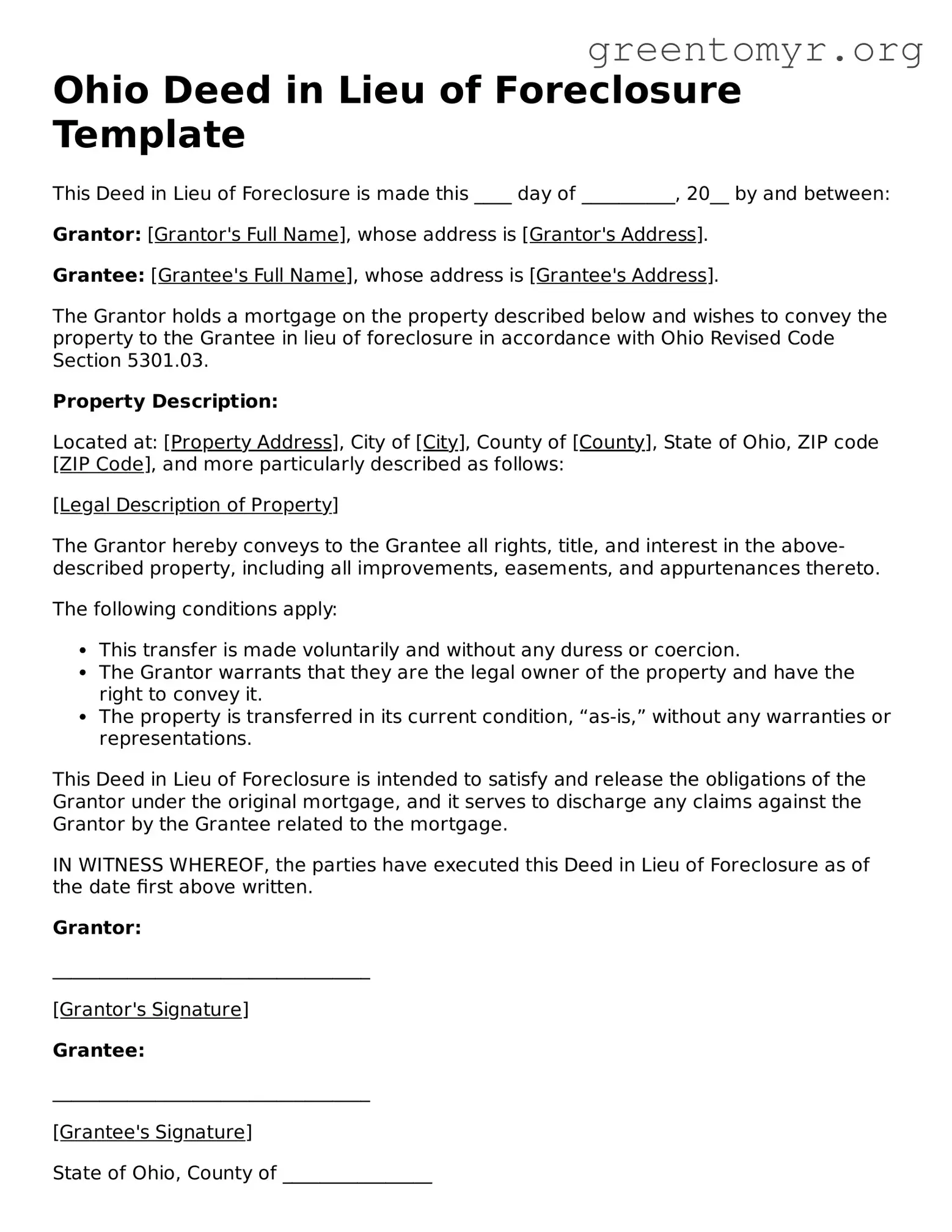

Ohio Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made this ____ day of __________, 20__ by and between:

Grantor: [Grantor's Full Name], whose address is [Grantor's Address].

Grantee: [Grantee's Full Name], whose address is [Grantee's Address].

The Grantor holds a mortgage on the property described below and wishes to convey the property to the Grantee in lieu of foreclosure in accordance with Ohio Revised Code Section 5301.03.

Property Description:

Located at: [Property Address], City of [City], County of [County], State of Ohio, ZIP code [ZIP Code], and more particularly described as follows:

[Legal Description of Property]

The Grantor hereby conveys to the Grantee all rights, title, and interest in the above-described property, including all improvements, easements, and appurtenances thereto.

The following conditions apply:

- This transfer is made voluntarily and without any duress or coercion.

- The Grantor warrants that they are the legal owner of the property and have the right to convey it.

- The property is transferred in its current condition, “as-is,” without any warranties or representations.

This Deed in Lieu of Foreclosure is intended to satisfy and release the obligations of the Grantor under the original mortgage, and it serves to discharge any claims against the Grantor by the Grantee related to the mortgage.

IN WITNESS WHEREOF, the parties have executed this Deed in Lieu of Foreclosure as of the date first above written.

Grantor:

__________________________________

[Grantor's Signature]

Grantee:

__________________________________

[Grantee's Signature]

State of Ohio, County of ________________

Subscribed and sworn before me this ____ day of __________, 20__.

__________________________________

Notary Public

[Notary’s Name]

My commission expires: _______________