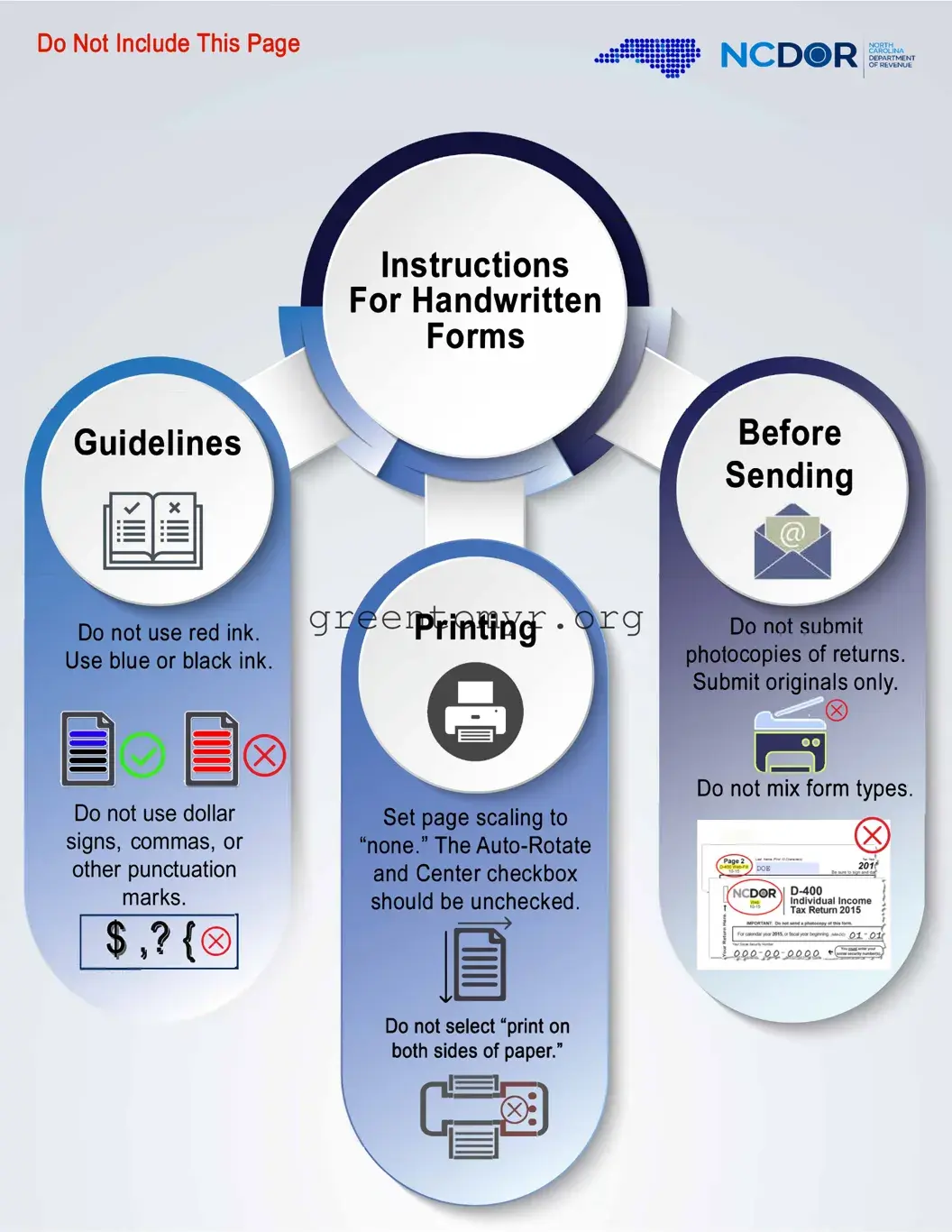

Do Not Include This Page

Guidelines

•· ......==- ........m u:

::::==· ===·=-·=

. •• ··=!!!:::!:•

Instructions

For Handwritten

Forms

I NORTH CAROLINA DEPARTMENT OF REVENUE

Do not use red ink. Use blue or black ink.

®

®

Do not use dollar signs, commas, or other punctuation

marks.

, 1 t®I

, 1 t®I

Printing

Set page scaling to

"none." The Auto-Rotate and Center checkbox should be unchecked.

