When completing the Michigan Power of Attorney form, individuals sometimes encounter pitfalls that can lead to confusion or legal issues. One common mistake is failing to specify the powers granted to the agent. A vague outline can leave room for interpretation, which may result in the agent acting outside the intended authority.

Another frequent error involves not designating a backup agent. Life is unpredictable, and the primary agent may become unavailable due to illness or other circumstances. Omitting a secondary choice can hinder decision-making when it is most critical.

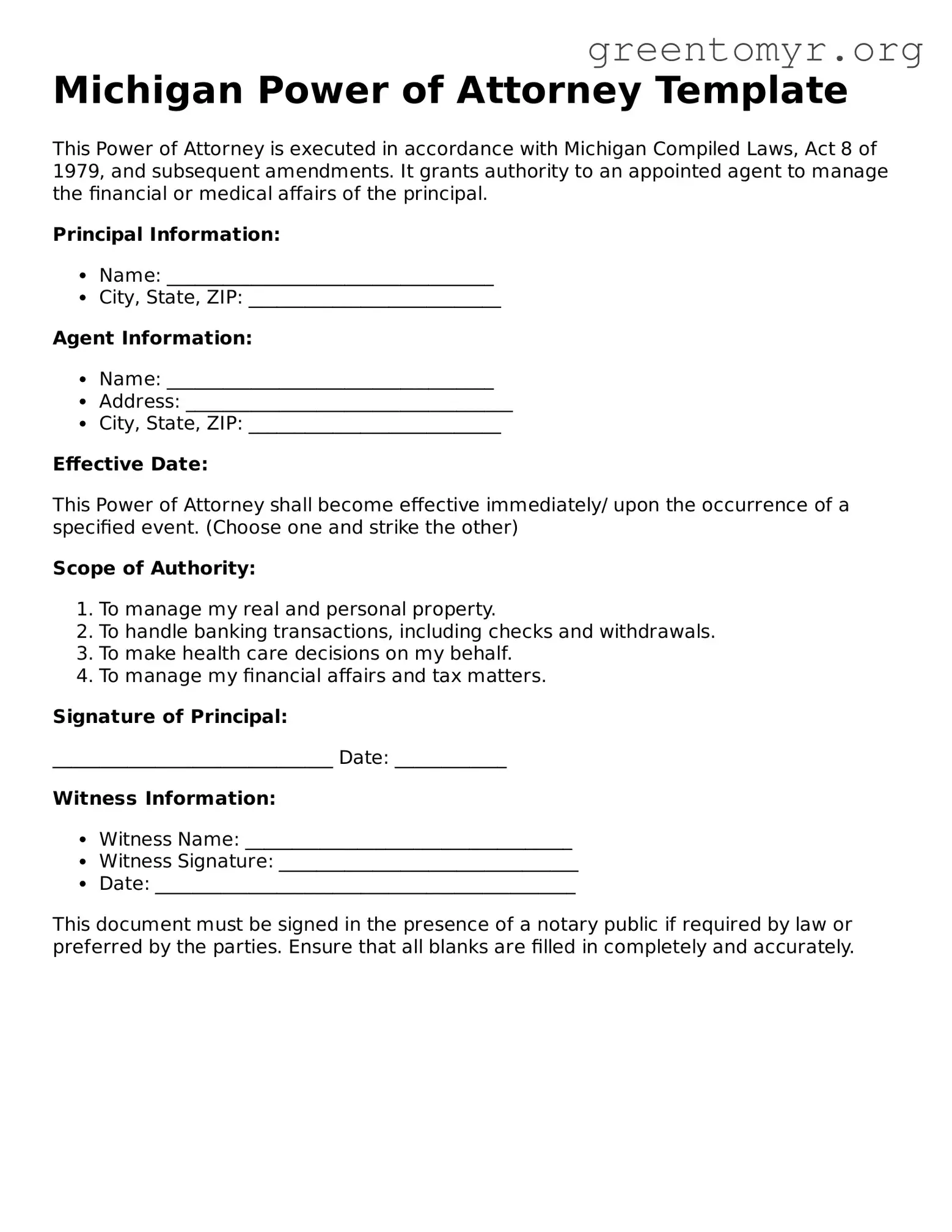

Some people neglect to sign the document in the presence of witnesses or a notary public, which is a requirement in Michigan. Without proper signatures, the Power of Attorney may not be honored by financial institutions and other entities.

The date of execution is another aspect that is often overlooked. While not always explicitly required, including the date can clarify the form's validity and avoid disputes concerning its effectiveness.

Individuals sometimes fail to review the form thoroughly before submission. Even minor errors such as typographical mistakes or inaccuracies in the agent’s information can create significant problems later on.

Inaccurate identification of the principal can also lead to complications. It is vital that the individual filling out the form is clearly identified to avoid any questions about authority and intent.

Another mistake includes using outdated forms. Legal requirements can change, and it is essential to utilize the most current version of the Michigan Power of Attorney form to ensure compliance with existing laws.

People may also overlook the importance of discussing the Power of Attorney with the chosen agent before signing. An unprepared agent may feel overwhelmed or may not fully understand their responsibilities, leading to complications when decisions must be made.

Another common error is not considering the scope of the authority granted. Some individuals may allow their agent too much power without understanding the implications, while others may inadvertently limit important decisions that should be made on their behalf.

Lastly, individuals may fail to communicate their wishes clearly with family members. Without open conversations, loved ones might be unaware of the principal’s intentions, which can create misunderstandings during significant life events.