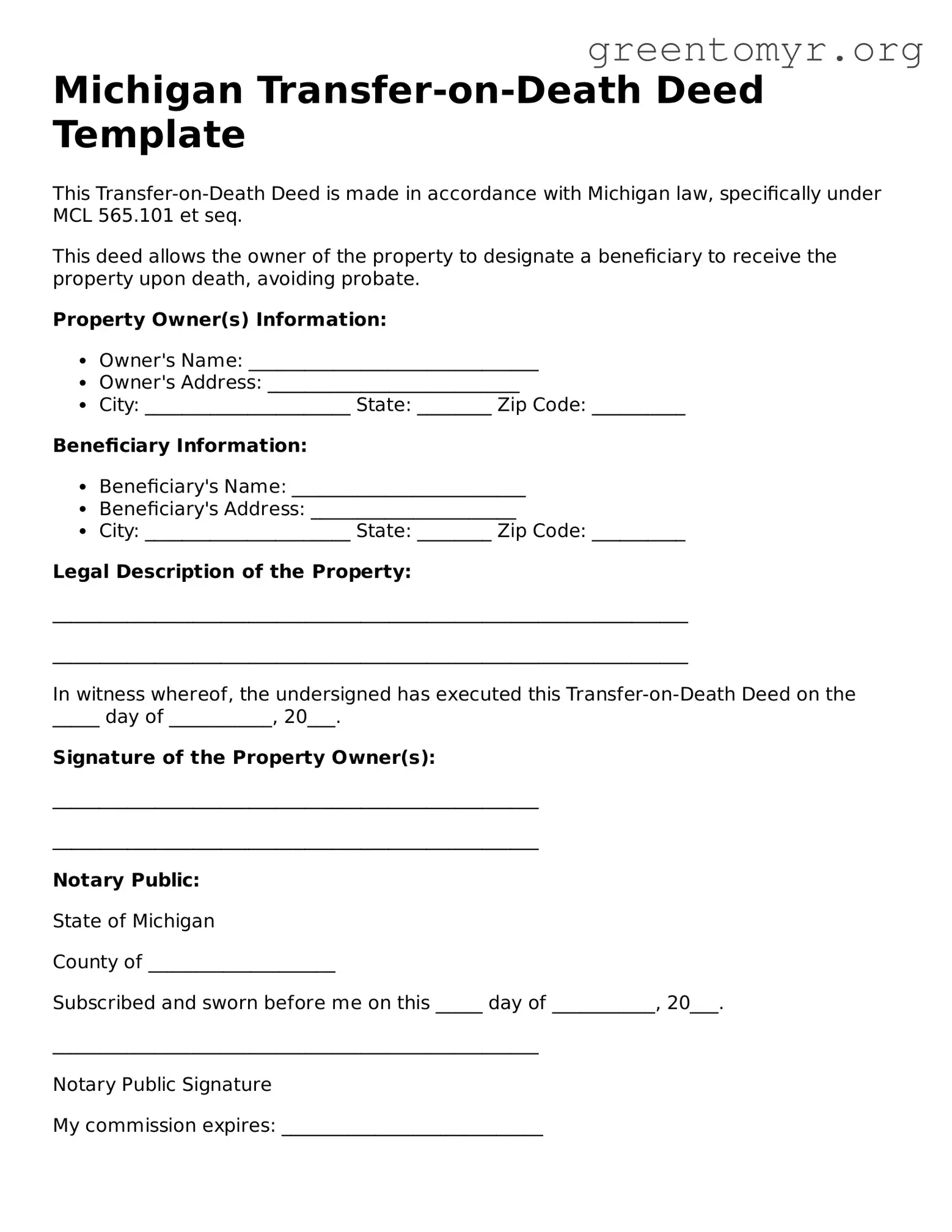

Michigan Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made in accordance with Michigan law, specifically under MCL 565.101 et seq.

This deed allows the owner of the property to designate a beneficiary to receive the property upon death, avoiding probate.

Property Owner(s) Information:

- Owner's Name: _______________________________

- Owner's Address: ___________________________

- City: ______________________ State: ________ Zip Code: __________

Beneficiary Information:

- Beneficiary's Name: _________________________

- Beneficiary's Address: ______________________

- City: ______________________ State: ________ Zip Code: __________

Legal Description of the Property:

____________________________________________________________________

____________________________________________________________________

In witness whereof, the undersigned has executed this Transfer-on-Death Deed on the _____ day of ___________, 20___.

Signature of the Property Owner(s):

____________________________________________________

____________________________________________________

Notary Public:

State of Michigan

County of ____________________

Subscribed and sworn before me on this _____ day of ___________, 20___.

____________________________________________________

Notary Public Signature

My commission expires: ____________________________