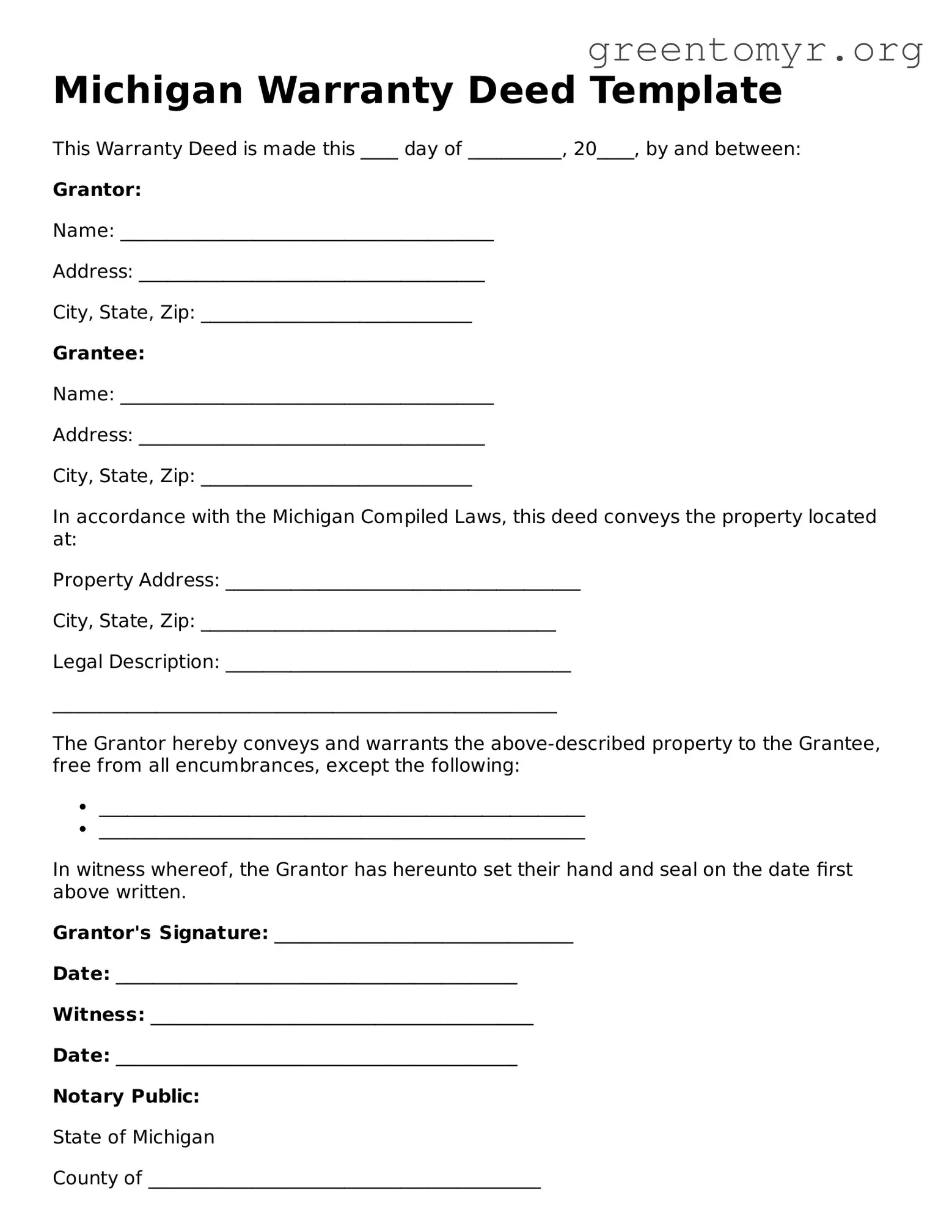

Michigan Warranty Deed Template

This Warranty Deed is made this ____ day of __________, 20____, by and between:

Grantor:

Name: ________________________________________

Address: _____________________________________

City, State, Zip: _____________________________

Grantee:

Name: ________________________________________

Address: _____________________________________

City, State, Zip: _____________________________

In accordance with the Michigan Compiled Laws, this deed conveys the property located at:

Property Address: ______________________________________

City, State, Zip: ______________________________________

Legal Description: _____________________________________

______________________________________________________

The Grantor hereby conveys and warrants the above-described property to the Grantee, free from all encumbrances, except the following:

- ____________________________________________________

- ____________________________________________________

In witness whereof, the Grantor has hereunto set their hand and seal on the date first above written.

Grantor's Signature: ________________________________

Date: ___________________________________________

Witness: _________________________________________

Date: ___________________________________________

Notary Public:

State of Michigan

County of __________________________________________

Subscribed and sworn to before me this ____ day of __________, 20____.

Notary's Signature: ________________________________

My Commission Expires: ___________________________