Filling out an Owner Financing Contract form can be complex, and there are common mistakes that individuals often make. One frequent error involves leaving out essential property information. Investors and buyers must include the complete address and legal description of the property to ensure clarity in the contract. Omitting this information can lead to confusion and complicate the financing arrangements.

Another mistake is incorrect or incomplete buyer and seller details. It is crucial that all parties involved provide their full legal names, addresses, and contact information. Inaccuracies can create issues during the contract's enforcement, potentially causing delays or disputes.

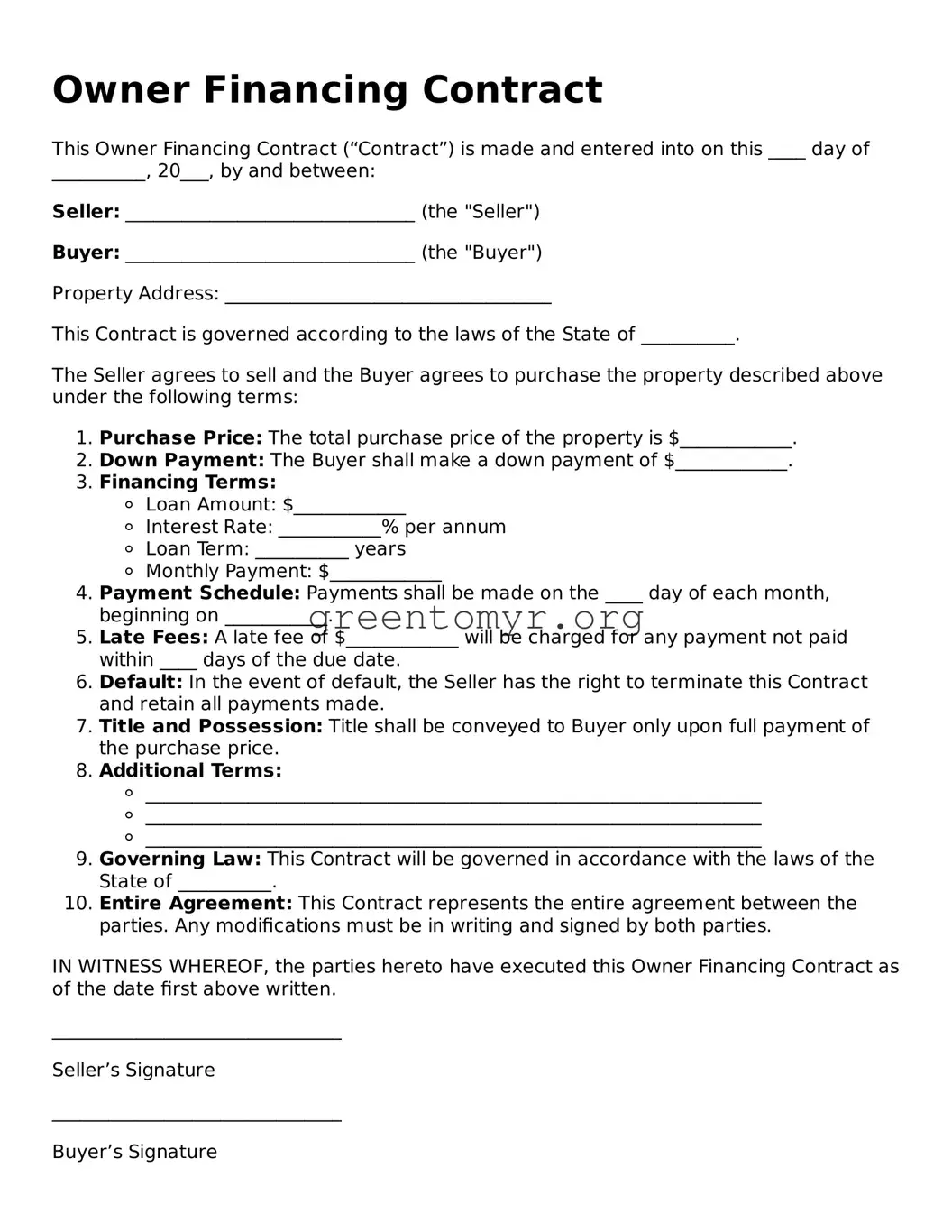

Many individuals fail to specify the terms of the financing clearly. This includes the interest rate, payment schedule, and any required down payment. Ambiguities in these terms can result in misunderstandings later on, which may lead to conflict between the buyer and seller.

Additionally, neglecting to include contingencies can be a significant oversight. Contingencies protect both parties by outlining conditions that must be met before the contract is final. Without them, one party may find themselves at a disadvantage, unable to exit the agreement under certain circumstances.

Some people may overlook the importance of including a legal description of the financing terms. Clearly detailing the repayment period and any applicable fees is critical. Failing to do so can affect the enforceability of the contract, leaving one party uncertain about their obligations.

Another common mistake is not obtaining signatures correctly. Both the buyer and seller must sign and date the contract for it to be legally binding. If this step is skipped or improperly executed, future enforcement of the terms can be questioned.

Inadequate consideration of default clauses can also lead to problems. It is important to outline what happens if a party fails to meet their obligations. By including clear default terms, both parties know how to proceed if a breach occurs.

People sometimes neglect to have the contract reviewed by a competent party. Consulting with a legal professional can help identify potential issues and ensure compliance with state laws. Skipping this step may result in overlooking important legal requirements.

Furthermore, not considering the implications of taxes could create future liabilities. Buyers and sellers should understand how owner financing affects their tax situations. Information about tax obligations should be researched and understood prior to signing the contract.

Lastly, one major mistake involves using a template without proper adaptation. Each owner financing agreement should be tailored to the specific situation. Relying too heavily on a standard form without adjustments may leave vital details unaddressed.