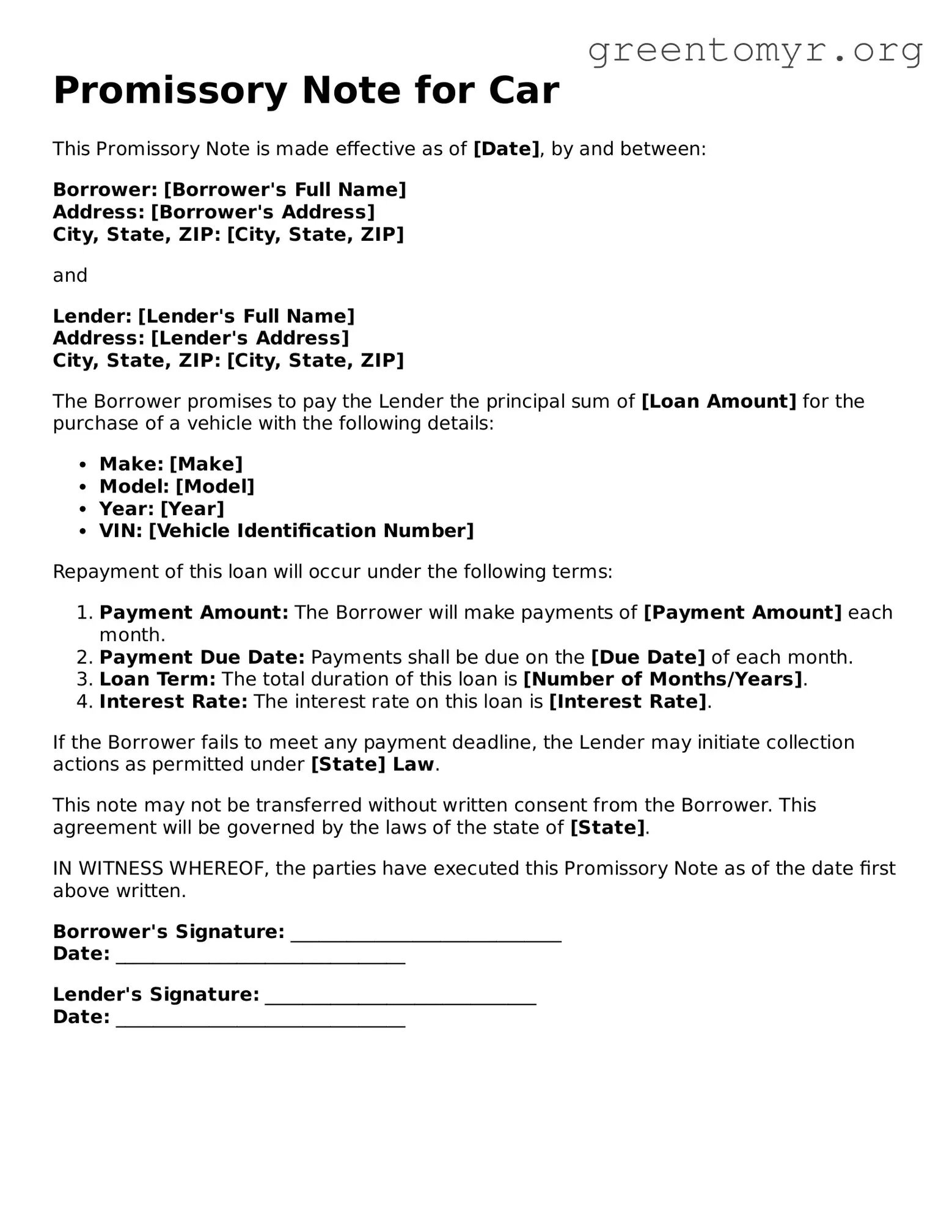

Promissory Note for Car

This Promissory Note is made effective as of [Date], by and between:

Borrower: [Borrower's Full Name]

Address: [Borrower's Address]

City, State, ZIP: [City, State, ZIP]

and

Lender: [Lender's Full Name]

Address: [Lender's Address]

City, State, ZIP: [City, State, ZIP]

The Borrower promises to pay the Lender the principal sum of [Loan Amount] for the purchase of a vehicle with the following details:

- Make: [Make]

- Model: [Model]

- Year: [Year]

- VIN: [Vehicle Identification Number]

Repayment of this loan will occur under the following terms:

- Payment Amount: The Borrower will make payments of [Payment Amount] each month.

- Payment Due Date: Payments shall be due on the [Due Date] of each month.

- Loan Term: The total duration of this loan is [Number of Months/Years].

- Interest Rate: The interest rate on this loan is [Interest Rate].

If the Borrower fails to meet any payment deadline, the Lender may initiate collection actions as permitted under [State] Law.

This note may not be transferred without written consent from the Borrower. This agreement will be governed by the laws of the state of [State].

IN WITNESS WHEREOF, the parties have executed this Promissory Note as of the date first above written.

Borrower's Signature: _____________________________

Date: _______________________________

Lender's Signature: _____________________________

Date: _______________________________