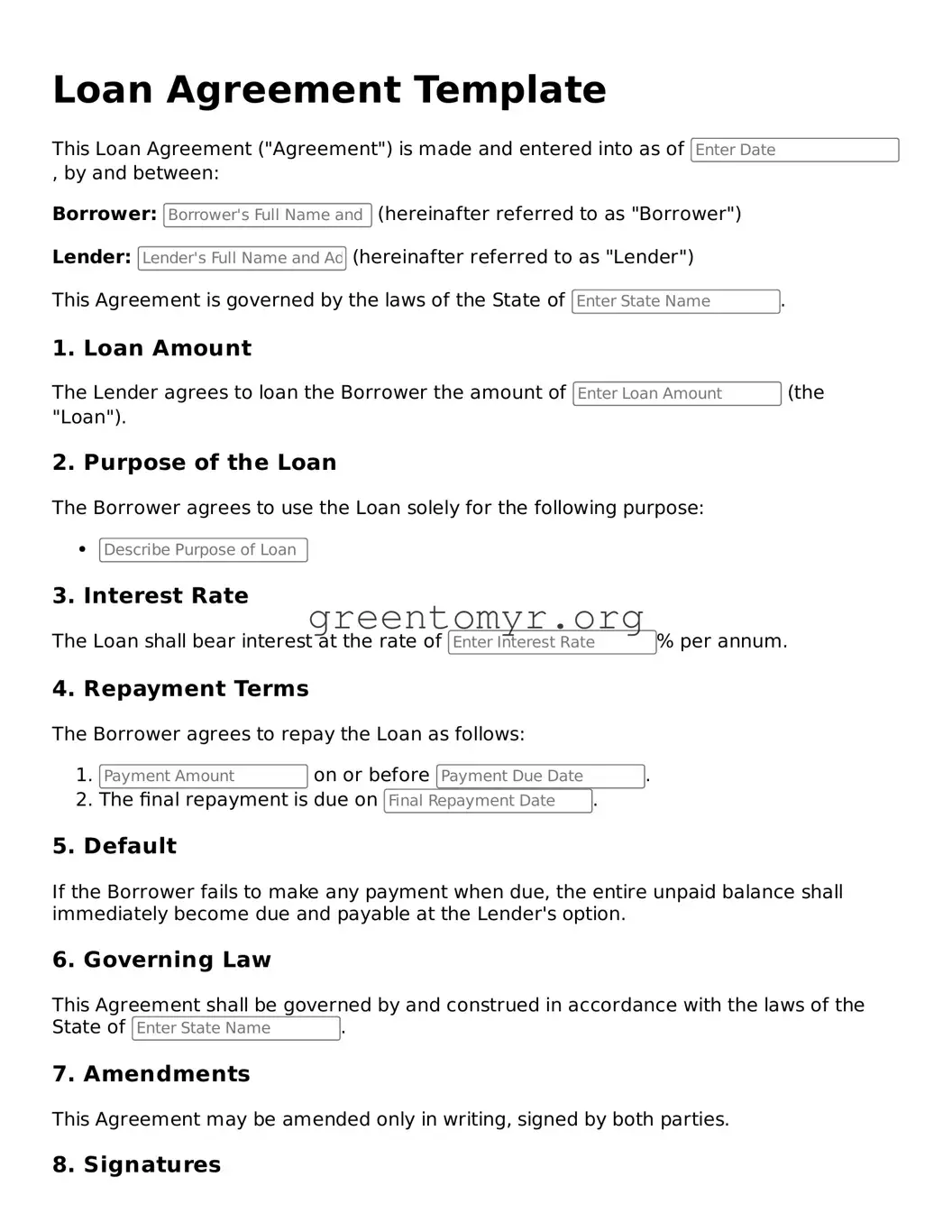

Valid Loan Agreement Form

A Loan Agreement form is a legal document that outlines the terms and conditions agreed upon by a lender and a borrower. It serves as a protection for both parties, clearly stating the amount borrowed, repayment schedule, interest rates, and default consequences. To begin your lending journey, consider filling out the form by clicking the button below.