Completing an Ohio Durable Power of Attorney form is an important task that allows individuals to designate someone to make financial and legal decisions on their behalf in the event they become incapacitated. However, many people make mistakes when filling out this form. Here are nine common errors to avoid.

One frequent mistake is failing to select the appropriate agent. It is crucial to choose someone trustworthy, as this individual will have significant authority over one’s finances. Many people mistakenly believe a close friend or relative will automatically make a good agent, but this is not always the case.

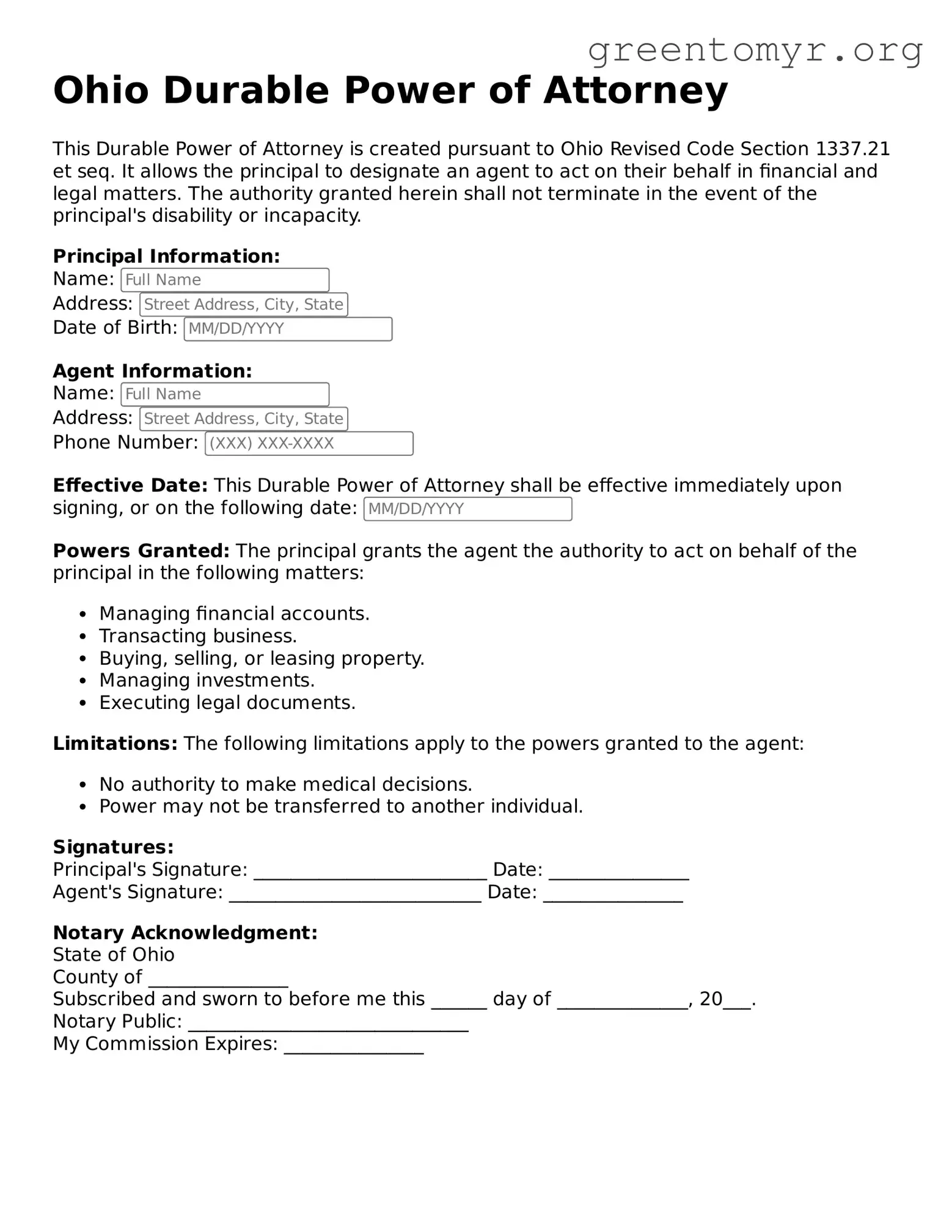

Another common pitfall is not specifying the powers granted to the agent. The form allows individuals to detail which financial or legal decisions the agent can make. Leaving this section incomplete can lead to uncertainties regarding what the agent is permitted to do.

Many overlook the importance of signing the form correctly. Signatures must be clear and legible. Inadequate signatures can raise questions about authenticity and validity, potentially compromising the document's effectiveness.

Failing to date the document is another mistake. A date provides clarity regarding when the durable power of attorney becomes effective. Without a date, there could be confusion about the timing of the agent’s authority.

Some individuals neglect to have the document witnessed or notarized, depending on the specific requirements in Ohio. Not meeting these criteria can invalidate the document, leaving the designated agent without authority.

People also often forget to discuss their decision with the chosen agent. An agent must understand their responsibilities and the individual’s wishes. Without this conversation, misunderstandings can arise, leading to conflict during challenging times.

Many make the error of not keeping copies of the completed form. It is essential to retain copies for personal records and to share them with relevant parties. Failure to do so can cause complications when the agent needs to exercise their powers.

Another mistake is ignoring the need to update the form. Life circumstances change, and it is vital to review and revise the durable power of attorney periodically. If an agent’s situation changes, appointing someone who reflects current relationships is necessary.

Lastly, some may misunderstand the concept of “durability.” It is essential to recognize that this document remains in effect even after the principal becomes incapacitated. A lack of understanding can lead to ineffective planning.

By recognizing and avoiding these mistakes, individuals can ensure that their Ohio Durable Power of Attorney accurately reflects their wishes and provides the necessary guidance during times of need.