What is a promissory note in Ohio?

A promissory note is a written promise to pay a specified amount of money to a specific person or entity at a predetermined time or on demand. In Ohio, this legal document outlines the terms of the loan, including the interest rate, payment schedule, and consequences for non-payment.

Who can use an Ohio promissory note?

Any individual or entity can use a promissory note in Ohio. This includes personal loans between friends or family, business loans between partners, or loans from banks or financial institutions. The key is that both parties agree to the terms outlined in the note.

What are the essential elements of an Ohio promissory note?

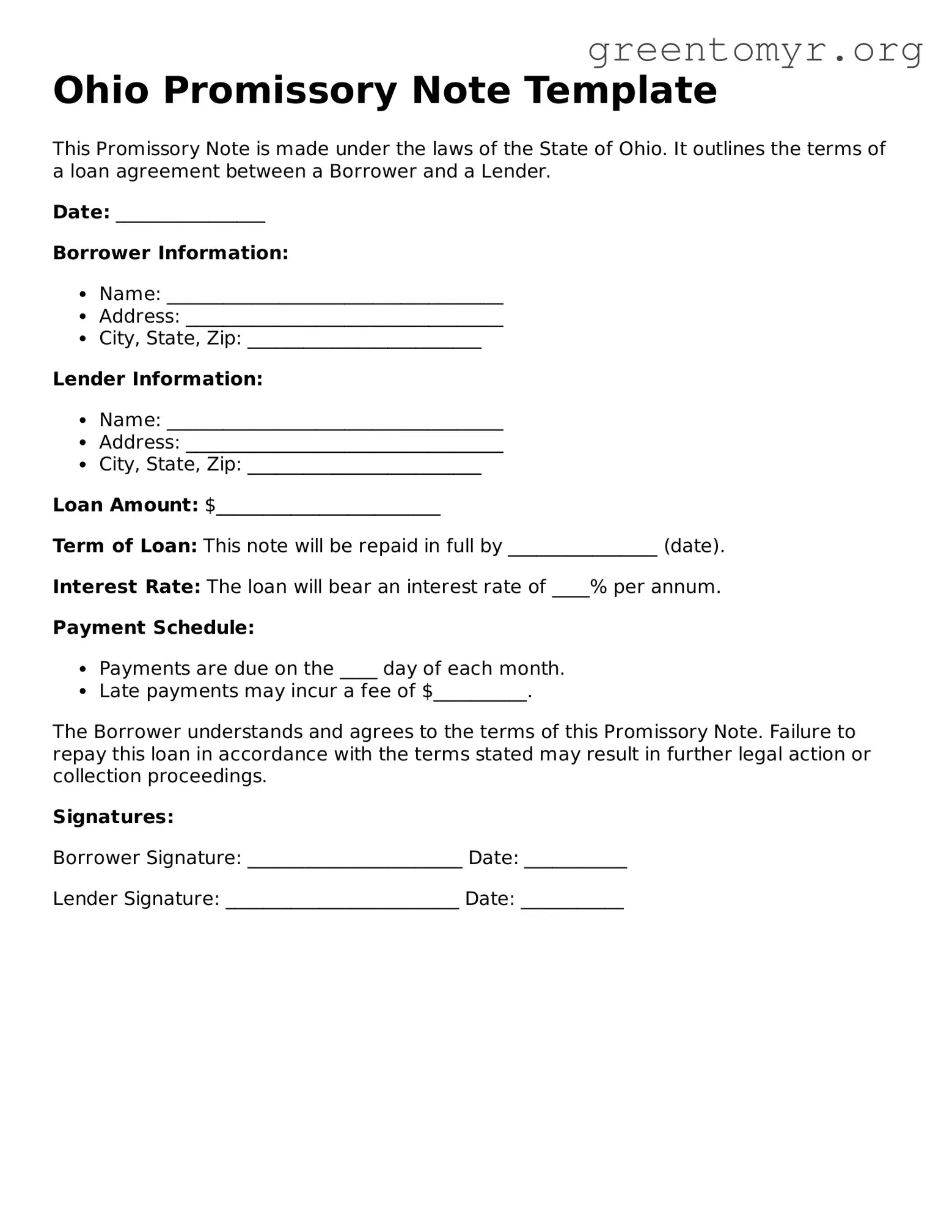

To be valid, a promissory note in Ohio should generally include the following elements:

-

The names and addresses of the borrower and lender.

-

The principal amount of the loan.

-

The interest rate (if any) on the loan.

-

The repayment schedule and due dates.

-

Any penalties for late payment.

-

Signatures of both parties.

Does a promissory note need to be notarized in Ohio?

No, notarization is not required for a promissory note to be legally valid in Ohio. However, it is a good practice to have the document notarized. This can help confirm the identities of the parties involved and add an extra layer of protection in case of disputes.

What happens if the borrower fails to repay the loan?

If the borrower does not repay the loan as specified in the promissory note, the lender may take legal action. This could involve filing a lawsuit to recover the owed amount. The lender may also attempt to collect the debt through other means, such as contacting a collection agency.

Can a promissory note be transferred to another person?

Yes, a promissory note can be transferred or assigned to another person, unless the note specifies otherwise. This means that the new holder essentially gains the rights to collect the debt as outlined in the original note.

Is a promissory note enforceable in court?

Yes, a properly executed promissory note is generally enforceable in court in Ohio. If there's a dispute over the terms or repayment, both parties can present the note as evidence in legal proceedings.

Are there any limitations on the amount of interest that can be charged?

Ohio law does impose some restrictions on the amount of interest that can be charged on loans. For most consumer loans, the maximum interest rate is capped at 8% unless agreed otherwise. It’s important to ensure that any interest charged complies with state law to avoid penalties.

How can I create a promissory note in Ohio?

Creating a promissory note in Ohio can be straightforward. You can either draft one using a template or consult with a legal professional to ensure that it meets your needs and complies with state regulations. It’s critical to include all essential elements and to have it signed by both parties.

Where can I find a template for an Ohio promissory note?

Templates for Ohio promissory notes can be found online through legal websites, financial institutions, or by consulting with a lawyer. Just ensure that the template is up-to-date and tailored to meet Ohio state requirements.