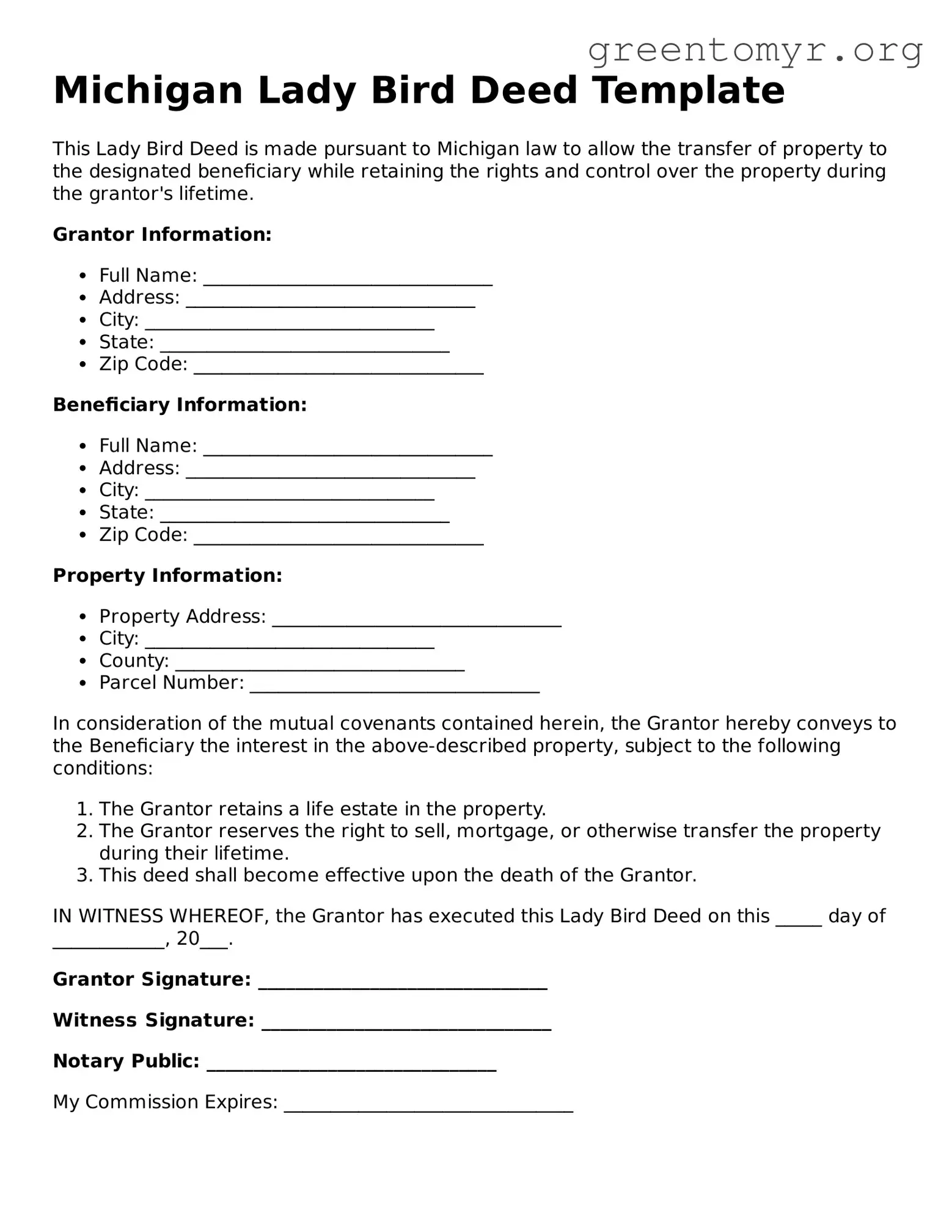

Michigan Lady Bird Deed Template

This Lady Bird Deed is made pursuant to Michigan law to allow the transfer of property to the designated beneficiary while retaining the rights and control over the property during the grantor's lifetime.

Grantor Information:

- Full Name: _______________________________

- Address: _______________________________

- City: _______________________________

- State: _______________________________

- Zip Code: _______________________________

Beneficiary Information:

- Full Name: _______________________________

- Address: _______________________________

- City: _______________________________

- State: _______________________________

- Zip Code: _______________________________

Property Information:

- Property Address: _______________________________

- City: _______________________________

- County: _______________________________

- Parcel Number: _______________________________

In consideration of the mutual covenants contained herein, the Grantor hereby conveys to the Beneficiary the interest in the above-described property, subject to the following conditions:

- The Grantor retains a life estate in the property.

- The Grantor reserves the right to sell, mortgage, or otherwise transfer the property during their lifetime.

- This deed shall become effective upon the death of the Grantor.

IN WITNESS WHEREOF, the Grantor has executed this Lady Bird Deed on this _____ day of ____________, 20___.

Grantor Signature: _______________________________

Witness Signature: _______________________________

Notary Public: _______________________________

My Commission Expires: _______________________________