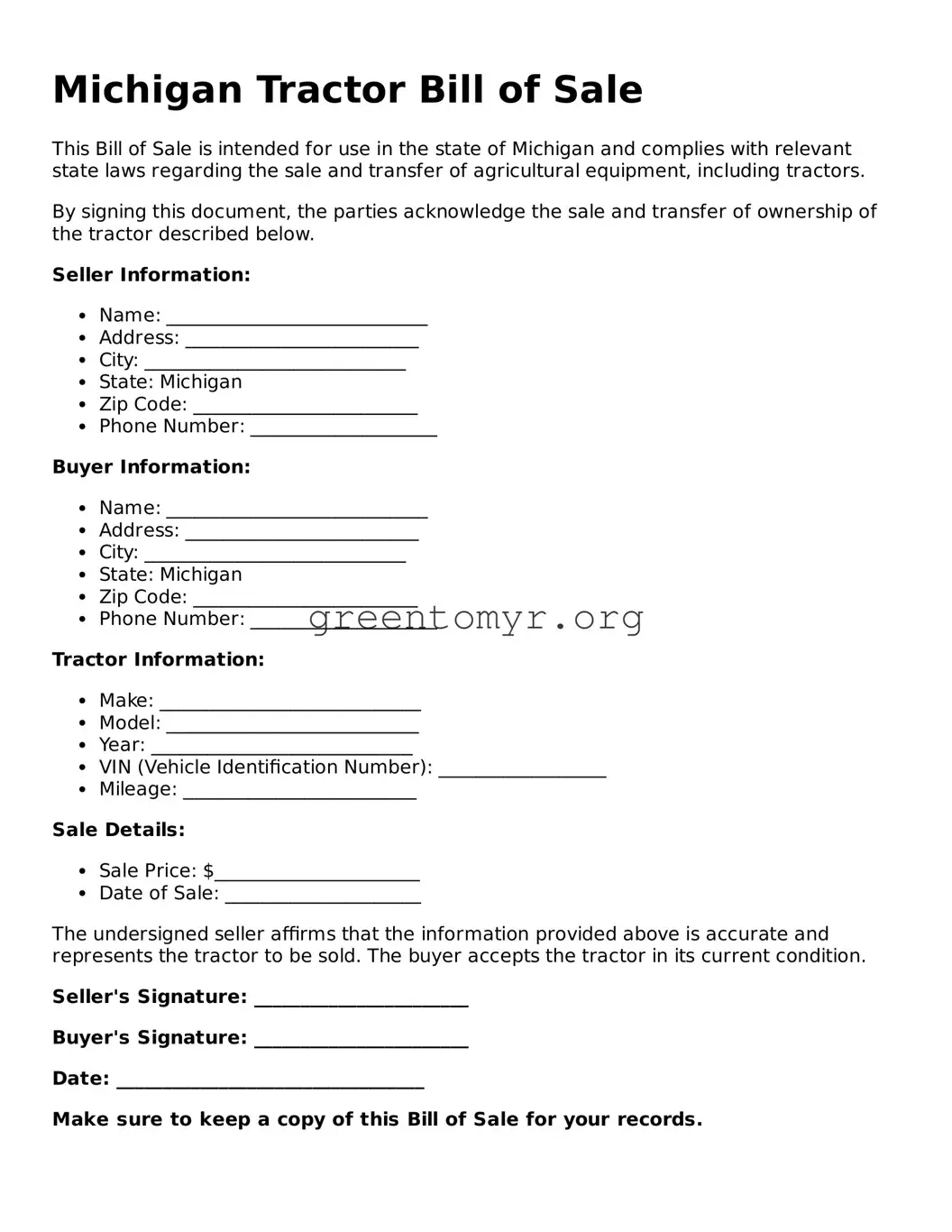

Michigan Tractor Bill of Sale

This Bill of Sale is intended for use in the state of Michigan and complies with relevant state laws regarding the sale and transfer of agricultural equipment, including tractors.

By signing this document, the parties acknowledge the sale and transfer of ownership of the tractor described below.

Seller Information:

- Name: ____________________________

- Address: _________________________

- City: ____________________________

- State: Michigan

- Zip Code: ________________________

- Phone Number: ____________________

Buyer Information:

- Name: ____________________________

- Address: _________________________

- City: ____________________________

- State: Michigan

- Zip Code: ________________________

- Phone Number: ____________________

Tractor Information:

- Make: ____________________________

- Model: ___________________________

- Year: ____________________________

- VIN (Vehicle Identification Number): __________________

- Mileage: _________________________

Sale Details:

- Sale Price: $______________________

- Date of Sale: _____________________

The undersigned seller affirms that the information provided above is accurate and represents the tractor to be sold. The buyer accepts the tractor in its current condition.

Seller's Signature: _______________________

Buyer's Signature: _______________________

Date: _________________________________

Make sure to keep a copy of this Bill of Sale for your records.