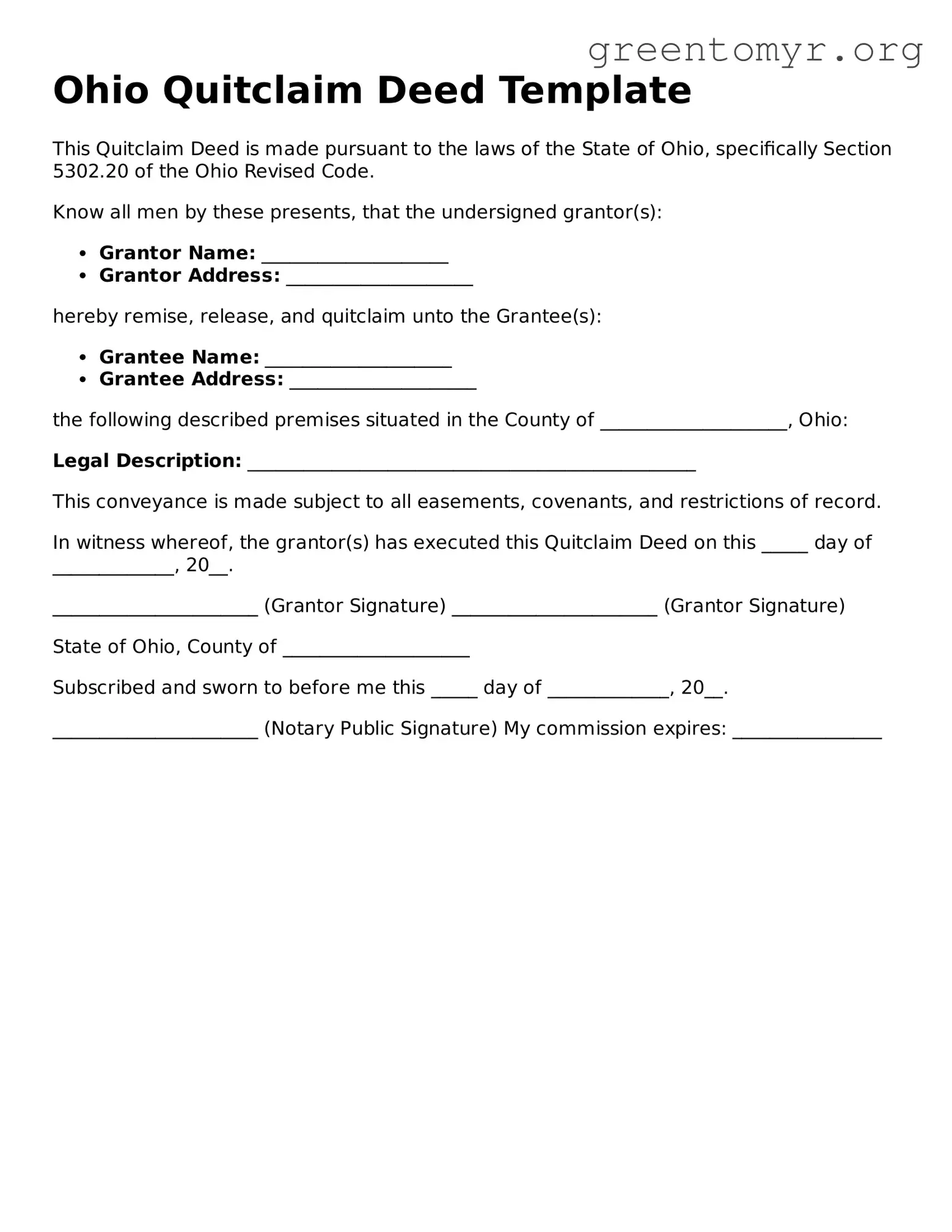

Ohio Quitclaim Deed Template

This Quitclaim Deed is made pursuant to the laws of the State of Ohio, specifically Section 5302.20 of the Ohio Revised Code.

Know all men by these presents, that the undersigned grantor(s):

- Grantor Name: ____________________

- Grantor Address: ____________________

hereby remise, release, and quitclaim unto the Grantee(s):

- Grantee Name: ____________________

- Grantee Address: ____________________

the following described premises situated in the County of ____________________, Ohio:

Legal Description: ________________________________________________

This conveyance is made subject to all easements, covenants, and restrictions of record.

In witness whereof, the grantor(s) has executed this Quitclaim Deed on this _____ day of _____________, 20__.

______________________ (Grantor Signature)

______________________ (Grantor Signature)

State of Ohio, County of ____________________

Subscribed and sworn to before me this _____ day of _____________, 20__.

______________________ (Notary Public Signature)

My commission expires: ________________