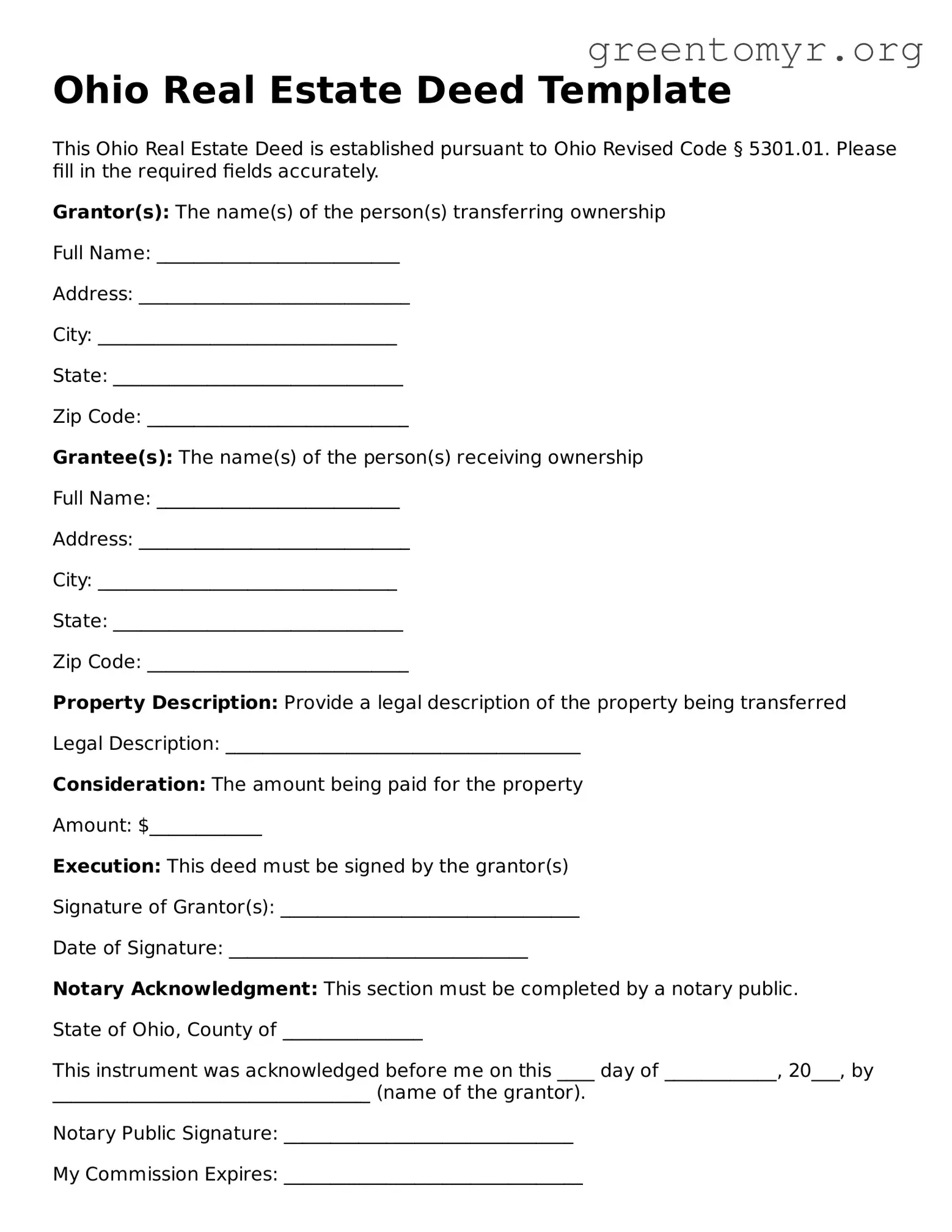

Ohio Real Estate Deed Template

This Ohio Real Estate Deed is established pursuant to Ohio Revised Code § 5301.01. Please fill in the required fields accurately.

Grantor(s): The name(s) of the person(s) transferring ownership

Full Name: __________________________

Address: _____________________________

City: ________________________________

State: _______________________________

Zip Code: ____________________________

Grantee(s): The name(s) of the person(s) receiving ownership

Full Name: __________________________

Address: _____________________________

City: ________________________________

State: _______________________________

Zip Code: ____________________________

Property Description: Provide a legal description of the property being transferred

Legal Description: ______________________________________

Consideration: The amount being paid for the property

Amount: $____________

Execution: This deed must be signed by the grantor(s)

Signature of Grantor(s): ________________________________

Date of Signature: ________________________________

Notary Acknowledgment: This section must be completed by a notary public.

State of Ohio, County of _______________

This instrument was acknowledged before me on this ____ day of ____________, 20___, by __________________________________ (name of the grantor).

Notary Public Signature: _______________________________

My Commission Expires: ________________________________

Ensure to check local regulations regarding recording this deed. Prompt submission to the county recorder’s office is vital.