Completing the Ohio Employment Verification form is a crucial step for many individuals seeking to confirm their employment status. However, it's not uncommon for people to make mistakes in the process. Here are ten common errors that can lead to unnecessary delays or complications.

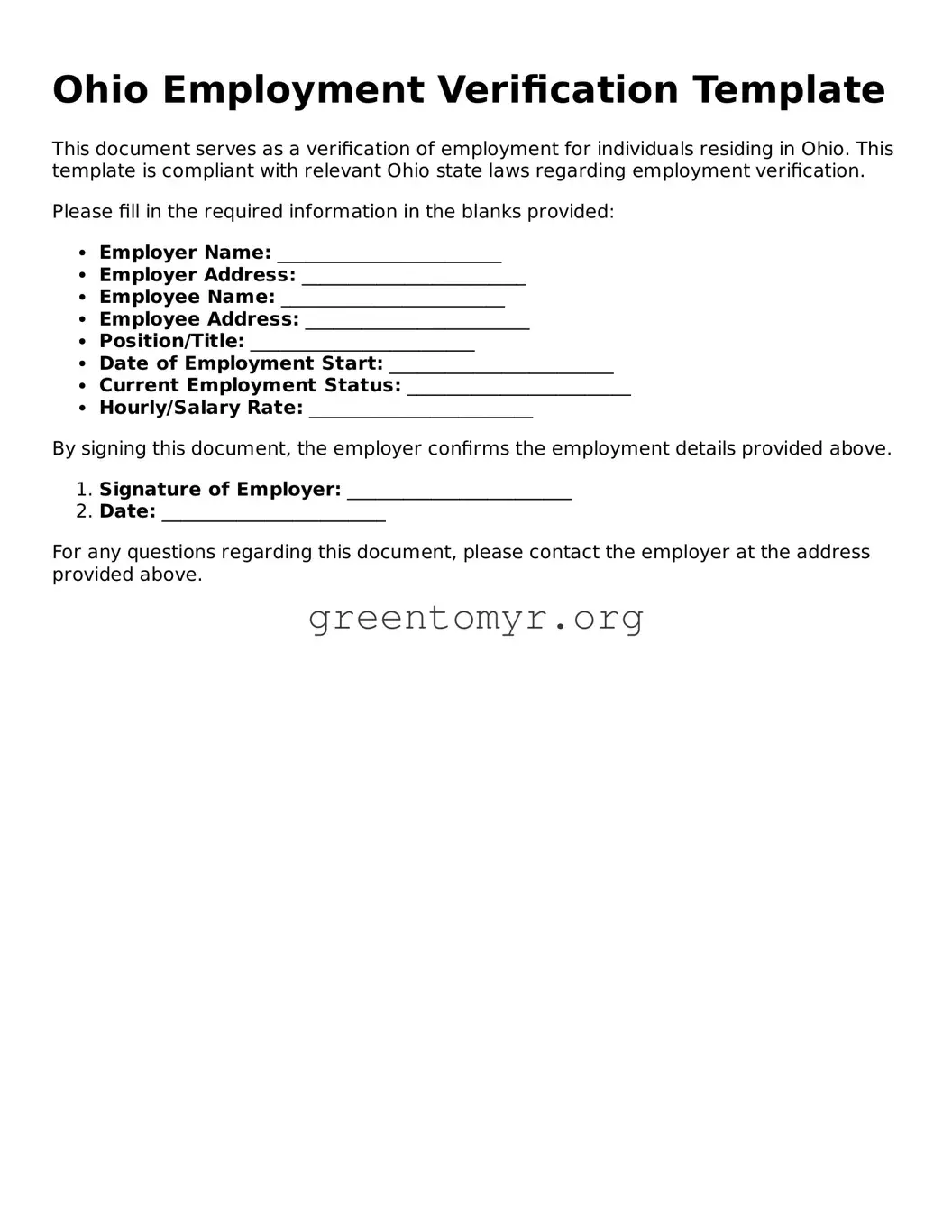

One frequent mistake is incomplete information. Although it may seem minor, omitting certain details such as job titles, employment dates, or salary can hinder the verification process. Ensure every section is filled out thoroughly to avoid this pitfall.

Another error is misidentifying the employer. It’s essential to accurately reflect the name of the company where you are employed. Sometimes, using a colloquial name instead of the formal business name can lead to confusion. Double-check the official name and be consistent.

People often overlook contact information. It's vital to provide the correct phone number and email address for the employer's HR department. An error in this critical information can prevent verification teams from reaching the right contacts.

A significant mistake happens when individuals do not sign the form. This oversight can render the entire document invalid. Always make sure to sign and date the form before submission, as it confirms your consent for the verification process.

Many individuals also misplace the focus on dates. Not understanding which dates to include can lead to confusion. Ensure that you indicate both your start date and, if applicable, your end date of employment clearly.

Failure to provide specific job duties can also be an issue. Employers appreciate understanding the context of your employment. Listing actual job responsibilities helps the verifier understand your role within the organization.

Some may confuse full-time and part-time status. Clarifying whether you are a full-time or part-time employee is essential for accurate verification. This distinction can impact benefits and eligibility for certain programs.

Omitting date of separation, if relevant, is another common error. If you are no longer employed, your previous employer will need this information for verification. Be transparent about your employment history.

Individuals sometimes neglect to review the form before submitting it. Skimming through the document rather than carefully checking each entry can lead to unintentional errors. Take the time to proofread for any mistakes or missing information.

Lastly, some fail to maintain copies of submitted forms. Keeping a personal record of the form you have submitted can be valuable for future reference. It can help in resolving any issues that may arise during the verification process.

By being aware of these mistakes, individuals can navigate the Ohio Employment Verification process more efficiently. Attention to detail can make a significant difference in ensuring that the verification goes smoothly.