1�

ocopies of returns. Submit originals only.

,,___(8)

Do not mix form types.

Do not select "print on bothc;sides of paper."

;�1

NC-4

Employee’s Withholding Allowance Certificate

PURPOSE - Complete Form NC-4 so that your employer can withhold the correct amount of State income tax from your pay. If you do not provide an NC-4 to your employer, your employer is required to withhold based on the filing status, “Single” with zero allowances.

FORM NC-4 EZ - You may use Form NC4-EZ if you plan to claim either the N.C. Standard Deduction or the N.C. Child Deduction Amount (but no other N.C. deductions), and you do not plan to claim any N.C. tax credits.

FORM NC-4 NRA - If you are a nonresident alien you must use Form NC-4 NRA. In general, a nonresident alien is an alien (not a U.S. citizen) who has not passed the green card test or the substantial presence test. (See Publication 519, U.S. Tax Guide for Aliens, for more information on the green card test and the substantial presence test.)

FORM NC-4 BASIC INSTRUCTIONS - Complete the NC-4 Allowance Worksheet. The worksheet will help you determine your withholding allowances based on federal and State adjustments to gross income

including the N.C. Child Deduction Amount, N.C. itemized deductions, and N.C. tax credits. However, you may claim fewer allowances than

you are entitled to if you wish to increase the tax withheld during the tax year. If your withholding allowances decrease, you must file a new NC-4 with your employer within 10 days after the change occurs. Exception:

When an individual ceases to be “Head of Household” after maintaining the household for the major portion of the year, a new NC-4 is not required until the next year.

TWO OR MORE JOBS - If you have more than one job, determine the total number of allowances you are entitled to claim on all jobs using one Form

NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the

“Multiple Jobs Table” to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

NONWAGE INCOME - If you have a large amount of nonwage income, such as interest or dividends, you should consider making estimated tax

payments using Form NC-40 to avoid underpayment of estimated tax interest. Form NC-40 is available on the Department’s website at www.

ncdor.gov.

HEAD OF HOUSEHOLD - Generally you may claim “Head of Household” filing status on your tax return only if you are unmarried and pay more than 50% of the costs of keeping up a home for yourself and your dependent(s)

or other qualifying individuals.

SURVIVING SPOUSE - You may claim “Surviving Spouse” filing status only if your spouse died in either of the two preceding tax years and you meet the following requirements:

1.Your home is maintained as the main household of a child or stepchild for whom you can claim a federal exemption; and

2.You were entitled to file a joint return with your spouse in the year of your spouse’s death.

MARRIED TAXPAYERS - For married taxpayers, both spouses must agree as to whether they will complete the NC-4 Allowance Worksheet based on

the filing status, “Married Filing Jointly” or “Married Filing Separately.”

•Married taxpayers who complete the worksheet based on the filing status, “Married Filing Jointly” should consider the sum of both spouses’ income, federal and State adjustments to income, and State tax credits to determine the number of allowances.

•Married taxpayers who complete the worksheet based on the filing status, “Married Filing Separately” should consider only his or her portion of income, federal and State adjustments to income, and State tax credits to determine the number of allowances.

All NC-4 forms are subject to review by the North Carolina Department of Revenue. Your employer may be required to send this form to the North Carolina Department of Revenue.

CAUTION: If you furnish an employer with an Employee’s Withholding Allowance Certificate that contains information which has no reasonable basis and results in a lesser amount of tax being withheld than would have been withheld had you furnished reasonable information, you are subject to a penalty of 50% of the amount not properly withheld.

Cut here and give this certificate to your employer. Keep the top portion for your records.

Cut here and give this certificate to your employer. Keep the top portion for your records.

NC-4

WebEmployee’s Withholding Allowance Certificate

10-17

1.Total number of allowances you are claiming

(Enter zero (0), or the number of allowances from Page 2, Line 17 of the NC-4 Allowance Worksheet)

2. Additional amount, if any, withheld from each pay period (Enter whole dollars)

Filing Status |

|

|

Single or Married Filing Separately |

Head of Household |

Married Filing Jointly or Surviving Spouse |

First Name (USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS) |

M.I. |

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

County (Enter first five letters) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

State |

Zip Code (5 Digit) |

|

|

Country (If not U.S.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee’s Signature |

Date |

I certify, under penalties provided by law, that I am entitled to the number of withholding allowances claimed on Line 1 above.

