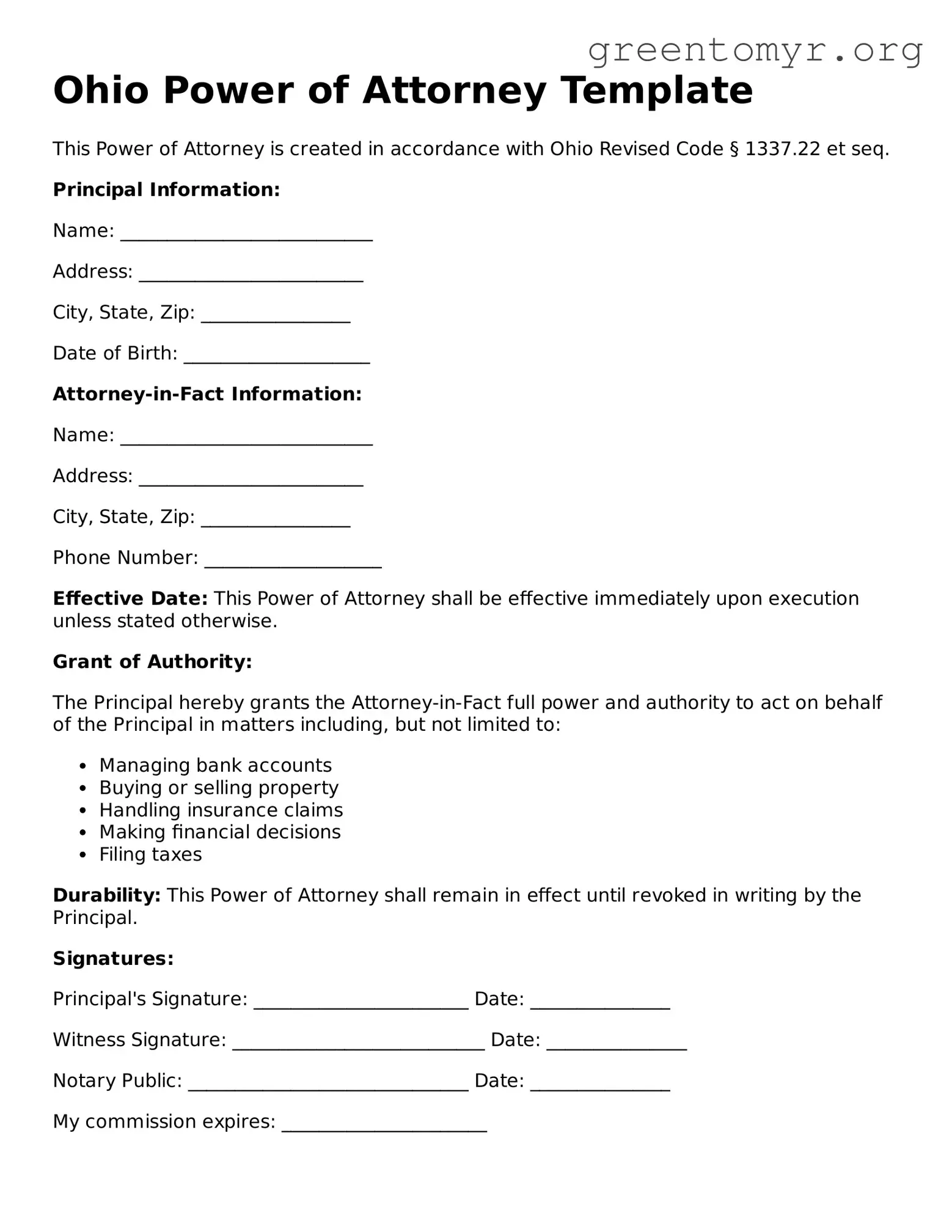

Ohio Power of Attorney Template

This Power of Attorney is created in accordance with Ohio Revised Code § 1337.22 et seq.

Principal Information:

Name: ___________________________

Address: ________________________

City, State, Zip: ________________

Date of Birth: ____________________

Attorney-in-Fact Information:

Name: ___________________________

Address: ________________________

City, State, Zip: ________________

Phone Number: ___________________

Effective Date: This Power of Attorney shall be effective immediately upon execution unless stated otherwise.

Grant of Authority:

The Principal hereby grants the Attorney-in-Fact full power and authority to act on behalf of the Principal in matters including, but not limited to:

- Managing bank accounts

- Buying or selling property

- Handling insurance claims

- Making financial decisions

- Filing taxes

Durability: This Power of Attorney shall remain in effect until revoked in writing by the Principal.

Signatures:

Principal's Signature: _______________________ Date: _______________

Witness Signature: ___________________________ Date: _______________

Notary Public: ______________________________ Date: _______________

My commission expires: ______________________