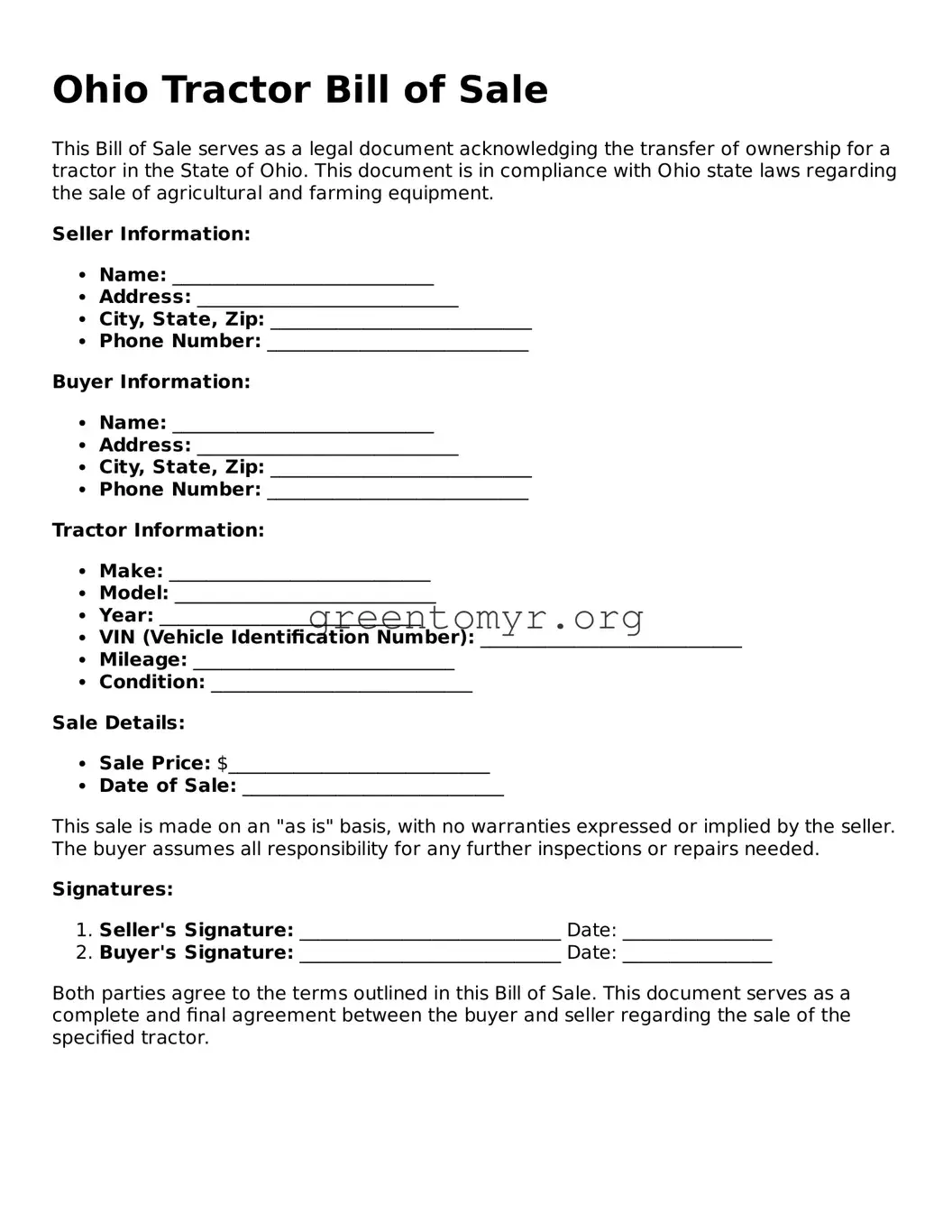

The Ohio Tractor Bill of Sale form is a legal document used for the sale and transfer of ownership of a tractor in Ohio. It serves as proof of the transaction between the buyer and the seller, detailing the terms of the sale and providing essential information about the tractor being sold.

Why is a Bill of Sale necessary for tractor transactions?

A Bill of Sale is necessary because it protects both the buyer and seller. It identifies the parties involved, describes the tractor, and documents the sale price. This form can also help resolve any future disputes regarding ownership or condition of the tractor.

The form typically requires the following information:

-

The names and addresses of the buyer and seller

-

The date of the transaction

-

A detailed description of the tractor (make, model, year, VIN)

-

The sale price

-

Any warranties or guarantees provided by the seller

While it is not always legally required, it is highly recommended to have a Bill of Sale for tractor transactions. Having this document helps to formalize the sale and provide legal backing for both parties.

Who should keep a copy of the Bill of Sale?

Both the buyer and the seller should keep a signed copy of the Bill of Sale. This ensures that each party has a record of the transaction, which can be useful for future references such as registrations, tax purposes, or legal matters.

Yes, either the buyer or the seller can create the Bill of Sale. However, it is important that both parties agree on the contents before signing to ensure mutual understanding and consent regarding the transaction.

What happens if a tractor is sold without a Bill of Sale?

Without a Bill of Sale, proving ownership can become difficult. The buyer may experience challenges when trying to register the tractor or prove they are the rightful owner. In the absence of this document, disputes regarding ownership are harder to resolve.

The form itself typically does not have fees associated with it, as it can often be created for free. However, there may be fees tied to registering the tractor with the state or obtaining a title.

Ohio Tractor Bill of Sale forms can often be found online through various legal document websites or state resources. You may also draft one yourself using templates available for purchase or download.

If assistance is needed, consider consulting with a legal professional or an experienced individual in tractor sales. They can provide guidance to ensure all necessary information is included and accurately recorded.