NC-4 Allowance Worksheet

Surviving Spouse - |

|

|

|

|

1. |

Will your N.C. itemized deductions from Page 3, Schedule 1 exceed 23,999? |

Yes |

o |

No |

o |

2. |

Will your N.C. Child Deduction Amount from Page 3, Schedule 2 exceed $2,499? |

Yes |

o |

No |

o |

3. |

Will you have federal adjustments or State deductions from income? |

Yes |

o |

No |

o |

4. |

Will you be able to claim any N.C. tax credits or tax credit carryovers? |

Yes |

o |

No |

o |

If you answered “No” to all of the above, STOP HERE and enter FOUR (4) as total allowances on Form NC-4, Line 1. |

If you answered “Yes” to any of the above, you may choose to go to Part II to determine if you qualify for additional |

allowances. Otherwise, enter FOUR (4) on Form NC-4, Line 1. |

|

|

|

|

NC-4 Part II

1. |

Enter your total estimated N.C. itemized deductions from Page 3, Schedule 1 |

..................................................... |

1. |

_______________________$ |

. |

|

|

|

2. |

Enter the applicable |

{ |

$10,750 if Single |

|

|

|

|

|

|

N.C. standard deduction |

$21,500 if Married Filing Jointly or Surviving Spouse |

|

|

|

|

based on your filing status. |

$10,750 if Married Filing Separately |

|

|

|

_______________________$ |

. |

|

|

$16,125 if Head of Household |

|

2. |

3. |

Subtract Line 2 from Line 1. If Line 1 is less than Line 2, enter ZERO (0) |

|

3. |

_______________________$ |

. |

|

|

4. |

Enter an estimate of your total N.C. Child Deduction Amount from Page 3, Schedule 2 |

4. |

_______________________$ |

. |

|

5. |

Enter an estimate of your total federal adjustments to income and State deductions from |

|

_______________________$ |

. |

|

federal adjusted gross income |

................................................................................................................................ |

|

|

5. |

|

|

|

|

|

|

6. |

Add Lines 3, 4, and 5 |

|

|

|

6. |

_______________________$ |

. |

|

|

|

|

7. |

Enter an estimate of your nonwage income (such as dividends or interest) |

7. |

$_____________________ |

. |

|

|

|

|

|

8.Enter an estimate of your State additions to federal adjusted gross

|

income |

8. |

$ |

. |

|

|

|

|

|

|

9. |

Add Lines 7 and 8 |

|

9. |

$ |

. |

|

|

10. |

Subtract Line 9 from Line 6 (Do not enter less than zero) |

|

10. |

$ |

. |

|

|

11. |

Divide the amount on Line 10 by $2,500 . Round down to whole number |

|

11. |

_______________________ |

|

Ex. $3,900 ÷ $2,500 = 1.56 rounds down to 1 |

|

|

|

|

|

12. |

Enter the amount of your estimated N.C. tax credits |

12. |

$ |

. |

|

|

|

|

|

13. |

Divide the amount on Line 12 by $134. Round down to whole number |

|

13. |

_______________________ |

|

Ex. $200 ÷ $134 = 1.49 rounds down to 1 |

|

|

|

|

|

14. If filing as Single, Head of Household, or Married Filing Separately, enter zero (0) on this line. If filing as Surviving Spouse, enter 4.

If filing as Married Filing Jointly, enter the appropriate number from either (a), (b), (c), (d), or (e) below.

(a)Your spouse expects to have combined wages and taxable retirement benefits of $0 for N.C. purposes, enter 4. (Taxable retirement benefits do not include: Bailey, Social Security, and Railroad retirement)

(b)Your spouse expects to have combined wages and taxable retirement benefits of more than $0 but less than or equal to $3,250, enter 3.

(c)Your spouse expects to have combined wages and taxable retirement benefits of more than $3,250 but less than or equal to $5,750, enter 2.

(d)Your spouse expects to have combined wages and taxable retirement benefits of more than $5,750 but less than or equal to $8,250, enter 1.

