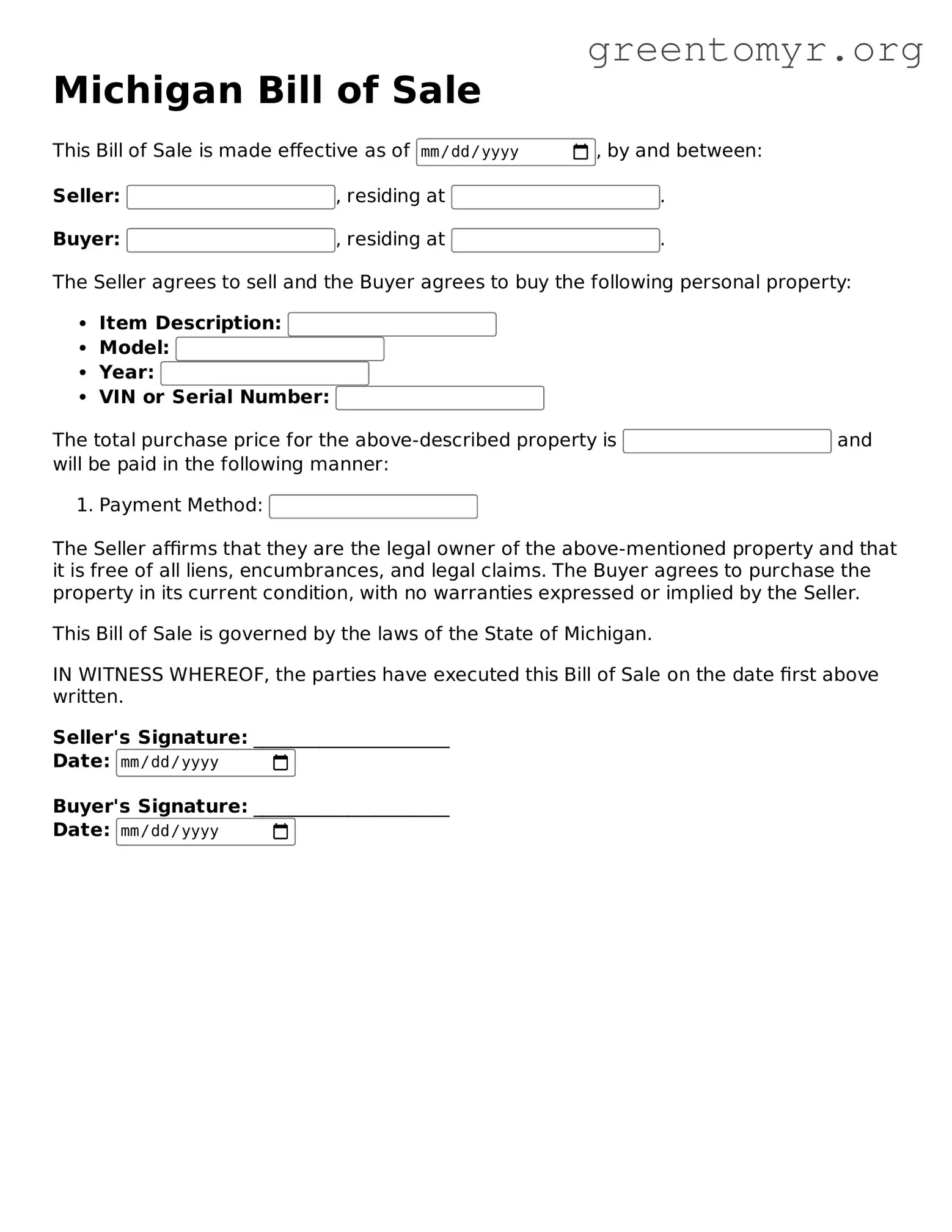

Bill of Sale Form for the State of Michigan

A Michigan Bill of Sale form is a legal document that serves as proof of the transfer of ownership of personal property from one individual to another. This form outlines the details of the transaction, including a description of the item, the purchase price, and the signatures of both parties. It is essential for buyers and sellers to complete this document to ensure clarity and protection in their transaction.

Ready to finalize your sale? Fill out the Michigan Bill of Sale form by clicking the button below.