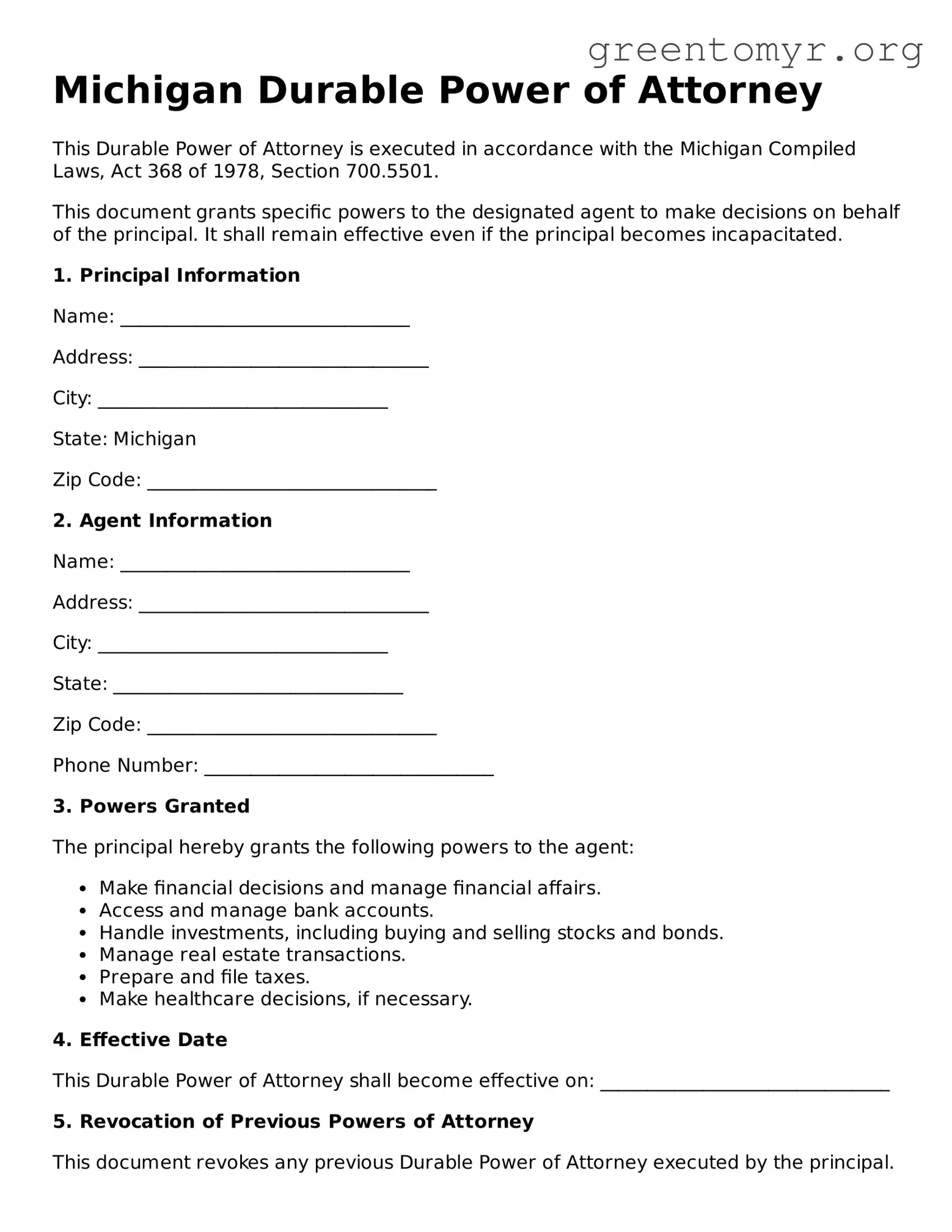

Michigan Durable Power of Attorney

This Durable Power of Attorney is executed in accordance with the Michigan Compiled Laws, Act 368 of 1978, Section 700.5501.

This document grants specific powers to the designated agent to make decisions on behalf of the principal. It shall remain effective even if the principal becomes incapacitated.

1. Principal Information

Name: _______________________________

Address: _______________________________

City: _______________________________

State: Michigan

Zip Code: _______________________________

2. Agent Information

Name: _______________________________

Address: _______________________________

City: _______________________________

State: _______________________________

Zip Code: _______________________________

Phone Number: _______________________________

3. Powers Granted

The principal hereby grants the following powers to the agent:

- Make financial decisions and manage financial affairs.

- Access and manage bank accounts.

- Handle investments, including buying and selling stocks and bonds.

- Manage real estate transactions.

- Prepare and file taxes.

- Make healthcare decisions, if necessary.

4. Effective Date

This Durable Power of Attorney shall become effective on: _______________________________

5. Revocation of Previous Powers of Attorney

This document revokes any previous Durable Power of Attorney executed by the principal.

6. Signature of Principal

Date: _______________________________

Signature: _______________________________

7. Witnesses and Notarization

This document must be signed in the presence of two witnesses or a notary.

Witness #1 Name: _______________________________

Witness #1 Signature: _______________________________

Date: _______________________________

Witness #2 Name: _______________________________

Witness #2 Signature: _______________________________

Date: _______________________________

Notary Public: _______________________________

My commission expires: _______________________________