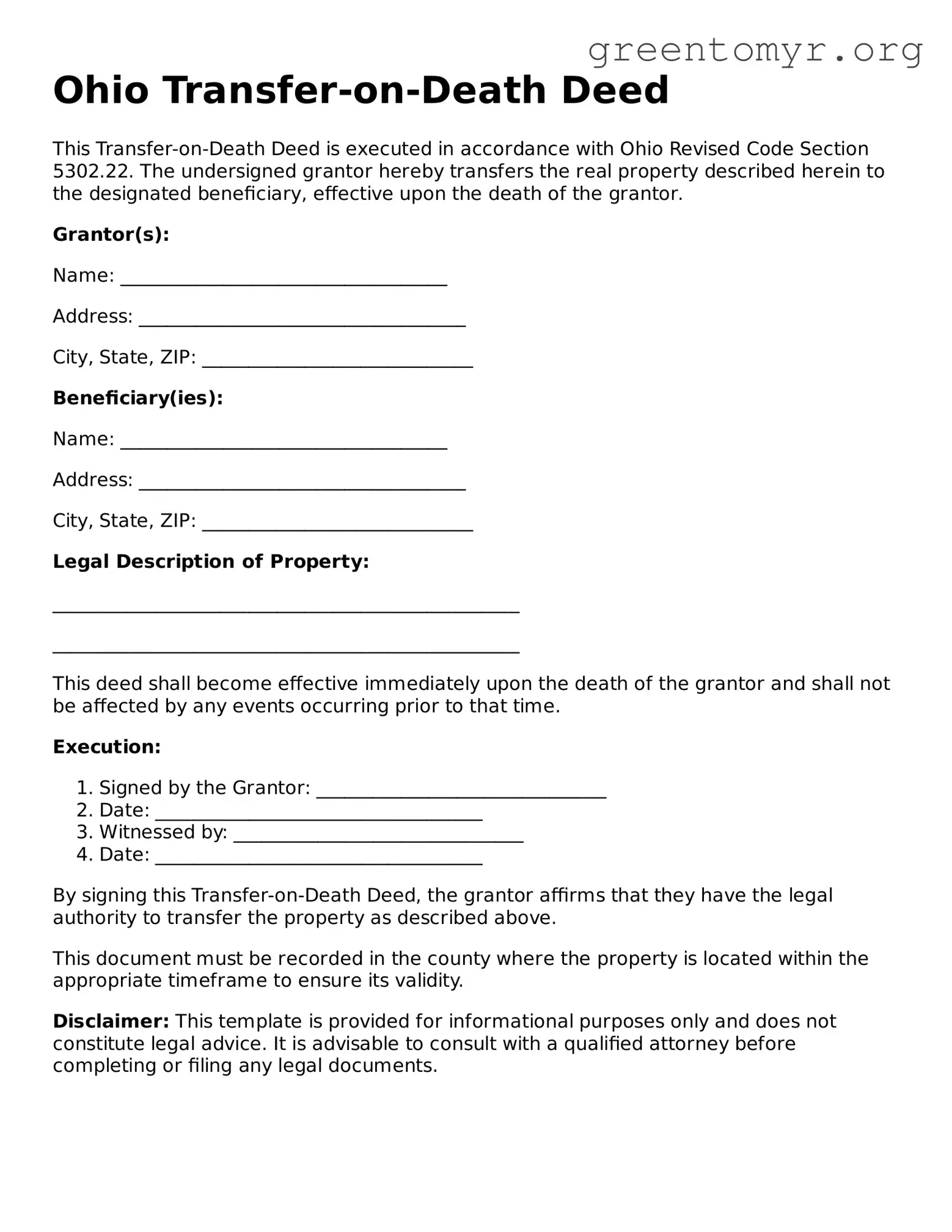

Ohio Transfer-on-Death Deed

This Transfer-on-Death Deed is executed in accordance with Ohio Revised Code Section 5302.22. The undersigned grantor hereby transfers the real property described herein to the designated beneficiary, effective upon the death of the grantor.

Grantor(s):

Name: ___________________________________

Address: ___________________________________

City, State, ZIP: _____________________________

Beneficiary(ies):

Name: ___________________________________

Address: ___________________________________

City, State, ZIP: _____________________________

Legal Description of Property:

__________________________________________________

__________________________________________________

This deed shall become effective immediately upon the death of the grantor and shall not be affected by any events occurring prior to that time.

Execution:

- Signed by the Grantor: _______________________________

- Date: ___________________________________

- Witnessed by: _______________________________

- Date: ___________________________________

By signing this Transfer-on-Death Deed, the grantor affirms that they have the legal authority to transfer the property as described above.

This document must be recorded in the county where the property is located within the appropriate timeframe to ensure its validity.

Disclaimer: This template is provided for informational purposes only and does not constitute legal advice. It is advisable to consult with a qualified attorney before completing or filing any legal documents.