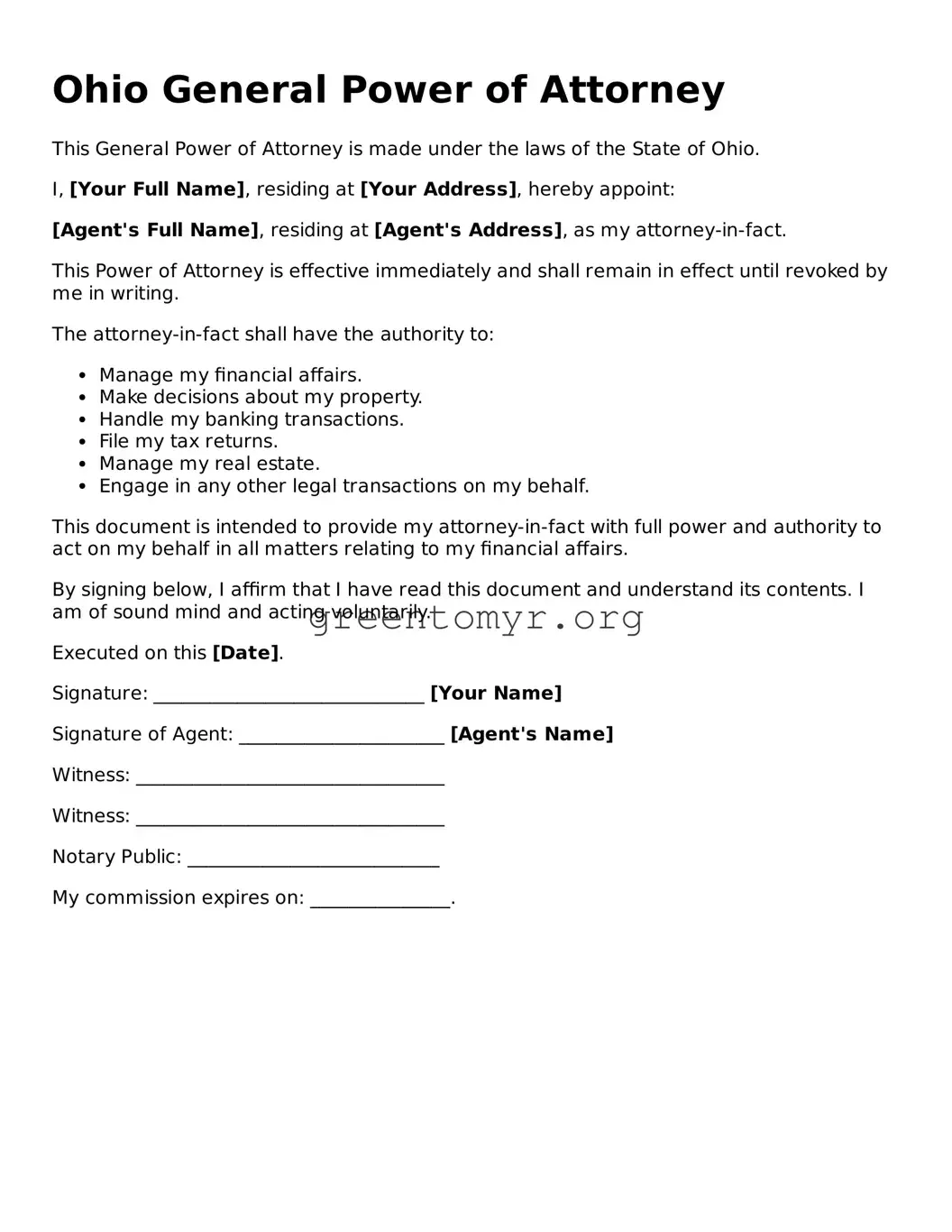

General Power of Attorney Form for the State of Ohio

The Ohio General Power of Attorney form is a legal document that allows an individual, known as the principal, to grant authority to another person, referred to as the agent, to make decisions and take actions on their behalf. This form is particularly useful for managing financial, legal, and business matters when the principal is unable to do so themselves. Understanding the nuances of this document can help ensure that your wishes are respected and appropriately executed.

Ready to fill out the Ohio General Power of Attorney form? Click the button below.