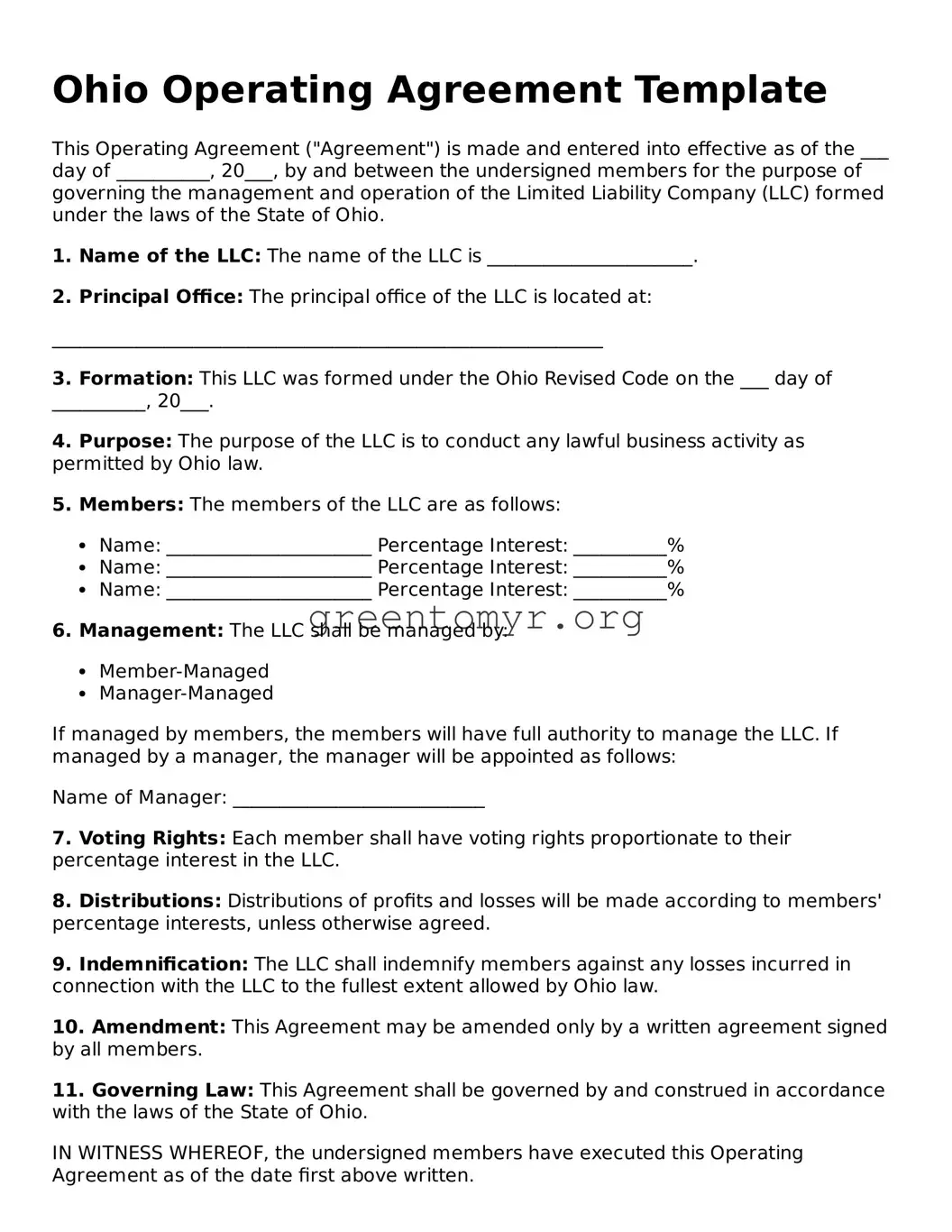

Ohio Operating Agreement Template

This Operating Agreement ("Agreement") is made and entered into effective as of the ___ day of __________, 20___, by and between the undersigned members for the purpose of governing the management and operation of the Limited Liability Company (LLC) formed under the laws of the State of Ohio.

1. Name of the LLC: The name of the LLC is ______________________.

2. Principal Office: The principal office of the LLC is located at:

___________________________________________________________

3. Formation: This LLC was formed under the Ohio Revised Code on the ___ day of __________, 20___.

4. Purpose: The purpose of the LLC is to conduct any lawful business activity as permitted by Ohio law.

5. Members: The members of the LLC are as follows:

- Name: ______________________ Percentage Interest: __________%

- Name: ______________________ Percentage Interest: __________%

- Name: ______________________ Percentage Interest: __________%

6. Management: The LLC shall be managed by:

- Member-Managed

- Manager-Managed

If managed by members, the members will have full authority to manage the LLC. If managed by a manager, the manager will be appointed as follows:

Name of Manager: ___________________________

7. Voting Rights: Each member shall have voting rights proportionate to their percentage interest in the LLC.

8. Distributions: Distributions of profits and losses will be made according to members' percentage interests, unless otherwise agreed.

9. Indemnification: The LLC shall indemnify members against any losses incurred in connection with the LLC to the fullest extent allowed by Ohio law.

10. Amendment: This Agreement may be amended only by a written agreement signed by all members.

11. Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of Ohio.

IN WITNESS WHEREOF, the undersigned members have executed this Operating Agreement as of the date first above written.

Member Signature: __________________________ Date: ________________

Member Signature: __________________________ Date: ________________

Member Signature: __________________________ Date: ________________