(e)Your spouse expects to have combined wages and taxable retirement benefits of more than

$8,250, enter 0 |

14. |

_______________________ |

|

15. Add Lines 11, 13, and 14, and enter the total here |

15. |

_______________________ |

|

16. If you completed this worksheet on the basis of Married Filing Jointly, the total number of allowances determined |

|

|

|

on Line 15 may be split between you and your spouse, however, you choose. Enter the number of allowances |

|

|

|

|

from Line 15 that your spouse plans to claim |

16. |

_______________________ |

|

17. Subtract Line 16 from Line 15 and enter the total number of allowances here and on Line 1 of your |

|

|

|

|

Form NC-4, Employee’s Withholding Allowance Certificate |

17. |

_______________________ |

|

|

|

|

|

|

|

Page |

|

2 |

|

|

|

|

|

NC-4 Allowance Worksheet Schedules

Important: If you cannot reasonably estimate the amount to enter in the schedules below, you should enter ZERO (0) on Line 1, NC-4.

Schedule 1 |

Estimated N.C. Itemized Deductions |

|

|

|

Qualifying mortgage interest |

$ |

. |

|

|

Real estate property taxes |

$ |

. |

|

. |

Total qualifying mortgage interest and real estate property taxes* |

$ |

Charitable Contributions (Same as allowed for federal purposes) |

$ |

. |

Medical and Dental Expenses (Same as allowed for federal purposes) |

$ |

. |

Total estimated N.C. itemized deductions. Enter on Page 2, Part II, Line 1 |

|

$ |

. |

*The sum of your qualified mortgage interest and real estate property taxes may not exceed $20,000. For married taxpayers, the $20,000 limitation applies to the combined total of qualified mortgage interest and real estate property

taxes claimed by both spouses, rather than to each spouse separately.

Schedule 2 |

Estimated N.C. Child Deduction Amount |

A taxpayer who is allowed a federal child tax credit under section 24 of the Internal Revenue Code is allowed a deduction for each dependent child unless adjusted gross income exceeds the threshold amount shown below.

The N.C. Child Deduction Amount can be claimed only for a child who is under 17 years of age on the last day of the year.

