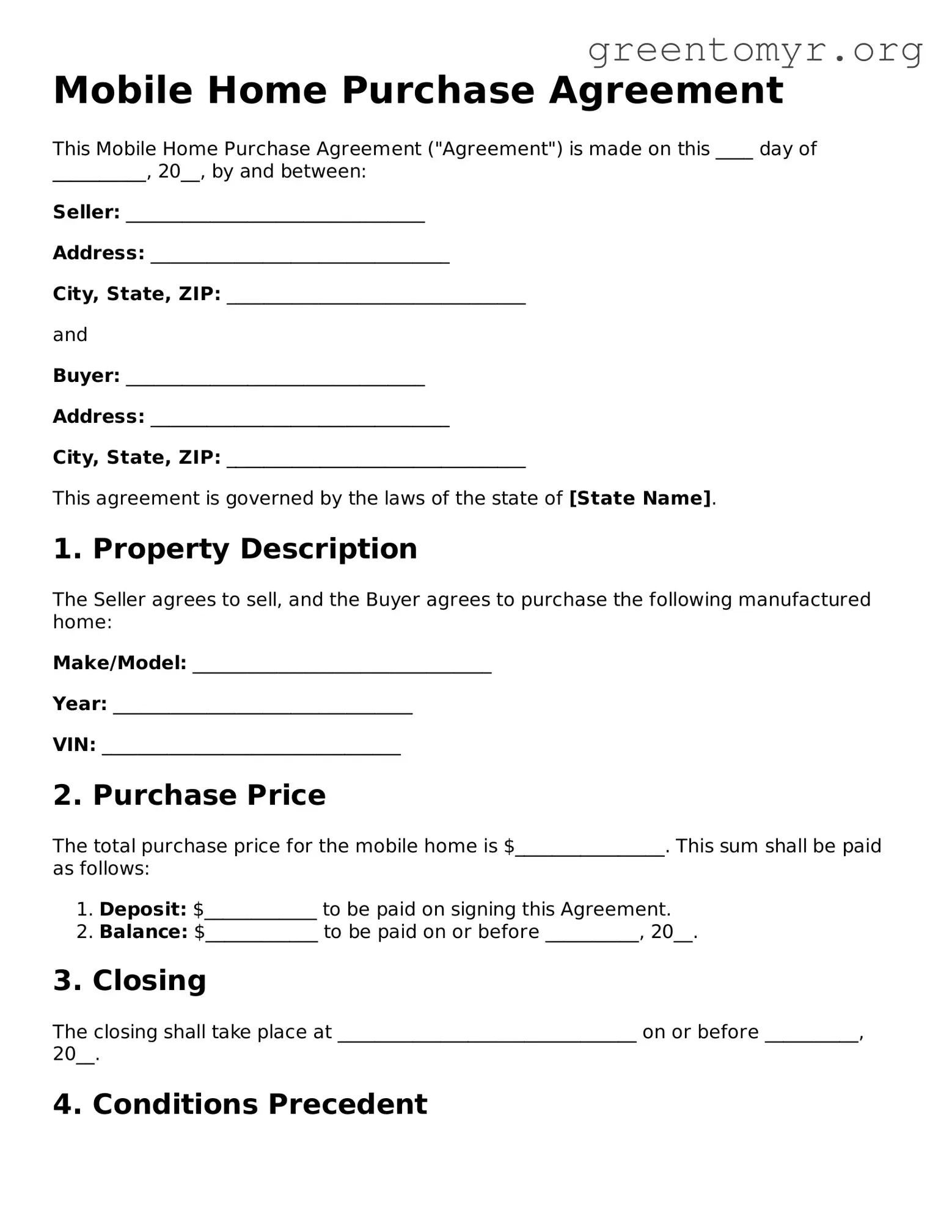

Mobile Home Purchase Agreement

This Mobile Home Purchase Agreement ("Agreement") is made on this ____ day of __________, 20__, by and between:

Seller: ________________________________

Address: ________________________________

City, State, ZIP: ________________________________

and

Buyer: ________________________________

Address: ________________________________

City, State, ZIP: ________________________________

This agreement is governed by the laws of the state of [State Name].

1. Property Description

The Seller agrees to sell, and the Buyer agrees to purchase the following manufactured home:

Make/Model: ________________________________

Year: ________________________________

VIN: ________________________________

2. Purchase Price

The total purchase price for the mobile home is $________________. This sum shall be paid as follows:

- Deposit: $____________ to be paid on signing this Agreement.

- Balance: $____________ to be paid on or before __________, 20__.

3. Closing

The closing shall take place at ________________________________ on or before __________, 20__.

4. Conditions Precedent

Upon execution of this Agreement, the following conditions must be satisfied before closing:

- The Buyer obtains financing.

- The Seller provides the Buyer with a clear title.

5. Representations and Warranties

The Seller hereby represents and warrants that:

- The mobile home is free of any liens or encumbrances.

- All necessary disclosures have been provided to the Buyer.

6. Default

In the event either party defaults in the performance of their obligations under this Agreement, the non-defaulting party shall have the right to seek all remedies available under state law.

7. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the state of [State Name].

8. Miscellaneous

This Agreement constitutes the entire agreement between the parties and supersedes any prior understandings or agreements, oral or written.

IN WITNESS WHEREOF, the parties have executed this Mobile Home Purchase Agreement as of the date first above written.

Seller's Signature: ________________________________ Date: _______________

Buyer's Signature: ________________________________ Date: _______________