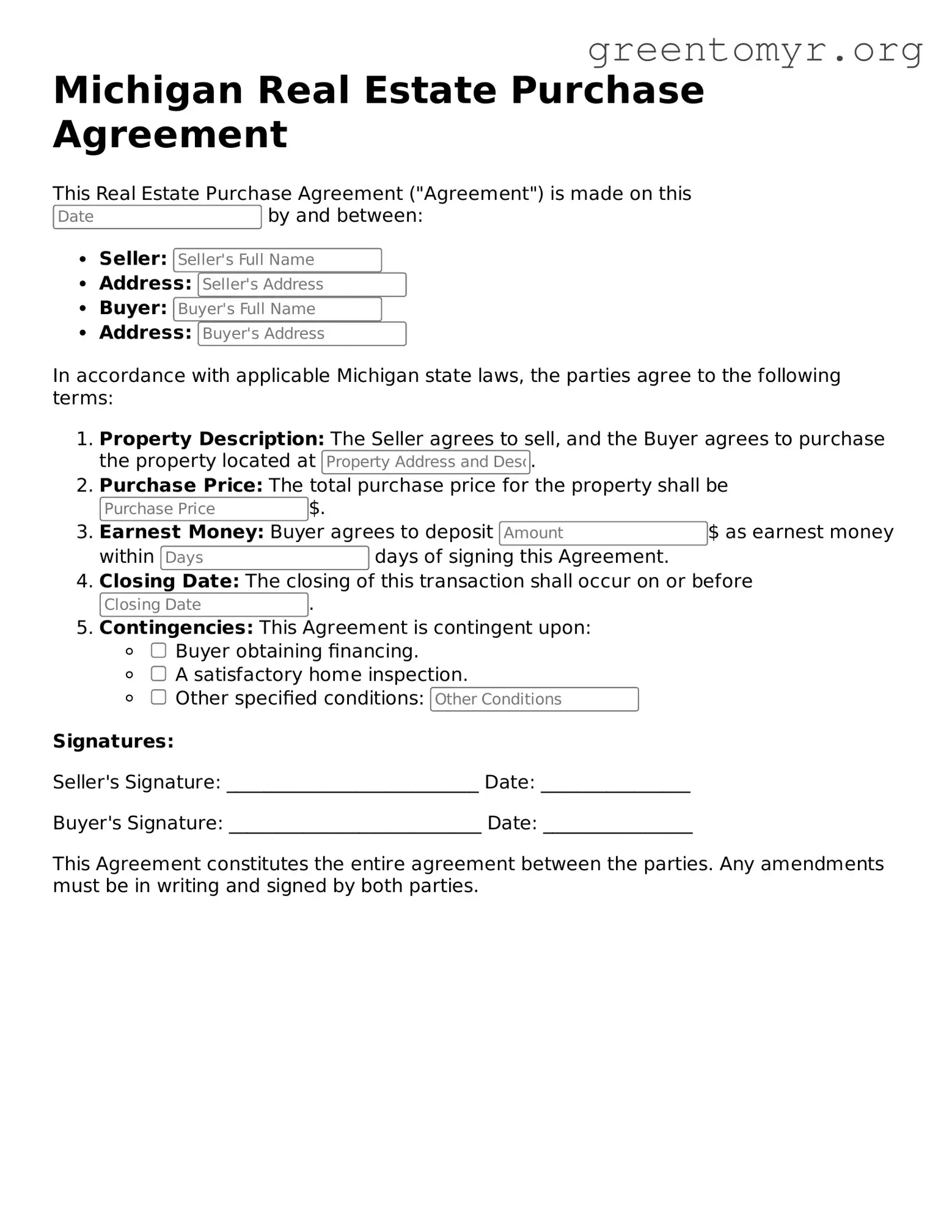

Filling out the Michigan Real Estate Purchase Agreement form can be a challenging task, and mistakes can lead to significant issues down the road. One common error is failing to provide complete information about the property. Buyers should ensure they include the full address and any relevant details like tax ID numbers or parcel numbers. Incomplete information can lead to misunderstandings and potential disputes later on.

Another frequent mistake involves neglecting to specify the earnest money deposit. This deposit shows that the buyer is serious about the offer. If the amount is missing or unclear, the seller might view the offer as less credible. Buyers should clearly state how much they plan to put down and the timeline for submitting that deposit.

Not understanding contingencies can also create problems. Buyers often forget to include necessary contingencies, such as financing or home inspections. Without these provisions, they may find themselves committed to a purchase even if critical issues arise, such as being unable to secure a mortgage.

Moreover, the closing date is important, yet it is sometimes left vague or omitted. Buyers and sellers should agree on a specific date for closing to avoid confusion and ensure both parties are prepared for the transaction. A clear timeline helps manage expectations and facilitates smooth coordination with lenders and title companies.

Failure to check for lender requirements is another pitfall. Buyers should consider that lenders may have specific conditions that must be outlined in the agreement. Missing these requirements can lead to delays or, in some cases, the denial of financing altogether. Always refer to lender guidelines during this process.

Additionally, missing signatures can be a dealbreaker. Both parties must sign the agreement for it to be valid. Disregarding this step can lead to a situation where the agreement is unenforceable. Buyers and sellers should review the document to ensure everyone involved has signed before submitting it.

Another mistake is not clearly listing all included fixtures and appliances. Buyers should specify what stays with the property, such as kitchen appliances, window treatments, or other fixtures. Vague descriptions can lead to disputes about what is included in the purchase.

Mistaking property taxes and assessments can result in financial surprises. Buyers may fail to confirm current property tax rates or any special assessments before making an offer. Understanding these costs is crucial to budgeting appropriately for the purchase.

Finally, communication is key. Buyers and sellers sometimes neglect to maintain clear and ongoing communication throughout the process. Misunderstandings can arise if either party is not kept in the loop about changes or developments. Good communication ensures a smoother transaction and reduces the risk of mistakes.