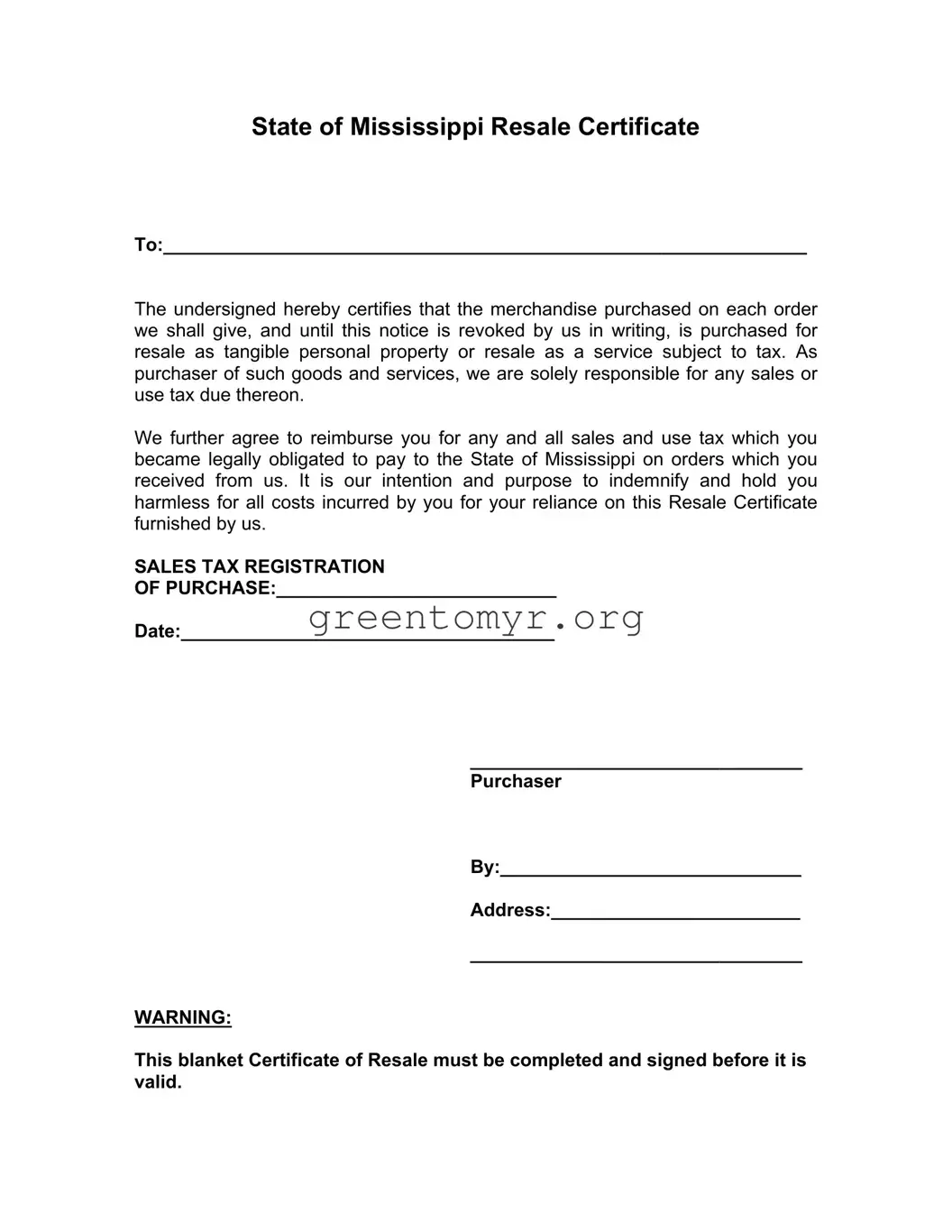

State of Mississippi Resale Certificate

To:______________________________________________________________

The undersigned hereby certifies that the merchandise purchased on each order we shall give, and until this notice is revoked by us in writing, is purchased for resale as tangible personal property or resale as a service subject to tax. As purchaser of such goods and services, we are solely responsible for any sales or use tax due thereon.

We further agree to reimburse you for any and all sales and use tax which you became legally obligated to pay to the State of Mississippi on orders which you received from us. It is our intention and purpose to indemnify and hold you harmless for all costs incurred by you for your reliance on this Resale Certificate furnished by us.

SALES TAX REGISTRATION

OF PURCHASE:___________________________

Date:____________________________________

________________________________

Purchaser

By:_____________________________

Address:________________________

________________________________

WARNING:

This blanket Certificate of Resale must be completed and signed before it is valid.