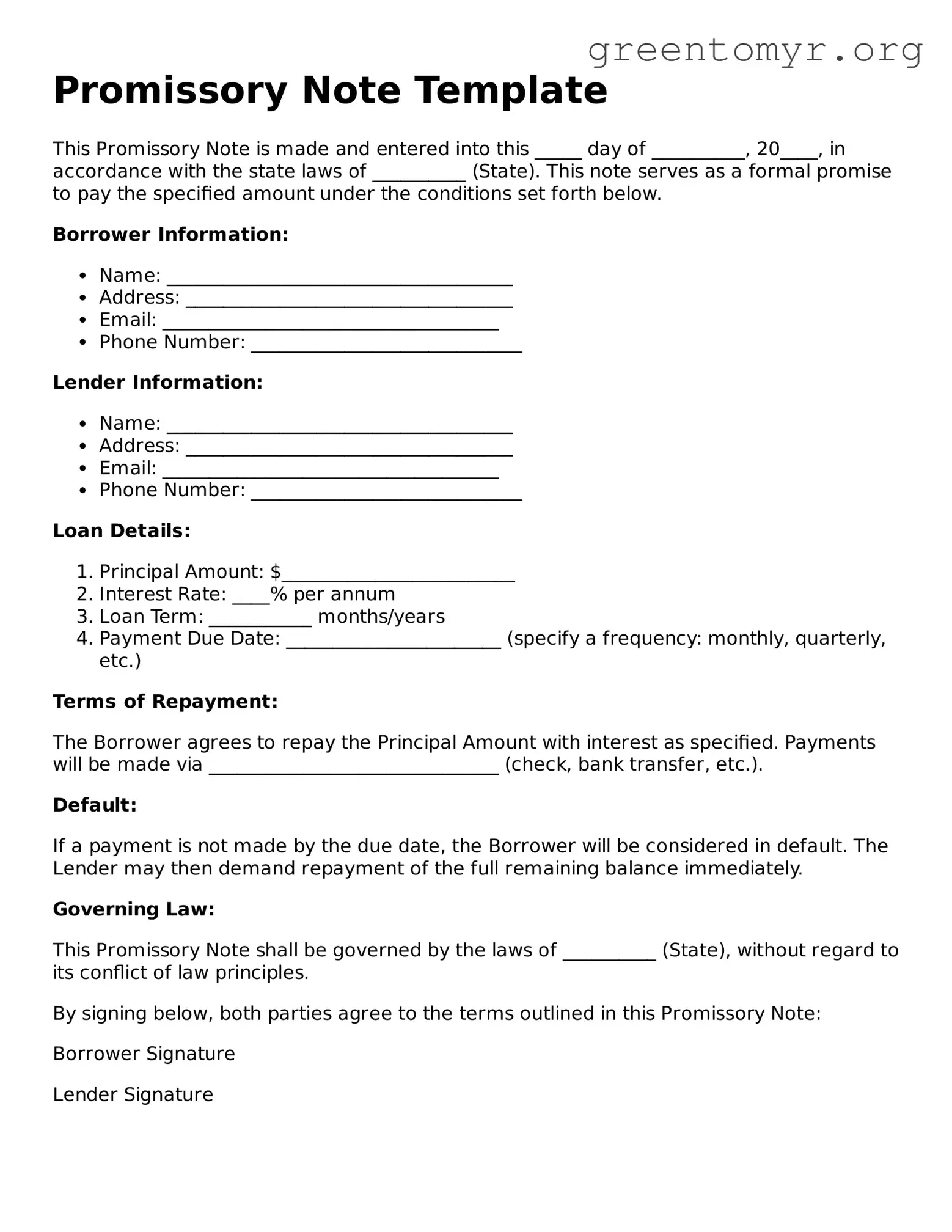

Promissory Note Template

This Promissory Note is made and entered into this _____ day of __________, 20____, in accordance with the state laws of __________ (State). This note serves as a formal promise to pay the specified amount under the conditions set forth below.

Borrower Information:

- Name: _____________________________________

- Address: ___________________________________

- Email: ____________________________________

- Phone Number: _____________________________

Lender Information:

- Name: _____________________________________

- Address: ___________________________________

- Email: ____________________________________

- Phone Number: _____________________________

Loan Details:

- Principal Amount: $_________________________

- Interest Rate: ____% per annum

- Loan Term: ___________ months/years

- Payment Due Date: _______________________ (specify a frequency: monthly, quarterly, etc.)

Terms of Repayment:

The Borrower agrees to repay the Principal Amount with interest as specified. Payments will be made via _______________________________ (check, bank transfer, etc.).

Default:

If a payment is not made by the due date, the Borrower will be considered in default. The Lender may then demand repayment of the full remaining balance immediately.

Governing Law:

This Promissory Note shall be governed by the laws of __________ (State), without regard to its conflict of law principles.

By signing below, both parties agree to the terms outlined in this Promissory Note:

Borrower Signature

Lender Signature