The Ohio Small Estate Affidavit is a legal document that allows an individual to collect a decedent's assets without going through the full probate process. This form is typically used when the total value of the deceased person's estate is below a certain threshold, which is currently set at $35,000 for individuals and $100,000 if the spouse is a co-heir. By using this affidavit, heirs can simplify the process of transferring assets following a person's death.

Who is eligible to use the Small Estate Affidavit?

Eligibility to use the Ohio Small Estate Affidavit is generally limited to individuals who are:

-

Heirs of the deceased, which may include spouses, children, or other close relatives.

-

Individuals who are 18 years or older.

-

Those who can confirm that the decedent did not have any unpaid debts exceeding the value of the estate.

It’s important to ensure that the criteria are met, as using this form improperly can lead to legal complications.

The Small Estate Affidavit can be used to collect various types of assets, including:

-

Bank accounts in the decedent's name.

-

Personal property such as cars, jewelry, or furniture.

-

Stocks or bonds held in the name of the decedent.

-

Real estate in certain circumstances, though specifics may vary.

However, it’s important to note that not all assets may qualify, particularly if they are jointly owned or held in trust.

How do I complete the Small Estate Affidavit?

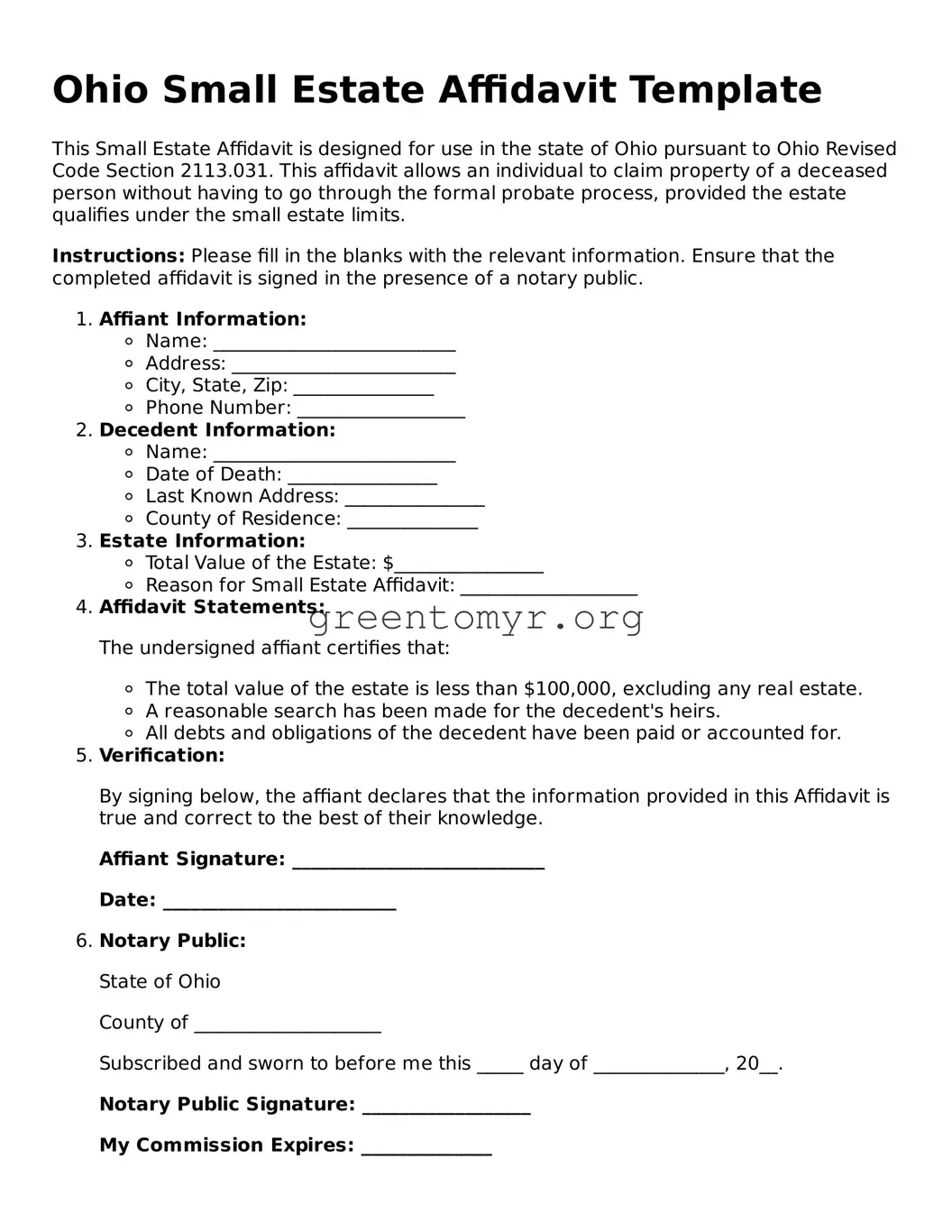

To complete the Small Estate Affidavit, follow these steps:

-

Obtain a copy of the form, which is available online or at local probate courts.

-

Fill in the required information, including details about the decedent and the assets involved.

-

Sign the affidavit in the presence of a notary public.

-

File the completed affidavit with any institutions holding the decedent’s assets.

Make sure to review the form for accuracy to avoid delays in processing.

Is there a deadline for filing the Small Estate Affidavit?

While there is no specific deadline for filing the Small Estate Affidavit, it is crucial to act within a reasonable time frame after the death of the individual. Delaying could result in complications, especially concerning outstanding debts or potential claims against the estate. Consulting with a legal professional can help clarify timelines based on your specific circumstances.

What happens if the estate exceeds the Small Estate limit?

If the total value of the estate exceeds the statutory limit, the Small Estate Affidavit cannot be used. Instead, the estate will typically need to go through formal probate proceedings. This process involves filing a will, if one exists, and working with the probate court to settle the estate according to state laws. Heirs will generally have to either hire an attorney or navigate the probate process themselves, which can be more time-consuming and complex than using the affidavit.

Where do I file the Small Estate Affidavit?

The Small Estate Affidavit should be filed with the relevant financial institutions or asset holders, such as banks or title companies. You may also need to present the affidavit to local probate courts when collecting certain assets. Different institutions may have their own requirements for processing the affidavit, so it’s wise to check with each entity beforehand.