What is the Ohio Articles of Incorporation form?

The Ohio Articles of Incorporation form is a legal document that establishes a corporation in the state of Ohio. This document outlines essential information about the corporation, including its name, purpose, and details about its registered agent. Filing this form with the Ohio Secretary of State is a critical step in starting a new corporation.

Who needs to file the Articles of Incorporation?

Any individual or group seeking to form a corporation in Ohio must file the Articles of Incorporation. This applies to business entities of various types, including profit corporations, nonprofit corporations, and professional corporations. If you plan to operate as a corporation, filing this document is a necessity.

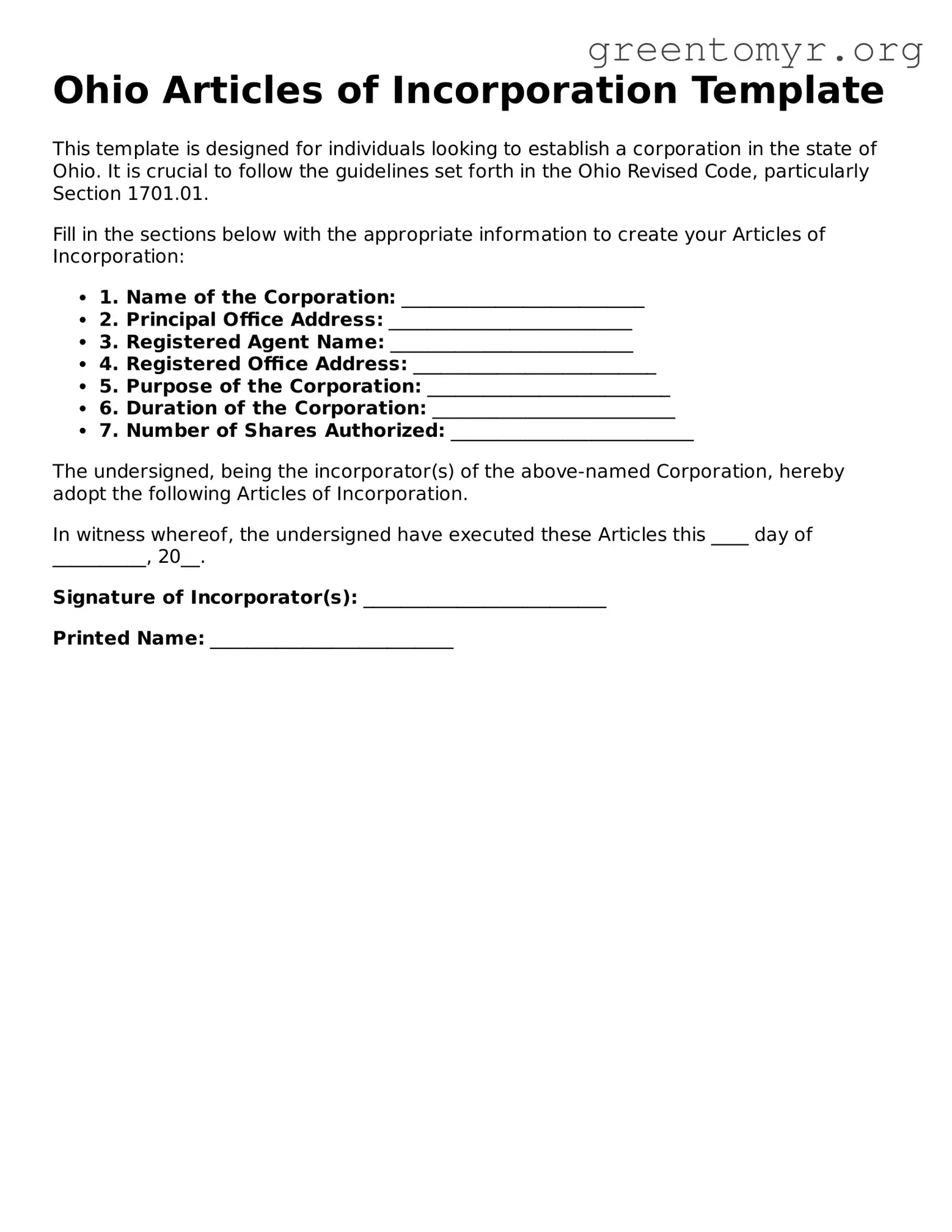

What information is required on the Articles of Incorporation form?

Key information needed includes:

-

The name of the corporation

-

The purpose of the corporation

-

The address of the principal office

-

The name and address of the registered agent

-

The number of shares the corporation is authorized to issue (for profit corporations)

-

The names and addresses of the incorporators

How much does it cost to file the Articles of Incorporation?

The filing fee for the Ohio Articles of Incorporation varies depending on the type of corporation you are establishing. Generally, the fee for a profit corporation is $99, while nonprofit corporations may pay a reduced fee. Always check the most current fee schedule on the Ohio Secretary of State’s website for accurate information.

How long does it take for my Articles of Incorporation to be processed?

Typical processing time for the Articles of Incorporation can vary greatly. Generally, applications are processed within 5 to 10 business days. If you opt for expedited service, this may significantly reduce the waiting time. Always consider checking with the Secretary of State’s office for the latest processing times.

Can I file the Articles of Incorporation online?

Yes, the Ohio Secretary of State offers an online filing system for Articles of Incorporation. This method is often quicker and more efficient. You can fill out the required forms and pay the associated fees directly through their website, simplifying the process.

What happens after I file the Articles of Incorporation?

After filing the Articles of Incorporation, the state will review your submission. Once approved, you will receive a stamped copy, which serves as official confirmation of your corporation's existence. You should keep this document safe, as it may be required for various business activities, like opening a bank account or securing financing.

Is there any ongoing paperwork or fees once I have filed the Articles of Incorporation?

Yes, after incorporation, corporations have several ongoing obligations. These may include:

-

Annual reports or updates to maintain good standing

-

Periodic fees, depending on the type of corporation

-

Compliance with state and federal regulations

It's essential to stay on top of these requirements to avoid penalties or loss of good standing.

Can I amend my Articles of Incorporation after filing?

Yes, amendments to the Articles of Incorporation are possible. If there are changes, such as in the corporation's name or structure, a formal amendment must be filed with the Ohio Secretary of State. This process does require additional paperwork and may involve a fee, so be prepared for that.

What is the difference between Articles of Incorporation and Bylaws?

The Articles of Incorporation serve as a foundational legal document filed with the state to create the corporation. In contrast, bylaws are internal rules that govern how the corporation operates and make decisions. Bylaws outline the structure of the organization, including details about board meetings, officer roles, and membership. While Articles of Incorporation must be filed with the state, bylaws are usually kept internally and not filed unless required by the state.