|

|

|

Deduction |

|

|

|

No. of |

Amount per |

Estimated |

Filing Status |

Adjusted Gross Income |

Children |

Qualifying Child |

Deduction |

Single |

Up to |

$ |

20,000 |

|

Over |

$ |

20,000 |

|

Over |

$ |

30,000 |

|

Over |

$ |

40,000 |

|

Over |

$ |

50,000 |

|

Over |

$ |

60,000 |

MFJ or SS |

Up to |

$ |

40,000 |

|

Over |

$ |

40,000 |

|

Over |

$ |

60,000 |

|

Over |

$ |

80,000 |

|

Over |

$ |

100,000 |

|

Over |

$ |

120,000 |

HOH |

Up to |

$ |

30,000 |

|

Over |

$ |

30,000 |

|

Over |

$ |

45,000 |

|

Over |

$ |

60,000 |

|

Over |

$ |

75,000 |

|

Over |

$ |

90,000 |

MFS |

Up to |

$ |

20,000 |

|

Over |

$ |

20,000 |

|

Over |

$ |

30,000 |

|

Over |

$ |

40,000 |

|

Over |

$ |

50,000 |

|

Over |

$ |

60,000 |

|

|

|

_____________ |

$ |

2,500 |

______________ |

Up to |

$ |

30,000 |

_____________ |

$ |

2,000 |

______________ |

Up to |

$ |

40,000 |

_____________ |

$ |

1,500 |

______________ |

Up to |

$ |

50,000 |

_____________ |

$ |

1,000 |

______________ |

Up to |

$ |

60,000 |

_____________ |

$ |

500 |

______________ |

|

|

|

_____________ |

$ |

- |

______________ |

|

|

|

_____________ |

$ |

2,500 |

______________ |

Up to |

$ |

60,000 |

_____________ |

$ |

2,000 |

______________ |

Up to |

$ |

80,000 |

_____________ |

$ |

1,500 |

______________ |

Up to |

$ |

100,000 |

_____________ |

$ |

1,000 |

______________ |

Up to |

$ |

120,000 |

_____________ |

$ |

500 |

______________ |

|

|

|

_____________ |

$ |

- |

______________ |

|

|

|

_____________ |

$ |

2,500 |

______________ |

Up to |

$ |

45,000 |

_____________ |

$ |

2,000 |

______________ |

Up to |

$ |

60,000 |

_____________ |

$ |

1,500 |

______________ |

Up to |

$ |

75,000 |

_____________ |

$ |

1,000 |

______________ |

Up to |

$ |

90,000 |

_____________ |

$ |

500 |

______________ |

|

|

|

_____________ |

$ |

- |

______________ |

|

|

|

_____________ |

$ |

2,500 |

______________ |

Up to |

$ |

30,000 |

_____________ |

$ |

2,000 |

______________ |

Up to |

$ |

40,000 |

_____________ |

$ |

1,500 |

______________ |

Up to |

$ |

50,000 |

_____________ |

$ |

1,000 |

______________ |

Up to |

$ |

60,000 |

_____________ |

$ |

500 |

______________ |

|

|

|

_____________ |

$ |

- |

______________ |

Multiple Jobs Table

Find the amount of your estimated annual wages from your lowest paying job(s) in the left hand column. Follow across to find the amount of additional tax to be withheld for each pay period. Enter the additional amount to be withheld on Line 2 of your Form NC-4.

Additional Withholding for Single, Married, or Surviving Spouse with Multiple Jobs

Estimated Annual Wages |

|

Payroll Period |

|

At Least |

But Less Than |

Monthly |

Semimonthly |

Biweekly |

Weekly |

|

|

|

|

|

|

0 |

1000 |

2 |

1 |

1 |

1 |

1000 |

2000 |

7 |

3 |

3 |

2 |

|

|

|

|

|

|

2000 |

3000 |

11 |

6 |

5 |

3 |

|

|

|

|

|

|

3000 |

4000 |

16 |

8 |

7 |

4 |

|

|

|

|

|

|

4000 |

5000 |

20 |

10 |

9 |

5 |

|

|

|

|

|

|

5000 |

6000 |

25 |

12 |

11 |

6 |

|

|

|

|

|

|

6000 |

7000 |

29 |

14 |

13 |

7 |

7000 |

8000 |

33 |

17 |

15 |

8 |

|

|

|

|

|

|

8000 |

9000 |

38 |

19 |

17 |

9 |

9000 |

10000 |

42 |

21 |

20 |

10 |

10000 |

10750 |

46 |

23 |

21 |

11 |

|

|

|

|

|

|

10750 |

Unlimited |

48 |

24 |

22 |

11 |

Additional Withholding for Head of Household Filers with Multiple Jobs

Estimated Annual Wages |

|

Payroll Period |

|

At Least |

But Less Than |

Monthly |

Semimonthly |

Biweekly |

Weekly |

|

|

|

|

|

|

0 |

1000 |

2 |

1 |

1 |

1 |

|

|

|

|

|

|

1000 |

2000 |

7 |

3 |

3 |

2 |

2000 |

3000 |

11 |

6 |

5 |

3 |

|

|

|

|

|

|

3000 |

4000 |

16 |

8 |

7 |

4 |

4000 |

5000 |

20 |

10 |

9 |

5 |

5000 |

6000 |

25 |

12 |

11 |

6 |

6000 |

7000 |

29 |

14 |

13 |

7 |

7000 |

8000 |

33 |

17 |

15 |

8 |

8000 |

9000 |

38 |

19 |

17 |

9 |

9000 |

10000 |

42 |

21 |

20 |

10 |

10000 |

11000 |

47 |

23 |

22 |

11 |

11000 |

12000 |

51 |

26 |

24 |

12 |

12000 |

13000 |

56 |

28 |

26 |

13 |

13000 |

14000 |

60 |

30 |

28 |

14 |

14000 |

15000 |

65 |

32 |

30 |

15 |

15000 |

16000 |

69 |

35 |

32 |

16 |

16000 |

Unlimited |

71 |

36 |

33 |

16 |

®

® ,

,

Cut here and give this certificate to your employer. Keep the top portion for your records.

Cut here and give this certificate to your employer. Keep the top portion for your records.