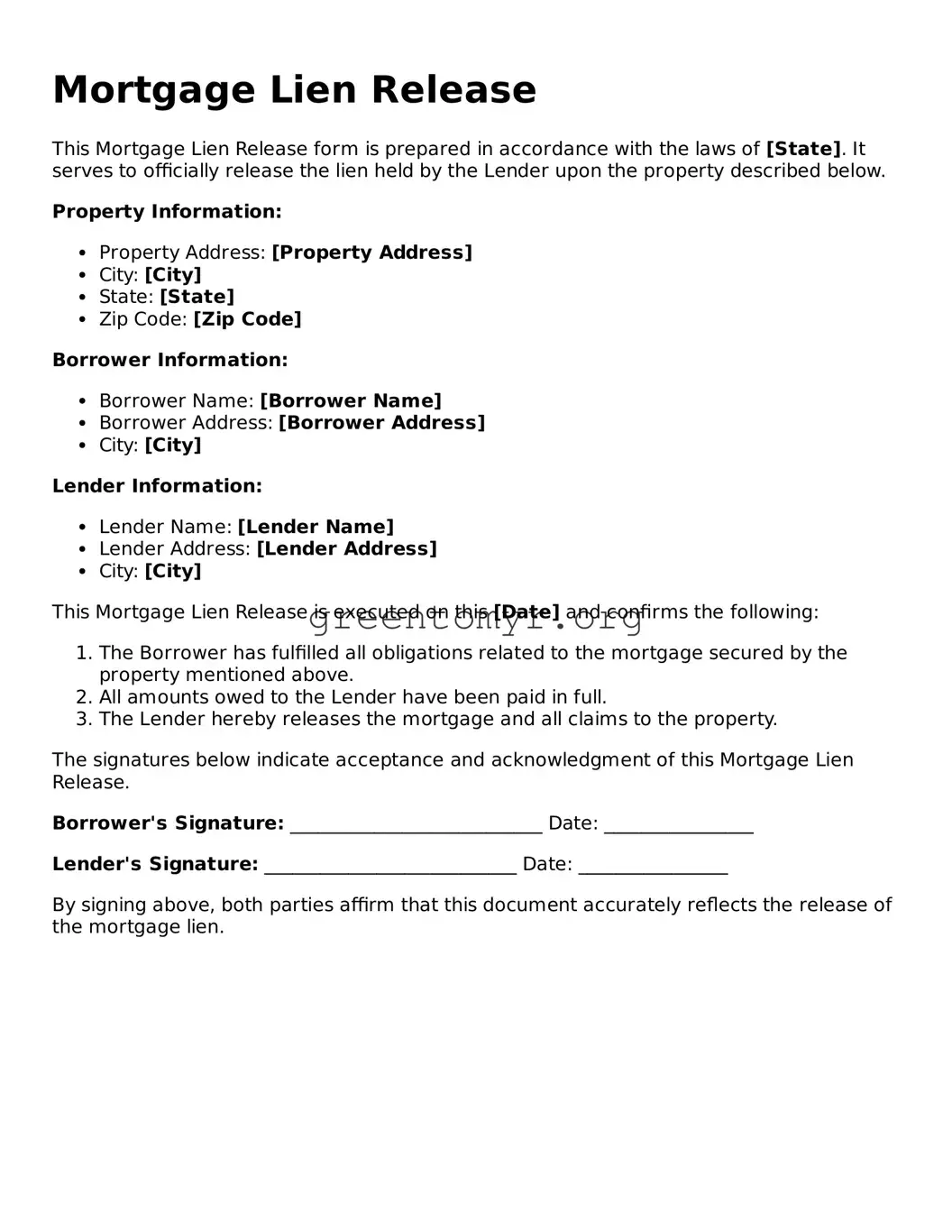

Mortgage Lien Release

This Mortgage Lien Release form is prepared in accordance with the laws of [State]. It serves to officially release the lien held by the Lender upon the property described below.

Property Information:

- Property Address: [Property Address]

- City: [City]

- State: [State]

- Zip Code: [Zip Code]

Borrower Information:

- Borrower Name: [Borrower Name]

- Borrower Address: [Borrower Address]

- City: [City]

Lender Information:

- Lender Name: [Lender Name]

- Lender Address: [Lender Address]

- City: [City]

This Mortgage Lien Release is executed on this [Date] and confirms the following:

- The Borrower has fulfilled all obligations related to the mortgage secured by the property mentioned above.

- All amounts owed to the Lender have been paid in full.

- The Lender hereby releases the mortgage and all claims to the property.

The signatures below indicate acceptance and acknowledgment of this Mortgage Lien Release.

Borrower's Signature: ___________________________ Date: ________________

Lender's Signature: ___________________________ Date: ________________

By signing above, both parties affirm that this document accurately reflects the release of the mortgage lien.