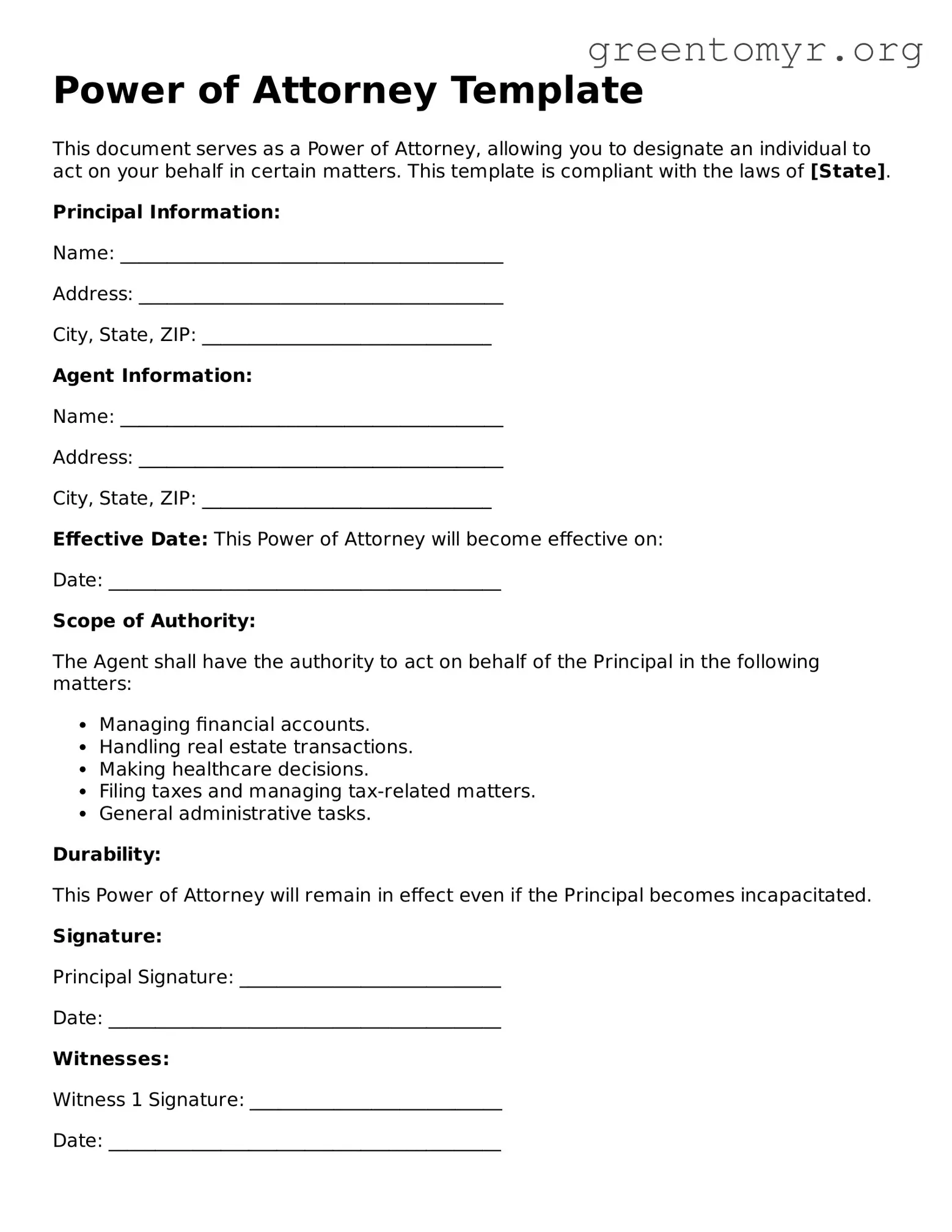

Power of Attorney Template

This document serves as a Power of Attorney, allowing you to designate an individual to act on your behalf in certain matters. This template is compliant with the laws of [State].

Principal Information:

Name: _________________________________________

Address: _______________________________________

City, State, ZIP: _______________________________

Agent Information:

Name: _________________________________________

Address: _______________________________________

City, State, ZIP: _______________________________

Effective Date: This Power of Attorney will become effective on:

Date: __________________________________________

Scope of Authority:

The Agent shall have the authority to act on behalf of the Principal in the following matters:

- Managing financial accounts.

- Handling real estate transactions.

- Making healthcare decisions.

- Filing taxes and managing tax-related matters.

- General administrative tasks.

Durability:

This Power of Attorney will remain in effect even if the Principal becomes incapacitated.

Signature:

Principal Signature: ____________________________

Date: __________________________________________

Witnesses:

Witness 1 Signature: ___________________________

Date: __________________________________________

Witness 2 Signature: ___________________________

Date: __________________________________________

Notarization:

State of ___________

County of __________

Subscribed and sworn to before me this _____ day of _______________, 20__.

Notary Public: _________________________________

My Commission Expires: ______________________