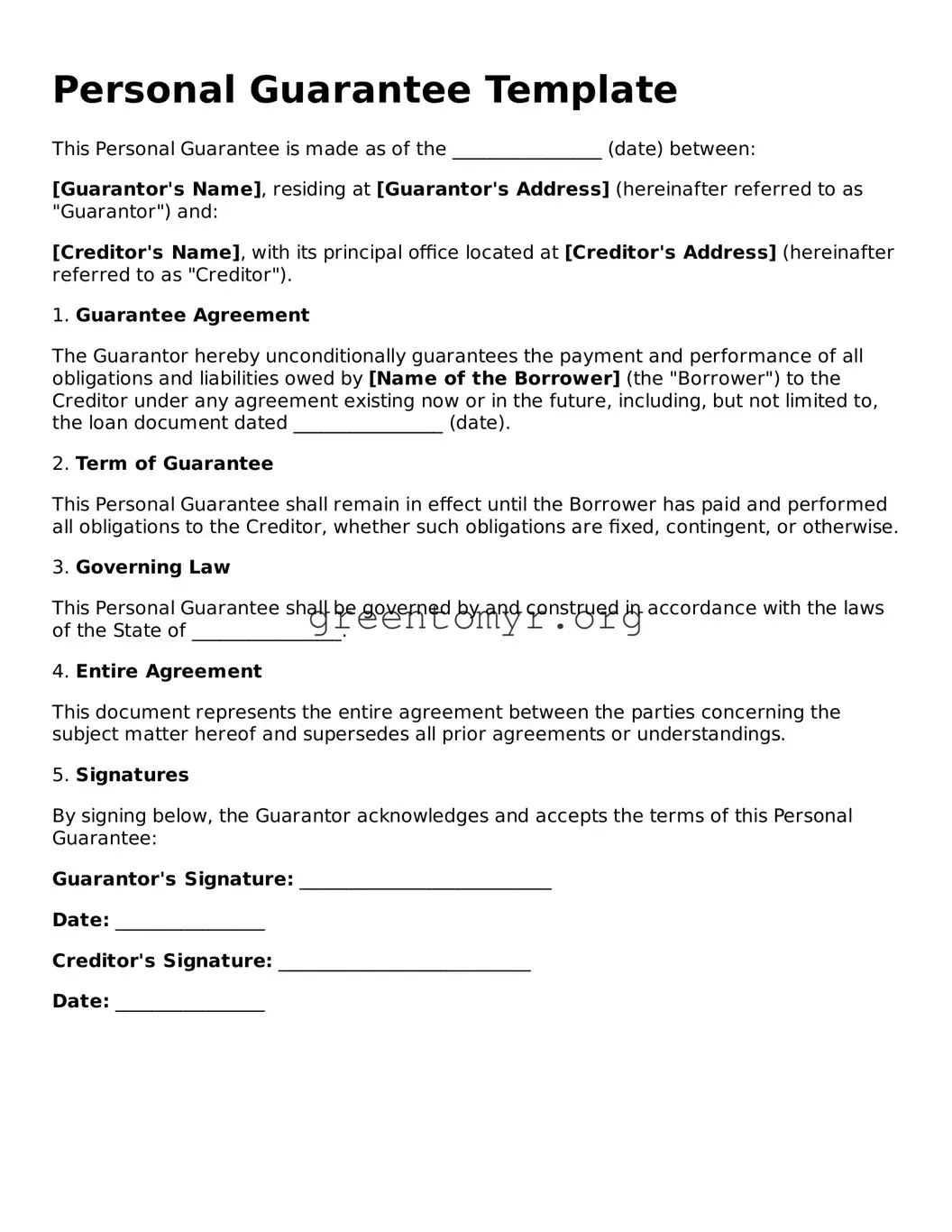

Personal Guarantee Template

This Personal Guarantee is made as of the ________________ (date) between:

[Guarantor's Name], residing at [Guarantor's Address] (hereinafter referred to as "Guarantor") and:

[Creditor's Name], with its principal office located at [Creditor's Address] (hereinafter referred to as "Creditor").

1. Guarantee Agreement

The Guarantor hereby unconditionally guarantees the payment and performance of all obligations and liabilities owed by [Name of the Borrower] (the "Borrower") to the Creditor under any agreement existing now or in the future, including, but not limited to, the loan document dated ________________ (date).

2. Term of Guarantee

This Personal Guarantee shall remain in effect until the Borrower has paid and performed all obligations to the Creditor, whether such obligations are fixed, contingent, or otherwise.

3. Governing Law

This Personal Guarantee shall be governed by and construed in accordance with the laws of the State of ________________.

4. Entire Agreement

This document represents the entire agreement between the parties concerning the subject matter hereof and supersedes all prior agreements or understandings.

5. Signatures

By signing below, the Guarantor acknowledges and accepts the terms of this Personal Guarantee:

Guarantor's Signature: ___________________________

Date: ________________

Creditor's Signature: ___________________________

Date: ________________