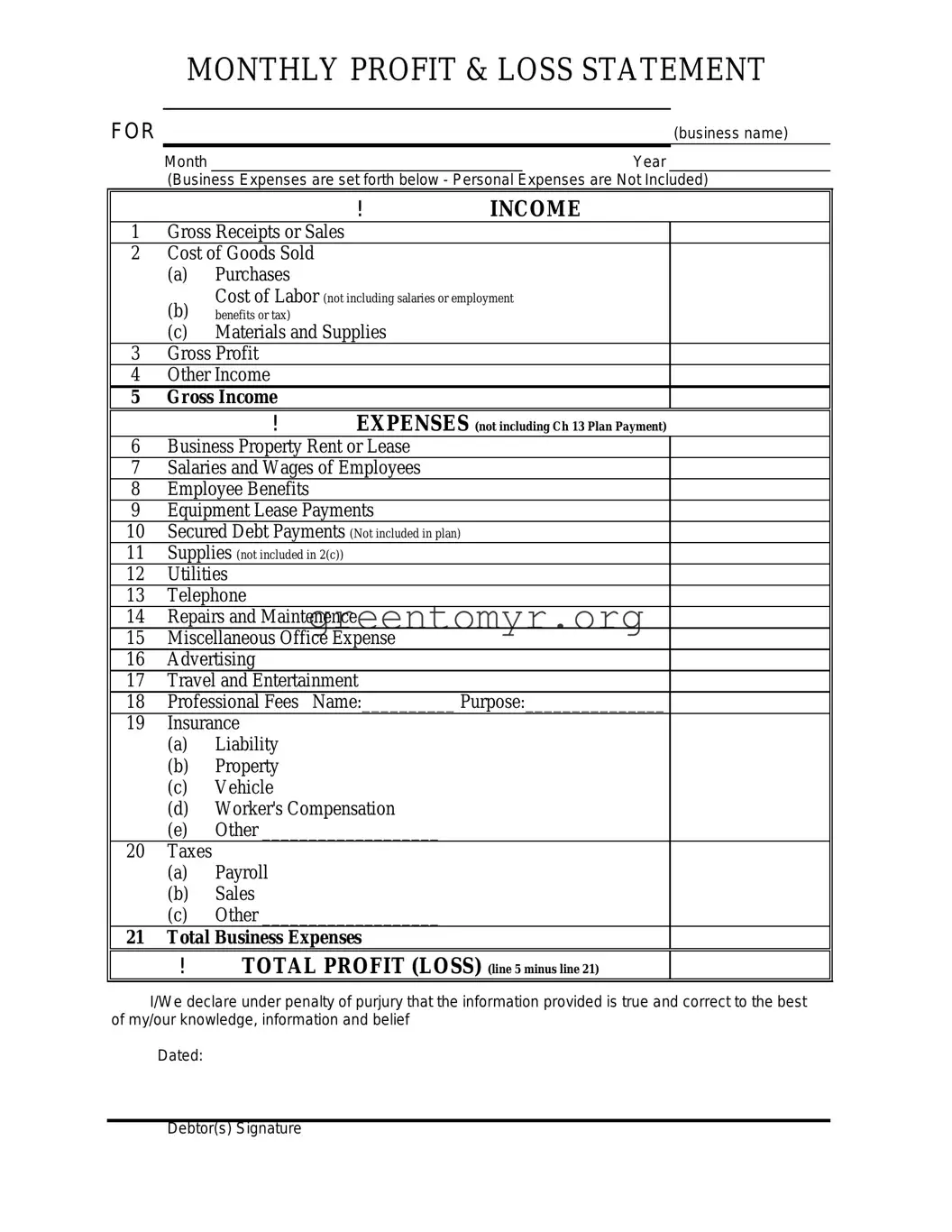

Fill in a Valid Profit And Loss Template

The Profit and Loss form, often referred to as an income statement, is a financial document that summarizes revenues, costs, and expenses incurred during a specific period. This form plays a crucial role in assessing the financial performance of a business, helping owners and stakeholders understand profitability. Ready to take control of your finances? Click the button below to fill out your Profit and Loss form today.