Filling out a Payroll Check form accurately is essential for ensuring that employees are paid correctly and on time. Unfortunately, many people make mistakes that can lead to delays or payment issues. Understanding common errors can help prevent these problems.

One frequent mistake is not including the correct employee identification number. This number helps the payroll department verify an employee's identity and track their earnings accurately. Leaving it blank or entering an incorrect number can lead to significant delays in processing the check.

Many individuals also overlook the importance of double-checking hours worked. Sometimes, people assume they have logged their hours correctly, but small errors can result in underpayment or overpayment. It's crucial to review hours thoroughly before submitting the form.

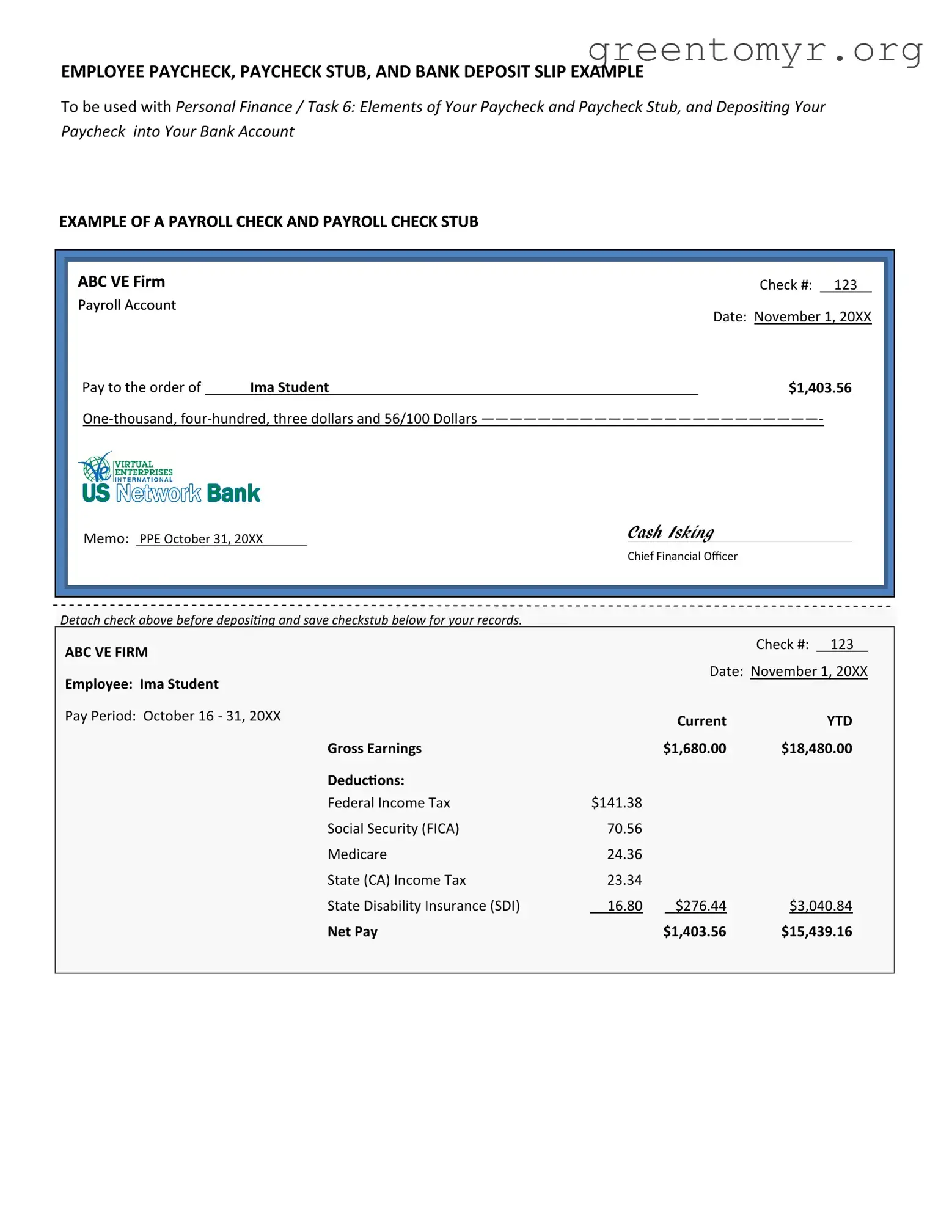

Incorrectly calculating deductions is another common error. Deductions for taxes, benefits, and other withholdings must be accurate. Failing to account for these correctly can lead to an employee either receiving too little or too much in their paycheck.

Not signing the Payroll Check form is a simple yet impactful mistake. This form requires an authorized signature to be processed. Forgetting this vital step can delay payment, creating frustration for both the payroll department and the employee waiting for their check.

Failing to update personal information, such as address or bank details, is also problematic. If an employee moves or changes their banking information, and these updates aren’t reflected, they may not receive their pay or might face complications receiving funds.

Lastly, submitting the form late can cause a ripple effect, leading to delayed paychecks. Payroll schedules are typically strict, and missing the deadline means the employee may not receive their payment on the expected date. Being mindful of deadlines can significantly improve the payroll process.