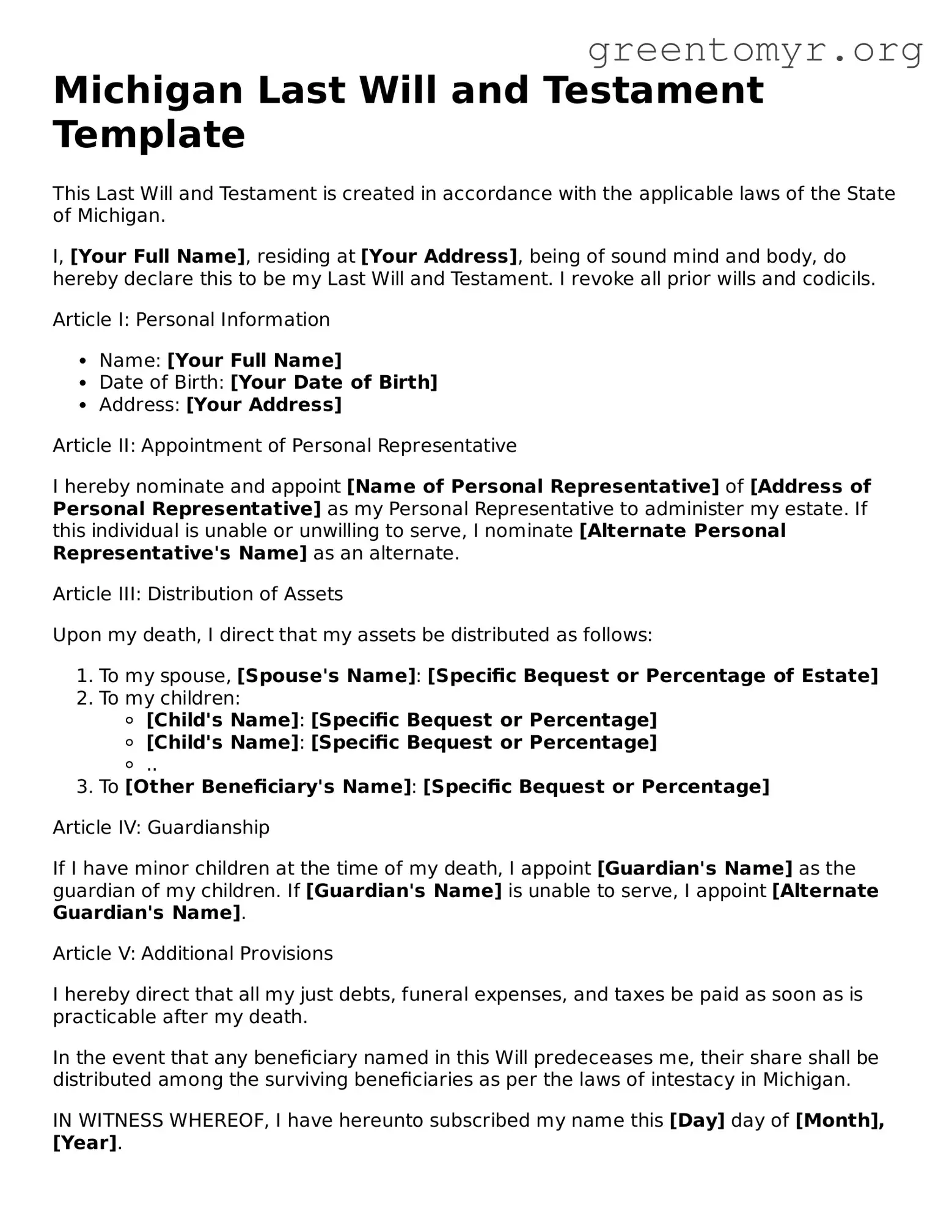

Michigan Last Will and Testament Template

This Last Will and Testament is created in accordance with the applicable laws of the State of Michigan.

I, [Your Full Name], residing at [Your Address], being of sound mind and body, do hereby declare this to be my Last Will and Testament. I revoke all prior wills and codicils.

Article I: Personal Information

- Name: [Your Full Name]

- Date of Birth: [Your Date of Birth]

- Address: [Your Address]

Article II: Appointment of Personal Representative

I hereby nominate and appoint [Name of Personal Representative] of [Address of Personal Representative] as my Personal Representative to administer my estate. If this individual is unable or unwilling to serve, I nominate [Alternate Personal Representative's Name] as an alternate.

Article III: Distribution of Assets

Upon my death, I direct that my assets be distributed as follows:

- To my spouse, [Spouse's Name]: [Specific Bequest or Percentage of Estate]

- To my children:

- [Child's Name]: [Specific Bequest or Percentage]

- [Child's Name]: [Specific Bequest or Percentage]

- ..

- To [Other Beneficiary's Name]: [Specific Bequest or Percentage]

Article IV: Guardianship

If I have minor children at the time of my death, I appoint [Guardian's Name] as the guardian of my children. If [Guardian's Name] is unable to serve, I appoint [Alternate Guardian's Name].

Article V: Additional Provisions

I hereby direct that all my just debts, funeral expenses, and taxes be paid as soon as is practicable after my death.

In the event that any beneficiary named in this Will predeceases me, their share shall be distributed among the surviving beneficiaries as per the laws of intestacy in Michigan.

IN WITNESS WHEREOF, I have hereunto subscribed my name this [Day] day of [Month], [Year].

[Your Signature]

Witnesses:

We, the undersigned witnesses, do hereby declare that the testator has signed and executed this instrument as their Last Will and Testament in our presence, and that we, in their presence and at their request, have signed as witnesses.

Witness 1:

Name: [Witness 1 Name]

Address: [Witness 1 Address]

Signature: [Witness 1 Signature]

Witness 2:

Name: [Witness 2 Name]

Address: [Witness 2 Address]

Signature: [Witness 2 Signature]

It is recommended that this document be signed in the presence of two witnesses and a notary public for the best validity.