What is a Michigan Promissory Note?

A Michigan Promissory Note is a legal document that outlines a promise to pay a specific amount of money to a designated party at a future date or on demand. This note serves as evidence of the debt and includes terms such as the interest rate, repayment schedule, and consequences for non-payment. It can be used in various situations, including personal loans, loan agreements between businesses, or any situation where one party is borrowing money from another.

What should be included in a Michigan Promissory Note?

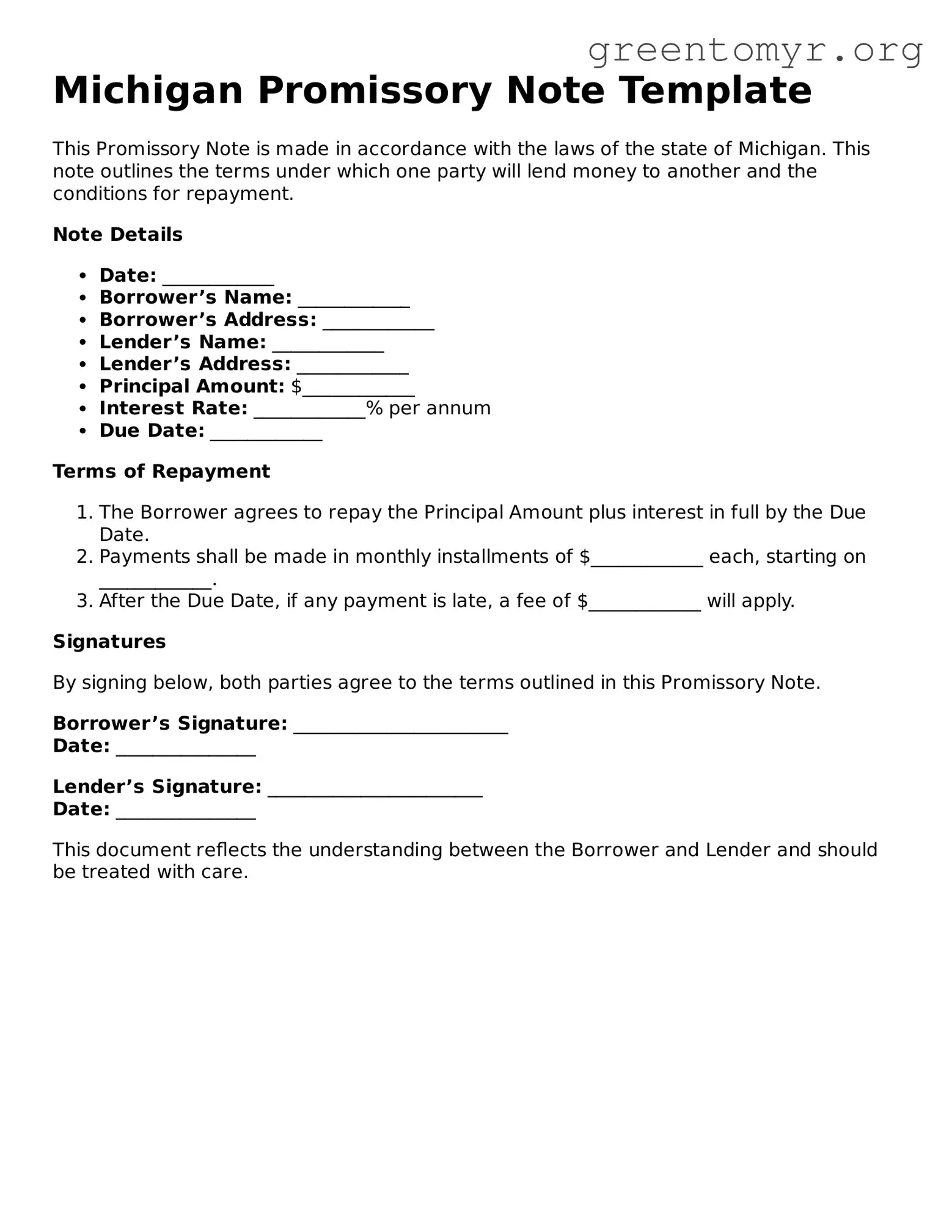

To create an effective and enforceable promissory note in Michigan, several key components should be included:

-

Names and Contact Information:

Clearly identify the borrower and the lender.

-

Principal Amount:

Specify the exact amount of money being borrowed.

-

Interest Rate:

Indicate whether the loan will carry an interest rate, and if so, detail the rate and calculation method.

-

Repayment Terms:

Describe how and when the loan will be paid back. This can include monthly installments or a lump-sum payment.

-

Default Consequences:

Outline what will happen if the borrower fails to make payments on time.

-

Signatures:

Both parties must sign and date the document, making it a valid agreement.

Is a Michigan Promissory Note legally binding?

Yes, a properly drafted Michigan Promissory Note is legally binding. For it to hold up in a court of law, it needs to meet specific requirements, such as being in writing, clearly stating the terms, and being signed by the relevant parties. If disputes arise, this document can be used as evidence in legal proceedings, making it essential to ensure accuracy and clarity in its creation.

How is a promissory note different from a loan agreement?

While both a promissory note and a loan agreement involve borrowing money, they differ in formality and content. A promissory note is typically shorter and focuses primarily on the promise to pay, detailing the amount owed, interest, and repayment terms. In contrast, a loan agreement offers more comprehensive terms, covering additional aspects like collateral, warranties, and conditions for loan disbursement. A loan agreement may be necessary for larger amounts or more complex transactions.

Can a promissory note be modified after signing?

Yes, a Michigan Promissory Note can be modified after it has been signed; however, any changes must be agreed upon by both parties and ideally documented in writing. It's advisable to create an amendment or addendum that outlines the changes, which both parties should sign. This helps in maintaining clarity and avoids confusion regarding the terms of the note.

What happens if the borrower defaults on the note?

If the borrower defaults, meaning they fail to make the required payments as specified in the promissory note, the lender has several options. These can include:

-

Contacting the borrower to discuss repayment options or restructuring the loan.

-

Assessing late fees or penalties as stated in the note.

-

Pursuing legal action to recover the owed money, which might include sending the borrower a demand letter or filing a lawsuit.

Each situation is unique, so it's important for the lender to review their rights under the law and consider seeking legal advice.