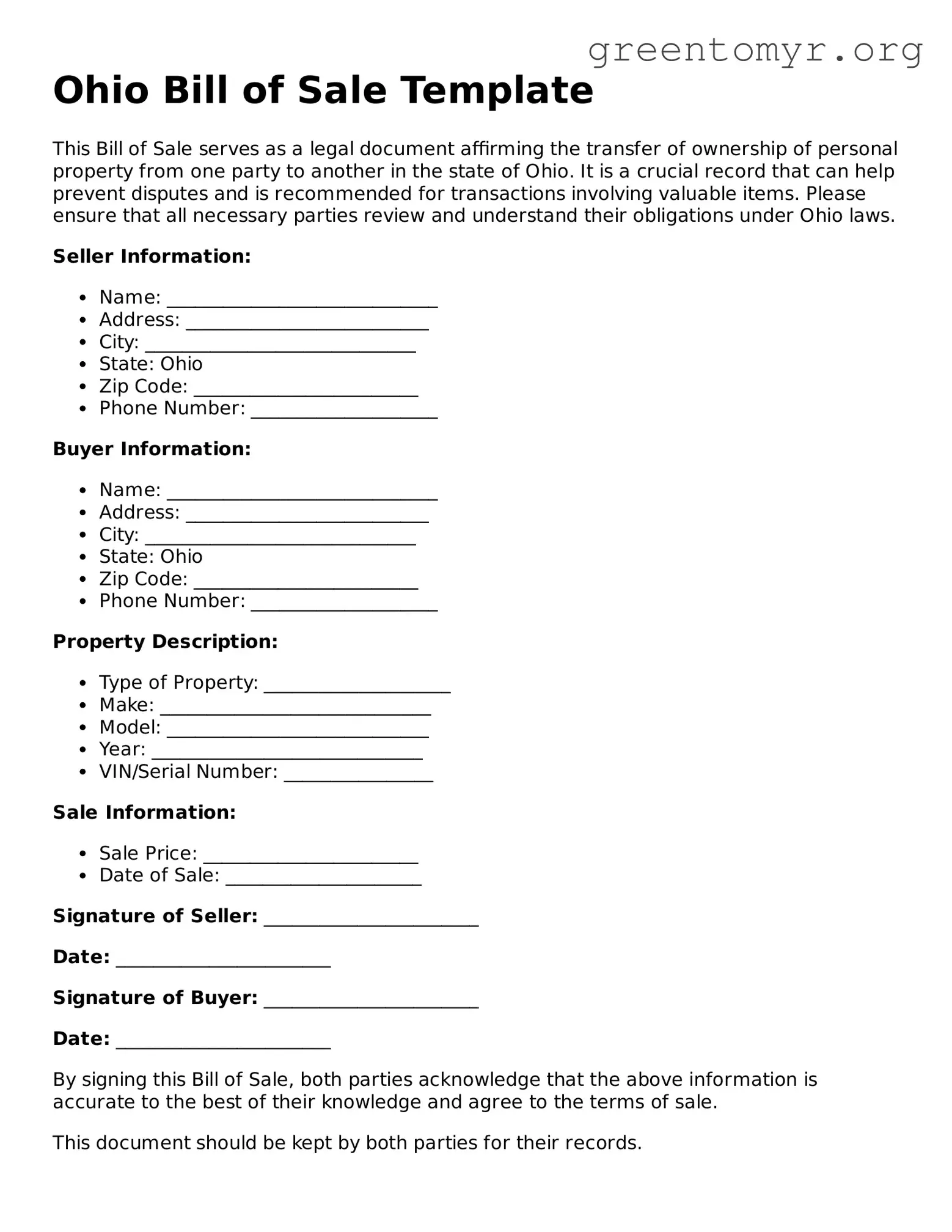

Ohio Bill of Sale Template

This Bill of Sale serves as a legal document affirming the transfer of ownership of personal property from one party to another in the state of Ohio. It is a crucial record that can help prevent disputes and is recommended for transactions involving valuable items. Please ensure that all necessary parties review and understand their obligations under Ohio laws.

Seller Information:

- Name: _____________________________

- Address: __________________________

- City: _____________________________

- State: Ohio

- Zip Code: ________________________

- Phone Number: ____________________

Buyer Information:

- Name: _____________________________

- Address: __________________________

- City: _____________________________

- State: Ohio

- Zip Code: ________________________

- Phone Number: ____________________

Property Description:

- Type of Property: ____________________

- Make: _____________________________

- Model: ____________________________

- Year: _____________________________

- VIN/Serial Number: ________________

Sale Information:

- Sale Price: _______________________

- Date of Sale: _____________________

Signature of Seller: _______________________

Date: _______________________

Signature of Buyer: _______________________

Date: _______________________

By signing this Bill of Sale, both parties acknowledge that the above information is accurate to the best of their knowledge and agree to the terms of sale.

This document should be kept by both parties for their records.